This

First Amendment to Loan Documents (this “Amendment”) is entered into as of May

24, 2009 by and between Chanticleer Investors, LLC, a Delaware limited liability

company (the “Holder”), the Estate of Robert H. Brooks (the “Maker”), Hooters of

America, Inc., a Georgia corporation (the “Company”), and A. J. Block, Jr. (the

“Escrow Agent”). Capitalized terms used herein and not otherwise defined shall

have the meanings set forth in the Loan Agreement (as defined

below).

RECITALS

WHEREAS,

the Holder made a $5 million loan to Robert H. Brooks pursuant to a Loan and

Conversion Agreement dated as of May 24, 2006 by and between the Holder, Robert

H. Brooks, the Company and the Escrow Agent (the “Loan Agreement”), which loan

was evidenced by a Convertible Secured Promissory Note dated May 24, 2006 made

by Robert H. Brooks to the order of the Holder (the “Note”) and was secured

pursuant to a Stock Pledge Agreement dated as of May 24, 2006 by and between the

Holder, Robert H. Brooks, and the Company (the “Pledge Agreement,” and together

with the Loan Agreement and the Note, the “Agreements”); and

WHEREAS,

Robert H. Brooks died on July 15, 2006; and

WHEREAS,

the parties hereto have agreed to amend certain terms of the Agreements as set

forth herein;

NOW

THEREFORE, for good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, and intending to be legally bound, the parties

hereto agree as follows:

|

|

1.

|

Amendments to the Loan

Agreement.

|

|

|

(a)

|

The

words “May 24, 2009” in the second recital and in Section 1 are amended

to read “November 24, 2010”.

|

|

|

(b)

|

Section

3(c) is deleted and replaced with “(c) [Intentionally

omitted]”.

|

|

|

(c)

|

Section

3(d)(vi) is deleted and replaced with the

following:

|

“(vi)

That in the event that, prior to November 24, 2010, the Maker enters into a

written definitive agreement (a “Definitive Agreement”) for a sale of any shares

of the Company, other than the Shares, the Maker shall deliver to the Holder

written notice thereof, including a copy of the Definitive Agreement. The Holder

shall then have a period of thirty (30) days from the date of receipt of the

Definitive Agreement in which to elect, by delivering written notice of such

election to the Maker together with a nonrefundable cash deposit equal in amount

to the deposit made pursuant to the Definitive Agreement, to purchase such

shares of the Company (the “Offered Shares”) pursuant to the terms and conditions of the Definitive Agreement. The Definitive Agreement

may be subject to customary closing conditions, including, but not limited to, a

financing contingency; provided, however, that the Definitive Agreement will be

supported by financing proposal(s) from a nationally recognized financial

institution(s) and the Buyer will have completed all material due diligence. In

the event that the Holder elects to purchase the Offered Shares pursuant to the

terms and conditions of the Definitive Agreement (the “Election”), the Holder

will have thirty (30) days from its delivery of the Election to close the

purchase of the Offered Shares. The Maker shall use commercially reasonable

efforts to give the Holder similar access to due diligence information (to

include access to any data room and to interview Company management) as is

granted to the party making the Offer during the 30-day period in which the

Holder may make the Election.

If the

Holder fails to make the Election within thirty (30) days from the date of

receipt of the Definitive Agreement or fails to close the purchase of the

Offered Shares within thirty (30) days after making the Election, the Maker

shall be free to sell the Offered Shares pursuant to the Definitive Agreement

(which may be amended so long as the final terms and conditions are no less

favorable to the Maker than the original terms and conditions of the Definitive

Agreement). If the Maker fails to sell the Offered Shares in accordance with the

preceding sentence, the Offered Shares shall once again be subject to the

Holder’s right of refusal pursuant to this Section 3(d)(vi).”

|

|

(e)

|

Section

4(a) is deleted and replaced with “(a) [Intentionally

omitted]”.

|

|

|

2.

|

Amendments to the

Note.

|

|

|

(a)

|

The

Note is hereby amended as necessary to provide that the stated maturity date of

the Note shall be extended to November 24,

2010.

|

(b) The

words “at the rate of six (6%) percent per annum” in the introductory paragraph

of the Note are hereby deleted and replaced with “at the rate of six percent

(6%) per annum from May 24, 2006 through and including May 24, 2009 and at the

rate of eight percent (8%) per annum thereafter”.

|

|

(c)

|

The

paragraph numbered “1” on the first page of the Note is hereby deleted and

replaced with the following: “1. [Intentionally

omitted]”.

|

(d) The

words “except as provided in Paragraph (1)” at the end of the paragraph numbered

“2” on the first page of the Note are deleted and replaced with the words

“except for any change of control (including the vesting in the personal

representatives of the Estate of Robert H. Brooks control over the equity

ownership of the Company and the election of such personal representatives as

directors of the Company) that arose prior to May 24, 2009 and was attributable to

the death of Robert H. Brooks”;

|

|

3.

|

Ratification of the

Agreements. As amended hereby, the Agreements shall continue in full force

in effect.

|

|

|

4.

|

Authority/Enforceability.

Each of the parties hereto represents and warrants as

follows:

|

(a) Such

party has taken all necessary action to authorize such party’s execution and

delivery of this Amendment and the performance by such party of the Agreements,

as amended by this Amendment, to which such party is a party.

(b)

This Amendment has been duly executed and delivered by such

party and constitutes such party’s legal, valid and binding obligation,

enforceable in accordance with its terms, except as such enforceability may be

subject to (i) bankruptcy, insolvency, reorganization, fraudulent conveyance or

transfer, moratorium or similar laws affecting creditors’ rights generally and

(ii) general principles of equity (regardless of whether such enforceability is

considered in a proceeding at law or in equity).

(c) No

consent, approval, authorization or order of, or filing, registration or

qualification with, any court or governmental authority or third party is

required in connection with the execution, delivery, or performance by such

party of this Amendment or the performance by such party of the Agreements, as

amended by this Amendment, to which such party is a party.

(d)

The execution and delivery of this Amendment by such party and the

performance by such party of the Agreements, as amended by this Amendment, to

which such party is a party does not (i) if applicable, violate, contravene or

conflict with any provision of its organizational documents or (ii) materially

violate, contravene or conflict with any law, regulation, order, writ, judgment,

injunction, decree or permit applicable to him or it.

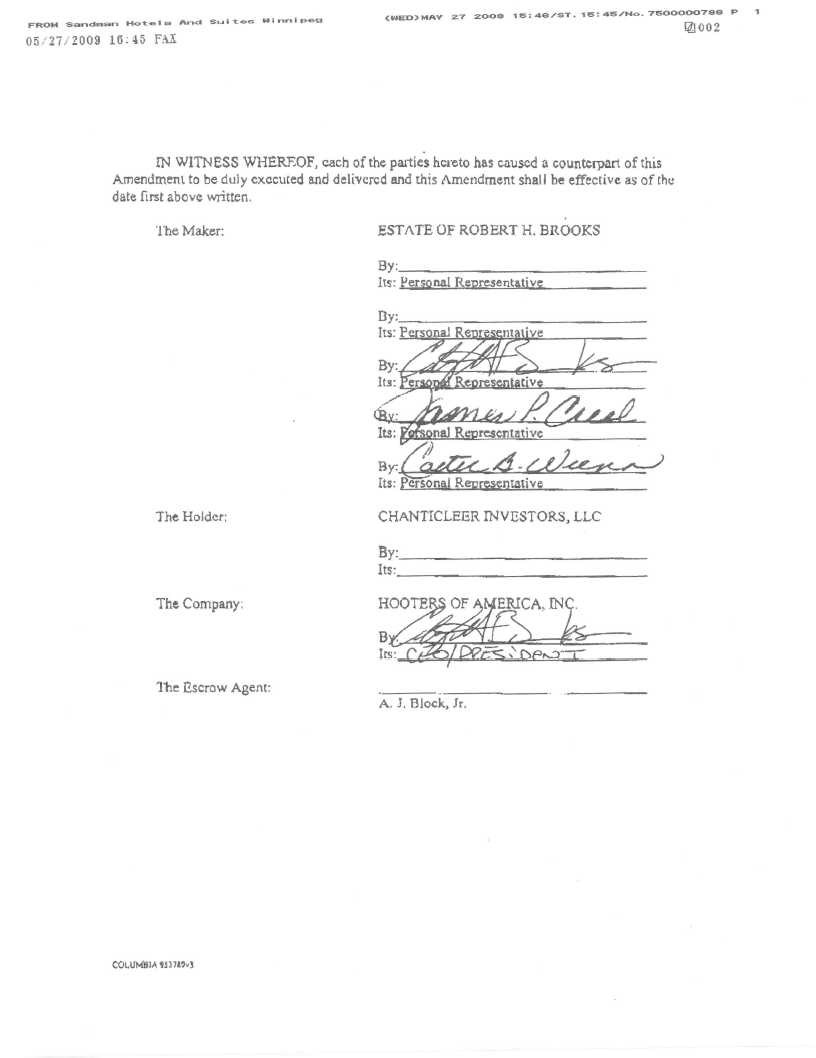

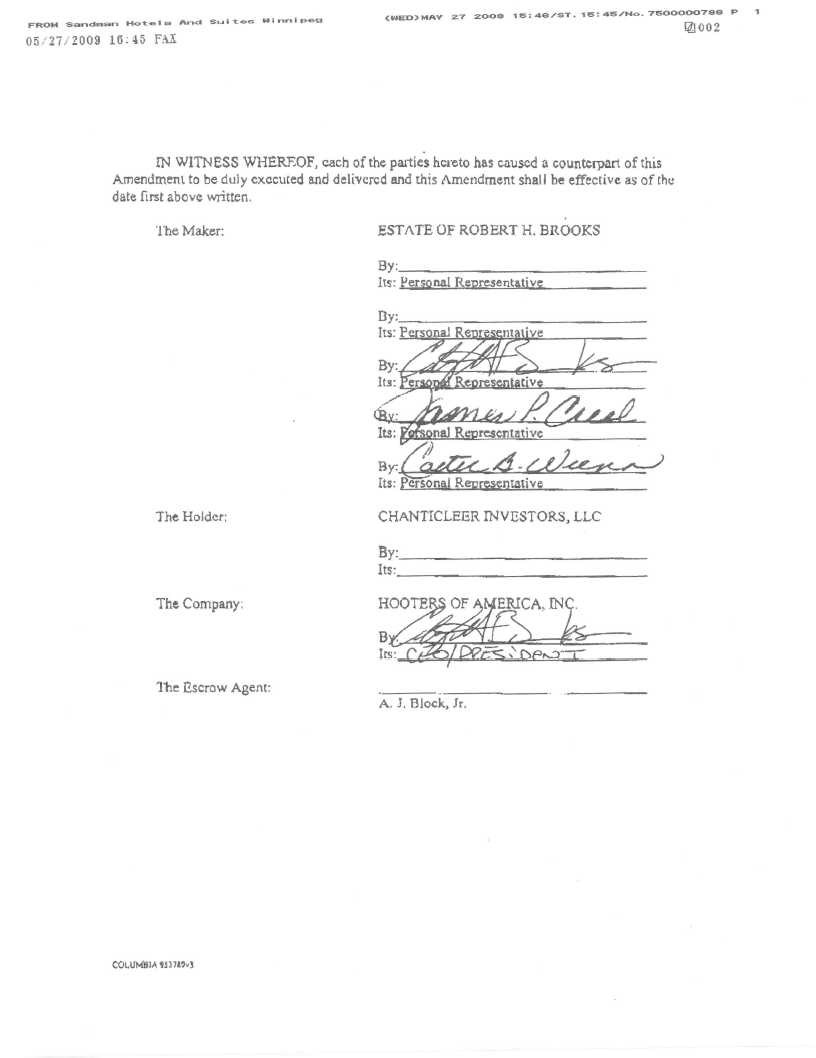

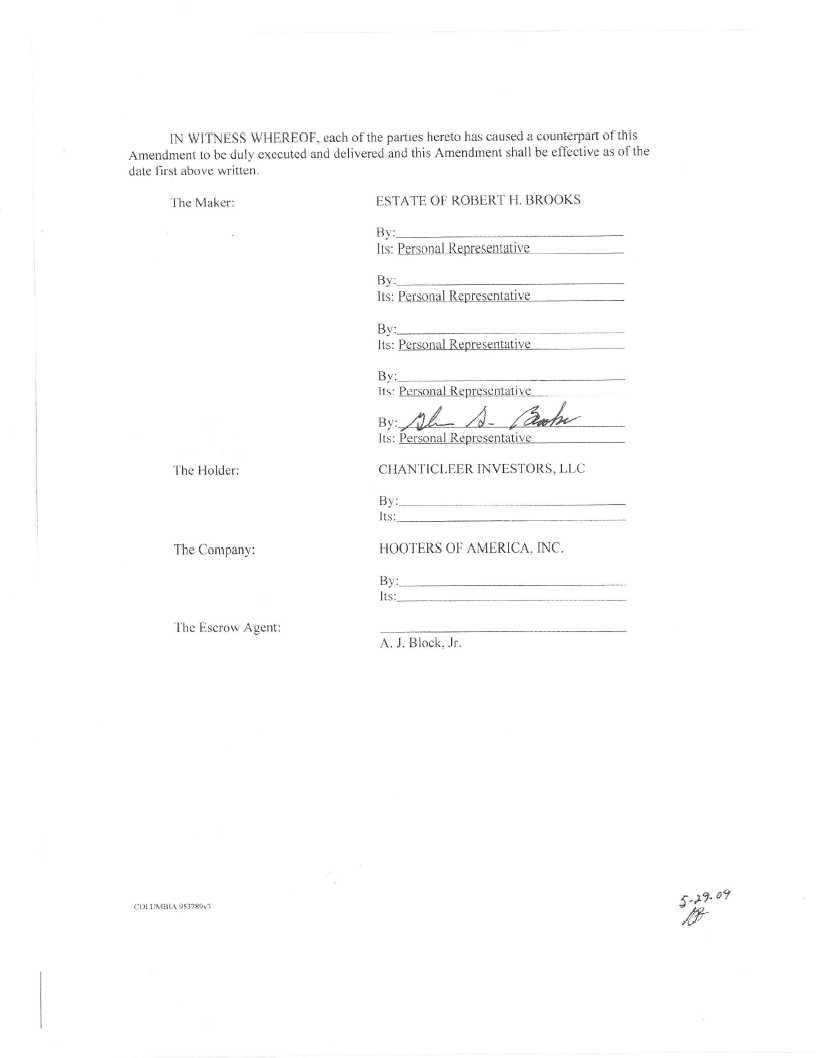

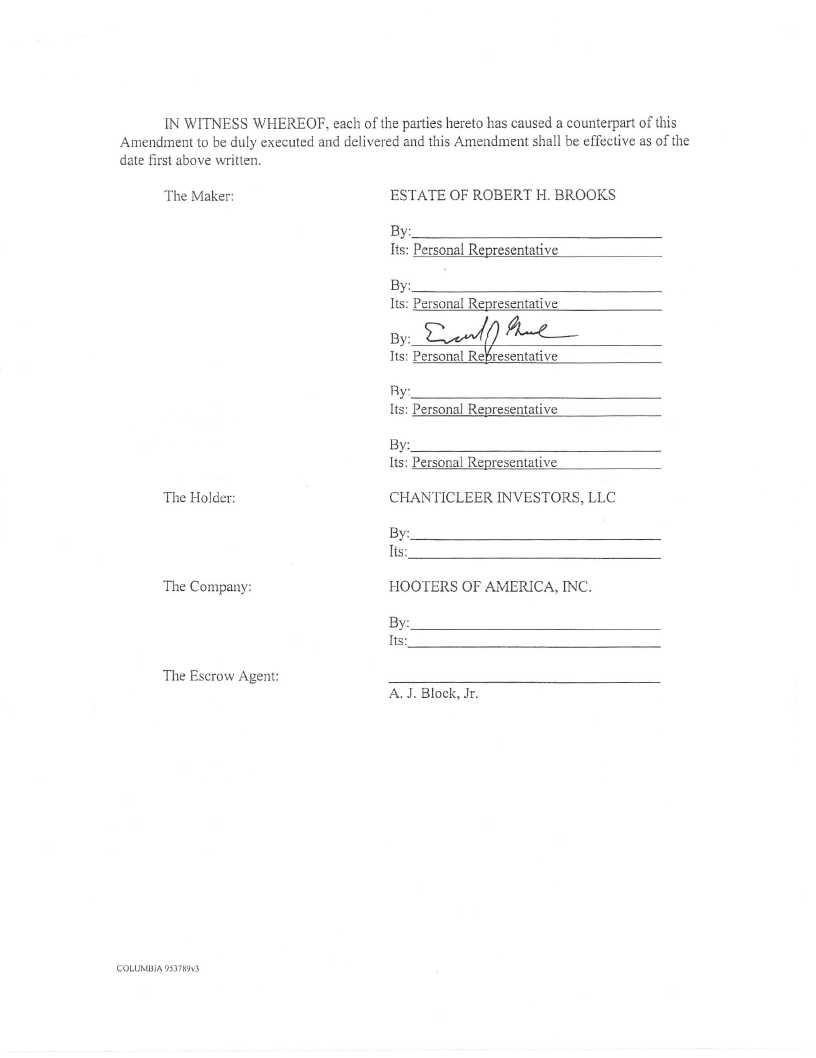

5.

Counterparts/Telecopy.

This Amendment may be executed in any number of counterparts, each of which when

so executed and delivered shall be an original, but all of which shall

constitute one and the same instrument. Delivery of executed counterparts of

this Amendment

by telecopy shall be effective as an original.

|

|

6.

|

Governing Law. This

Amendment shall be governed by, construed, and interpreted in accordance

with the laws of the state of

Delaware.

|

[remainder

of page intentionally left blank]