|

Delaware

|

8742

|

20-2932652

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification

No.)

|

|

Joel D. Mayersohn, Esq.

|

|

|

Clint J. Gage, Esq.

|

Bruce C. Rosetto, Esq.

|

|

Roetzel & Andress

|

Greenburg Traurig, P.A.

|

|

350 East Las Olas Blvd., Ste. 1150

|

5100 Town Center Circle, Suite 400

|

|

Fort Lauderdale, FL 33301

|

Boca Raton, FL 37486

|

|

(954) 462-4150

|

(561) 955-7600

|

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

|

Title of each class of Securities to be

Registered (1)

|

Amount

to be

Registered

|

Proposed

Maximum

Offering

Price Per

Security

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

||||||||||||

|

Units, each consisting of: (2)

|

5,750,000

|

3.00

|

$

|

17,250,000

|

$

|

1,976.85

|

||||||||||

|

(i) one share of common stock; and

|

5,750,000

|

—

|

—

|

—

|

||||||||||||

|

(ii) one warrant to purchase one share of common stock; and

|

5,750,000

|

—

|

—

|

—

|

||||||||||||

|

Representative’s warrant (3)

|

400,000

|

—

|

—

|

—

|

||||||||||||

|

Units issuable upon exercise of the representative’s warrants, each unit consisting of:

|

400,000

|

$

|

3.45

|

$

|

1,380,000

|

$

|

158.15

|

|||||||||

|

(i) one share of common stock; and

|

400,000

|

—

|

—

|

—

|

||||||||||||

(ii)

one warrant to purchase one share of common stock

|

400,000

|

—

|

—

|

—

|

||||||||||||

|

Shares of common stock issuable upon exercise of the warrants including the warrants underlying the representative's warrant(2)

|

6,150,000

|

$

|

3.25

|

$

|

19,987,500

|

$

|

2,290.57

|

|||||||||

|

Total

|

$

|

38,617,500

|

$

|

4,425.57

|

||||||||||||

|

(1)

|

Offering price computed in accordance with Rule 457(g).

|

|

(2)

|

Includes 750,000 units which would be issued, or issuable, upon exercise of the underwriter's over-allotment option.

|

|

(3)

|

In connection with the sale of the units, the registrant will issue the representative of the underwriters a warrant to purchase up to 400,000 units.

|

| i |

|

Per Unit

|

Total

|

|||||||

|

Public offering price

|

$ | 3.00 | $ | 15,000,000 | ||||

|

Underwriting discounts and commissions (1)

|

$ | 0.24 | $ | 1,200,000 | ||||

|

Proceeds to us, before expenses

|

$ | 2.76 | $ | 13,800,000 | ||||

|

(1)

|

For a description of the compensation to be received by the underwriters in addition to the underwriting discount, see the "Underwriting," section of this prospectus.

|

| ii |

|

Page

|

||

|

Prospectus Summary

|

1

|

|

|

Special Note Regarding Forward-Looking Statements

|

8

|

|

|

Risk Factors

|

9

|

|

|

Use of Proceeds

|

18

|

|

|

Capitalization

|

19

|

|

|

Dilution

|

|

|

|

Market for Common Equity and Related Shareholder Matters

|

19

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

|

Business

|

30

|

|

|

Properties

|

33

|

|

|

Legal Proceedings

|

34

|

|

|

Management

|

35

|

|

|

Certain Relationships and Related Transactions

|

38

|

|

|

Security Ownership of Certain Beneficial Owners

|

40

|

|

|

Underwriting

|

42

|

|

|

Description of Securities

|

45

|

|

|

Transfer Agent and Registrar

|

47

|

|

|

Legal Matters

|

47

|

|

|

Experts

|

47

|

|

|

Where You Can Find More Information

|

47

|

|

|

Index to Financial Statements

|

49

|

| iii |

| 1 |

|

|

·

|

4% of gross revenue is paid to HOA monthly as a continuing royalty fee for the first 18 months a restaurant is open. After this initial period, the rate is calculated based on the last 12 months revenue on a sliding scale. Currently our Durban location is our only location that has been open more than 18 months and the rate for the next 12 months has been set at 4%.

|

|

|

·

|

4% of gross revenue is to be spent on advertising and marketing.

|

|

|

·

|

Open seven locations by December 31, 2014.

|

|

|

·

|

Advise us on locating and opening a completed restaurant, including supplier lists, acceptable site criteria, and architectural plan (at HOA’s option).

|

|

|

·

|

Provide us with management training and pre-opening training for non-management employees.

|

|

|

·

|

Advise us on operation, advertising and promotion.

|

|

|

·

|

Provide us with the requirements for a standardized system for accounting, cost control, and inventory control.

|

| 2 |

Our first location in South Africa opened in December 2009 and as of December 31, 2011 LP’s have been paid $129,877 (36.9%) against their 20% return. Our second location opened in June 2010 and as of December 31, 2011 LP’s have been paid $65,461 (15.9%) against their 20% return. Our third location opened in June 2011 and as of December 31, 2011 LP’s have been paid $18,000 (4.2%) against their 20% return. The payments to investors for our first and second locations were primarily funded from the cash flows of the restaurants. The payments to investors for the third location were funded by the Company as an advance on expected future cash flows.

|

·

|

Brazil - we have acquired development rights for

Hooters in five states of Brazil, which would include Rio de Janeiro. We have partnered with the current local franchisee who

owns the Hooters franchise rights in the state of Sao Paolo and we own 60% of the entity holding the development rights, with

our local partner owning the remaining 40%.

|

|

·

|

Hungary - we have applied to HOA for franchise rights in Hungary, where we anticipate we would own 80% of the entity holding the franchise rights, with our local partner owning the remaining 20%. We anticipate that we will contract with our local partner, who we believe is an experienced franchise restaurateur, to manage the day-to-day operations of the locations, although we do not presently have any agreement in writing.

|

|

·

|

Australia - we have partnered with the current

Hooters franchisee in a joint venture. The first Hooters restaurant under this joint venture (which would be the third

Hooters restaurant currently open) opened in January 2012 in Campbelltown, a suburb of Sydney. We are in discussions

to purchase from the same franchisee a partial interest in the first two existing Hooters locations in the Sydney area.

|

|

·

|

Europe – we have a non-binding letter

of intent with a current franchisee to purchase 100% of an existing Hooters location.

|

| 3 |

|

The Offering

|

||

|

Securities Offered

|

5,000,000 units. Each unit consists of one share of common stock and one redeemable warrant to purchase one share of stock.

Initially, the common stock and the warrants will be quoted only as a unit for a minimum of 30 days unless the representative of the underwriters determines that an earlier date is acceptable. No later than the 45th day following the date of this prospectus. the common stock and the warrant will each be quoted separately, and the units will no longer be quoted. We will notify our security holders regarding the separation of our units through the issuance of a press release and publication of a report on Form 8-K in advance of the date our units separate and the common stock and the warrants begin to be quoted separately.

|

|

|

Warrants

|

The warrant included in the units will be exercisable at any time after they become quoted separately and until either they are redeemed or they expire in accordance with their terms on the fifth anniversary of the date of this prospectus. The exercise price of a warrant is $3.25. Beginning [six] months after the date of this prospectus, the warrants will be redeemable at our option for $_____ per warrant upon 30 days' prior written notice, at any time after our common stock has closed at a price of at least $5.00 per share for at least twenty (20) consecutive trading days. The warrants may only be redeemed if we have a current and effective registration statement available covering the exercise of the warrants.

|

| 4 |

|

Securities Outstanding After This Offering

|

|

|

| Units | 5,000,000 | |

| Common Stock | 7,498,724(1) shares | |

| Warrants | 5,400,000(1) | |

|

Use of Proceeds

|

The proceeds from the offering, less fees and expenses incurred by us in connection with the offering, are intended to be used for owning and operating international Hooters franchises and for general corporate purposes, including working capital.

|

|

|

Risk Factors

|

Investing in the units involves significant risks, including, but not limited to, the following: our limited operating history and history of losses; risks inherent in expansion of our operations; our lack of restaurant management experience; continued satisfactory relationship with HOA; and the limited public market for our securities. You should carefully consider the information set forth in the "Risk Factors" section of this prospectus prior to investing in the units.

|

|

|

|

(1) The number of shares of our common stock to be outstanding after this offering excludes an aggregate of 4,814,018 additional shares of common stock and warrants issuable under various outstanding warrant agreements with expiration dates between October 1, 2016 and August 9, 2021, and exercise prices ranging from $2.75 to $3.50.

|

|

| Unless we specifically state otherwise, the share information is as of _______, 2011 and reflects or assumes no exercise of outstanding options or warrants to purchase shares of our common stock, and no exercise of the over-allotment option. |

| 5 |

| Year Ended | Year Ended | |||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||

| Statement of Operations Data: | As reported | Adjustment | Proforma | As reported | As reported | |||||||||||||||

| Revenues | $ | 1,463,820 | $ | 136,301 | $ | 602,978 | ||||||||||||||

| Expenses | 2,567,210 | 1,147,866 | 1,416,674 | |||||||||||||||||

| Net loss | $ | (1,103,390 | ) | $ | (1,011,565 | ) | $ | (813,696 | ) | |||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Current Assets | $ | 623,681 | $ | 13,300,000 | $ | 13,923,681 | $ | 158,718 | $ | 60,180 | ||||||||||

| Working Capital (deficit) | (3,003,625 | ) | 13,300,000 | 10,296,375 | (486,916 | ) | (675,471 | ) | ||||||||||||

| Total assets | 5,504,678 | 13,300,000 | 18,804,678 | 1,414,559 | 1,453,669 | |||||||||||||||

| Total stockholders’ equity | 1,641,263 | 13,300,000 | 14,941,263 | 82,425 | 718,018 | |||||||||||||||

| 6 |

|

Ja nuary

1, 2011 through December 31, 2011:

|

Durban

(1)

|

Johannesburg

(2)

|

CapeTown

(3)

|

Total

|

||||||||||||

Net

sales

|

$ | 1,367,022 | $ | 2,395,803 | $ | 568,898 | $ | 4,331,723 | ||||||||

Cost

of sales

|

589,430 | 982,950 | 227,575 | 1,799,955 | ||||||||||||

Gross

profit

|

777,592 | 1,412,853 | 341,323 | 2,531,768 | ||||||||||||

Total

Operating Expenses

|

578,023 | 1,183,772 | 305,671 | 2,067,466 | ||||||||||||

EBITDA

|

199,569 | 229,081 | 35,652 | 464,302 | ||||||||||||

Interest

expense

|

5,054 | 9,291 | 4,682 | 19,027 | ||||||||||||

Amortization

and depreciation

|

63,283 | 176,472 | 41,167 | 280,922 | ||||||||||||

Income

taxes

|

37,446 | 17,207 | 8,774 | 63,427 | ||||||||||||

| 105,783 | 202,970 | 54,623 | 363,376 | |||||||||||||

Net

income

|

93,786 | 26,111 | (18,971 | ) | 100,926 | |||||||||||

January

1, 2010 through December 31, 2011:

|

Durban

(1)

|

Johannesburg

(2)

|

CapeTown

(3)

|

Total

|

||||||||||||

Revenues

|

$ | 3,319,947 | $ | 4,385,541 | $ | 568,898 | $ | 8,274,386 | ||||||||

Cost

of Goods Sold

|

1,205,869 | 1,591,983 | 227,575 | 3,025,427 | ||||||||||||

Gross

Profit

|

2,114,078 | 2,793,558 | 341,323 | 5,248,959 | ||||||||||||

Operating

expenses

|

1,509,304 | 2,035,776 | 305,671 | 3,850,751 | ||||||||||||

EBITDA

|

604,774 | 752,782 | 35,652 | 1,398,208 | ||||||||||||

Interest

expense

|

10,079 | 15,415 | 4,682 | 30,176 | ||||||||||||

Amortization

and depreciation

|

131,395 | 275,394 | 41,167 | 447,956 | ||||||||||||

Income

taxes

|

129,113 | 135,831 | 8,774 | 273,71 8 | ||||||||||||

Net

income

|

$ | 334,187 | $ | 331,142 | $ | (18,971 | ) | $ | 646,358 | |||||||

| 7 |

| 8 |

| 9 |

|

|

•

|

the availability of suitable sites for new locations;

|

|

|

•

|

our ability to negotiate acceptable lease or purchase terms for new locations, obtain adequate financing, on favorable terms, required to construct, build-out and operate new locations and meet construction schedules, and hire and train and retain qualified restaurant managers and personnel;

|

|

|

•

|

managing construction and development costs of new restaurants at affordable levels;

|

|

|

•

|

the establishment of brand awareness in new markets; and

|

|

|

•

|

the ability of our Company to manage this anticipated expansion.

|

|

|

•

|

adverse changes in national, regional or local economic or market conditions;

|

|

|

•

|

increased costs of labor;

|

|

|

•

|

increased costs of food products;

|

|

|

•

|

availability of, and ability to obtain, adequate supplies of ingredients that meet our quality standards;

|

|

|

•

|

increased energy costs;

|

|

|

•

|

management problems;

|

|

|

•

|

increases in the number and density of competitors;

|

| 10 |

|

|

•

|

changing consumer tastes, habits and spending priorities;

|

|

|

•

|

changing demographics;

|

|

|

•

|

changes in government regulation; and

|

|

|

•

|

local, regional or national health and safety matters.

|

| 11 |

| 12 |

| 13 |

|

·

|

they have specialized knowledge about our company and operations;

|

|

|

·

|

they have specialized skills that are important to our operations; or

|

|

|

·

|

they would be particularly difficult to replace.

|

|

|

·

|

announcements or press releases relating to the biopharmaceutical sector or to our own business or prospects;

|

| 14 |

|

|

·

|

regulatory, legislative, or other developments affecting us or the healthcare industry generally;

|

|

|

·

|

sales by holders of restricted securities pursuant to effective registration statements or exemptions from registration; and

|

|

|

·

|

market conditions specific to biopharmaceutical companies, the healthcare industry and the stock market generally.

|

| 15 |

| 16 |

|

|

·

|

quarterly variations in operating results and achievement of key business metrics;

|

|

|

·

|

changes in earnings estimates by securities analysts, if any;

|

|

|

·

|

any differences between reported results and securities analysts’ published or unpublished expectations;

|

|

|

·

|

announcements of new contracts or service offerings by us or our competitors;

|

|

|

·

|

market reaction to any acquisitions, joint ventures or strategic investments announced by us or our competitors;

|

|

|

·

|

shares being sold pursuant to Rule 144 or upon exercise of warrants;

|

|

|

·

|

our ability to obtain working capital financing; and

|

|

|

·

|

general economic or stock market conditions unrelated to our operating performance.

|

| 17 |

USE OF PROCEEDS

We estimate that the net proceeds to us from the sale of the units that we are offering, assuming gross proceeds of $15.0 million, will be approximately $13.3 million, after deducting underwriting discounts and commissions and estimated offering expenses, or approximately $15.9 million if the underwriter’s over-allotment is exercised in full.

We expect to use any proceeds received from this offering as follows:

| • | $10.5 million for investment in Hooters international franchises – presently we have agreements in place for Surfers Paradise (Australia), Brazil and Hungary. Approximately $5.0 million is for purchasing interests in existing international Hooters locations, including ones we presently operate, $5.1 million for buildout and startup costs on eight locations and $0.4 million is for Hooters franchise rights; | |

| • | $4.2 million to payoff existing debt – $1.5 million estimated balance of our bank line of credit, which currently has an annual interest rate of 4.5% (0.5 % over Wall Street Journal Prime rate, or floor of 4.5%, whichever is higher) and matures on August 20, 2012;and $2.7 million payoff of convertible debt, which currently has an annual interest rate of 18% and matures from dates ranging between April and August 2012. In lieu of cash repayments, a portion of the convertible debt will be converted into units as part of the offering; | |

| • | $0.6 million for general corporate working capital. |

The projected expenditures shown above are only estimates or approximations. We expect the proceeds from this offering together with revenues generated from our business, will be sufficient to cover our anticipated capital requirements for at least the next 24 months. Until we are able to apply the net proceeds of this offering to the uses described above, we intend to invest the proceeds in short term investment grade securities. Any proceeds received from the exercise of warrants will be used for working capital.

| 18 |

Pro

Forma

|

||||||||

Actual

|

As

Adjusted

|

|||||||

Common

stock, 2,498,891 shares at December 31, 2011;

|

||||||||

7,498,891

shares on a pro forma basis

|

$ | 301 | $ | 801 | ||||

Additional

paid-in capital

|

6,459,506 | 19,759,006 | ||||||

Other

stockholders' equity

|

1,214,264 | 1,214,264 | ||||||

Accumulated

deficit

|

(6,032,808 | ) | (6,032,808 | ) | ||||

Stockholders'

equity

|

$ | 1,641,263 | $ | 14,941,263 | ||||

High

|

Low

|

|||||||

| First Quarter, 2012 | $ | 3.70 | $ | 2.20 | ||||

First

Quarter, 2011

|

$ | 3.38 | $ | 2.12 | ||||

Second

Quarter, 2011

|

$ | 3.20 | $ | 2.09 | ||||

Third

Quarter, 2011

|

$ | 3.00 | $ | 2.15 | ||||

Fourth

Quarter, 2011

|

$ | 5.00 | $ | 2.40 | ||||

Year

ended December 31, 2010

|

||||||||

First

Quarter

|

$ | 4.25 | $ | 2.50 | ||||

Second

Quarter

|

$ | 4.25 | $ | 2.60 | ||||

Third

Quarter

|

$ | 4.25 | $ | 3.50 | ||||

Fourth

Quarter

|

$ | 4.25 | $ | 3.01 | ||||

Year

ended December 31, 2009

|

||||||||

First

Quarter

|

$ | 5.75 | $ | 1.01 | ||||

Second

Quarter

|

$ | 5.55 | $ | 3.00 | ||||

Third

Quarter

|

$ | 5.40 | $ | 2.25 | ||||

Fourth

Quarter

|

$ | 5.50 | $ | 2.05 | ||||

Year

ended December 31, 2008

|

||||||||

First

Quarter

|

$ | 8.00 | $ | 5.40 | ||||

Second

Quarter

|

$ | 7.00 | $ | 5.10 | ||||

Third

Quarter

|

$ | 7.00 | $ | 5.75 | ||||

Fourth

Quarter

|

$ | 7.00 | $ | 5.50 | ||||

| 19 |

| Item 7: | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this report that are not historical fact are "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. The words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "believes," "estimates," "projects" or similar expressions are intended to identify these forward-looking statements. These statements are subject to risks and uncertainties beyond our reasonable control that could cause our actual business and results of operations to differ materially from those reflected in our forward-looking statements. The safe harbor provisions provided in the Securities Litigation Reform Act do not apply to forward-looking statements we make in this report. Forward-looking statements are not guarantees of future performance. Our forward-looking statements are based on trends which we anticipate in our industry and our good faith estimate of the effect on these trends of such factors as industry capacity, product demand and product pricing. The inclusion of projections and other forward-looking statements should not be regarded a representation by us or any other person that we will realize our projections or that any of the forward-looking statements contained in this prospectus will prove to be accurate.

Management’s Analysis of Business

We have changed our focus recently from managing investments to owning and operating Hooters franchises internationally. Hooters restaurants are casual beach-themed establishments with sports on television, jukebox music, and the “nearly world famous” Hooters Girls. The menu consists of spicy chicken wings, seafood, sandwiches and salads. Each locations menu can vary with the tastes of the locality it is in. Hooters began in 1983 with its first restaurant in Clearwater, Florida. From the original restaurant and licensee Mr. Robert Brooks, Hooters has become a global brand, with locations in 44 states domestically and over 450 Hooters restaurants worldwide. Besides restaurants, Hooters has also branched out to other areas, including licensing its name to a golf tour and the sale of packaged food in supermarkets.

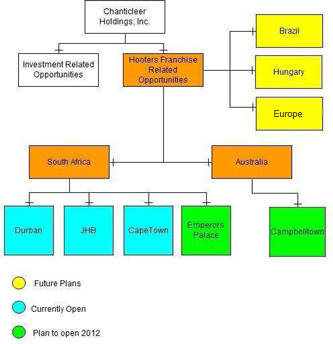

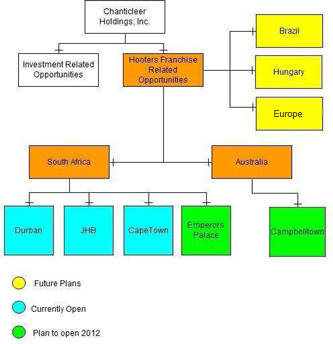

We expect to either own 100% of the Hooters franchise or partner with a local franchisee in the countries we target. We based this decision on what we believe to be the successful launch of our South African Hooters venture and believe we have aligned partners and operators in various international markets. We are focused on expanding our Hooters operations, and expect to use substantially all the net proceeds from the upcoming offering, in South Africa, Brazil, Hungary, Australia and Europe.

Accordingly, we operate in two business segments; Hooters franchise restaurants and our legacy investment management and consulting services businesses.

LIQUIDITY AND CAPITAL RESOURCES AND GOING CONCERN

Historical information:

At December 31, 2011 and 2010, the Company had current assets of $623,681 and $158,718; current liabilities of $3,627,306 and $645,634; and a working capital deficit of $3,003,625 and $486,916, respectively. The Company incurred a loss of $1,103,390 during the year ended December 31, 2011 and had an unrealized loss from available-for-sale securities of $13,005 and foreign currency translation losses of $6,357, resulting in a comprehensive loss of $1,122,752.

The Company's corporate general and administrative expenses averaged approximately $295,000 per quarter during 2011. In the fourth quarter of 2011, $64,000 was added when we began consolidating the South African operations. The Company expects costs to increase as we expand our footprint internationally in 2012. Effective October 1, 2011, the Company acquired majority control of the restaurants in South Africa and began consolidating these operations. The Company also will share 49% of the profits in our Hooters location opened in January 2012 in Campbelltown, Australia, a suburb of Sydney.

In addition, the Company has a note with a balance at December 31, 2011 of $242,964 owed to its bank which is due in August 2013 and a line of credit with its bank with a balance at December 31, 2011 of $1,165,000 (total available $2,000,000) due on August 20, 2012. We also have convertible notes payable with certain investors with a balance at December 31, 2011 of $1,625,000 due in the second quarter of 2012. The Company plans to continue to use limited partnerships, if the Company’s contemplated raise is not completed, to fund its share of costs for additional Hooters restaurants.

| 20 |

The Company expects to meet its obligations in 2012 with some or all of the following:

| · | File an S-1 Registration during the second quarter of 2012, and, assuming it becomes effective, plans to raise up to $15,000,000 from the sale of common stock and warrant units; | |

| · | The Company received $100,000 in January 2012 as a fee for its CEO sitting on the Board of Hooters of America and expect to continue to receive this fee for the next three years based on the current agreement; | |

| · | Extend a portion of its existing line of credit; | |

| · | Convert its convertible notes payable into common stock. |

If the above events do not occur or if the Company does not raise sufficient capital, substantial doubt about the Company’s ability to continue as a going concern exists. These consolidated financial statements do not reflect any adjustments that might result from the outcome of these uncertainties.

Evaluation of the amounts and certainty of cash flows:

The Company plans to use the funding from the S-1 Registration to complete its expansion plans in South Africa, Brazil, Australia, Hungary and Europe. The Company has used short-term financing to meet the preliminary requirements of its planned expansion, principally in South Africa and Australia. If the Company is unable to obtain the funding from the S-1 Registration, the Company would be required to limit its expansion plans. We would use limited partner funding and other sources of capital to the extent necessary to attempt to fund as much of the planned expansion as possible. There can be no assurance that any of this funding will be available when needed.

Cash requirements and capital expenditures:

In 2012, we expect to open one restaurant in each of the following countries – Australia (in addition to the one already opened in February 2012), Brazil, Hungary and South Africa. The Company expects the total cash requirements for these restaurants to be approximately $3.1 million, of which approximately $350,000 has been paid as of March 27, 2012.

In addition, we expect general and administrative expenses to be approximately $1.3-$1.4 million for 2012.

Discussion and analysis of known trends and uncertainties:

The World economy has been in a state of flux for some time with the debt problems of a number of countries in Europe, the recent recession in the United States, the significant increase to debt in the United States compounded by continuing to give away more than can reasonably be collected, the slowing economy in China and other factors. It is impossible to forecast what this will mean to our expansion plans in South Africa, Brazil, Australia, Poland and Hungary. We feel that we minimize our risks through investment in different geographical areas.

Expected changes in the mix and relative cost of capital resources:

Since the middle of 2010, the Company has utilized high cost capital to finance its international growth. The Company hopes to eliminate the majority of this debt with new equity and further, to use this equity to complete its expansion plans over the next two years.

Other prospective sources for and uses of cash:

If the Company is unable to obtain the funding from its Offering, it will seek other sources of interim funding to maintain its current operations and complete the restaurants already underway.

If the above events do not occur or the Company is unable to develop its business model, substantial doubt about the Company's ability to continue as a going concern exists.

| 21 |

RESULTS OF OPERATIONS

Revenue

Revenue amounted to $1,463,820 in 2011 and $136,301 in 2010. Cash revenues were $493,167 and $967,418 in 2011 from the management and restaurant businesses, respectively, and $84,218 in 2010 from the management business. The majority of our cash revenues in 2011 for the management business was from a fee of $400,000 received in January 2011 for our services in facilitating the acquisition of HOA and TW and of $91,667 of the Company’s annual payment from HOA of $100,000, which is due in January each year while Mr. Pruitt serves on its board. In 2010 cash revenues were management fees from Investors LLC and Investors II. Non-cash revenues in 2011 and 2010 of $3,235 and $52,083, respectively were recognized from the receipt of securities for our services.

The fair value of the equity instruments for management fees received was determined based upon the stock prices as of the date we reached an agreement with the third party. The terms of the securities are not subject to adjustment after the measurement date. See Note 4 of the consolidated financial statements for details.

Restaurant cost of sales

Restaurant cost of sales totaled $360,810, or 37.3% of restaurant net sales. We expect the percentage to remain approximately the same in 2012 as we expand our business in South Africa and other countries.

Restaurant operating expenses

Restaurant operating expenses totaled $483,946, or 50.0% of restaurant net sales. We expect the percentage of operating expenses to restaurant net sales to decline as we open more Hooters locations, however we have a limited history to be able to forecast a range.

General and Administrative Expense (“G&A”)

G&A amounted to $1,245,752 in 2011 and $935,110 in 2010. The more significant components of G&A are summarized as follows:

| 2011 | 2010 | |||||||

| Professional fees | $ | 104,016 | $ | 106,594 | ||||

| Payroll and benefits | 563,323 | 518,162 | ||||||

| Consulting and investor relation fees | 261,315 | 17,223 | ||||||

| Travel and entertainment | 84,767 | 42,950 | ||||||

| Accounting and auditing | 70,450 | 67,914 | ||||||

| Director fees | - | 42,500 | ||||||

| Bad debt expense | 750 | 24,907 | ||||||

| Other G&A | 161,131 | 114,860 | ||||||

| $ | 1,245,752 | $ | 935,110 | |||||

G&A costs are expected to increase in 2012 to $325-$350,000 per quarter, with the costs associated with the activities of the restaurant business continuing to grow. Revenue from the restaurants is expected to exceed this increase in expense.

Payroll and benefits increased $45,161 in 2011 from 2010 primarily from the addition of restaurant management personnel in the fourth quarter of 2011.

Consulting and investor relations fees increased $244,092 from 2011 to 2010 as the Company engaged experienced personnel to startup our European subsidiary and to increase the Company’s recognition in the investment arena. Non-cash fees for services were $74,573 and $25,000 in 2011 and 2010, respectively.

Travel and entertainment increased $41,817 as Company personnel, primarily the CEO, traveled to increase our company awareness and lockdown financing and partners for the restaurant locales.

There were no director fees in 2011. Effective December 31, 2010, the Company issued 20,000 shares of its common stock to its outside directors for current and prior director fees. The stock was valued at $42,500 based on the closing price of the common stock on that date.

The Company recognized a bad debt in the amount of $750 in 2011 and $24,907 in 2010. The amount in 2010 was for prior management services of $24,000 and expense advances of $907 owed by Green St. Energy, Inc., a company for which the Company previously provided management services.

| 22 |

Asset Impairment

In 2010, the Company recorded an impairment of $250,000 for our equity interest in BreezePlay as a result of it not being able to raise sufficient capital to complete its business plan and substantially ceasing operation.

OTHER INCOME (EXPENSE)

Other income (expense) consisted of the following at December 31, 2011 and 2010:

| 2011 | 2010 | |||||||

| Other income (expense): | ||||||||

| Equity in earnings (losses) of investments | $ | (76,113 | ) | $ | 58,337 | |||

| Realized gains from sale of investments | 19,991 | 106,035 | ||||||

| Interest expense | (180,825 | ) | (140,016 | ) | ||||

| Interest income | 4,541 | 46,000 | ||||||

| Miscellaneous income | 476 | - | ||||||

| Other than temporary decline in available-for-sale securities | (147,973 | ) | (40,386 | ) | ||||

| $ | (379,903 | ) | $ | 29,970 | ||||

Equity in Earnings of Investments

Equity in earnings of investments includes our share of earnings from investments in which we own at least 20% and are being accounted for using the equity method. This included losses from the Hoot Campbelltown and Hoot SA partnerships in 2011 of $66,857 and $9,256, respectively and income from the Hoot SA partnerships in 2010 of $58,337.

Realized Gains from Sale of Investments

Realized gains are recorded when investments are sold and include transactions in 2011 from a gain on sales of DineOut and in 2010 from a gain on sales of DineOut of $157,807, a loss on sales of Vought Defense Systems of $58,355 and a gain on sales of Healthsport of $6,583.

Interest Expense

Interest expense increased in 2011 from 2010 primarily due to the addition in 2011 of a line of credit for $1,165,000 and convertible notes payable in the amount of $1,625,000, offset by the conversion of $686,500 of convertible notes payable from 2010.

Interest Income

Interest income in 2011 decreased $41,459 as 2011 includes earnings from Investors for one month, compared to 2010 which includes our earnings from Investors for the entire year.

Other than Temporary Decline in Available-for-Sale Securities

The Company determined that its investment in available-for-sale securities had an other than temporary decline in value and recorded a realized loss in the amount of $147,973 and $40,386 in 2011 and 2010, respectively. Valuations were determined based on the quoted market price for the stock when it was determined the decline was not temporary and the decline was recorded. In 2011, the Company recorded an impairment of $147,973 primarily related to the Company’s investment in HiTech Stages ($124,573) and Efftec International ($22,500). In 2010, the Company recorded an impairment of $40,386 primarily related to the Company’s investment in Remodel Auction ($39,100).

| 23 |

PROVISION FOR INCOME TAXES

The Company recorded income tax expense of $14,608 based on the net profit of one of our South African locations at a 28% corporate income tax rate.

RECENT ACCOUNTING PRONOUNCEMENTS

There are several new accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”) which are not yet effective. Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe any of these accounting pronouncements has had or will have a material impact on the Company’s financial position or operating results. See Note 2 to the consolidated financial statements.

Critical Accounting Policies

The SEC has suggested companies provide additional disclosure and commentary on their most critical accounting policies, which they defined as the ones that are most important to the portrayal of a company’s financial condition and operating results, and require management to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition our most critical accounting policy is the valuation of our investments. The methods, estimates and judgments we use in applying this accounting policy has a significant impact on the results we report in our financial statements.

Leases

Restaurant Operations lease certain properties under operating leases. Many of these lease agreements contain rent holidays, rent escalation clauses and/or contingent rent provisions. Rent expense is recognized on a straight-line basis over the expected lease term, including cancelable option periods when failure to exercise such options would result in an economic penalty. We use a time period for straight-line rent expense calculation that equals or exceeds the time period used for depreciation. In addition, the rent commencement date of the lease term is the earlier of the date when they become legally obligated for the rent payments or the date when they take access to the grounds for build out. Accounting for leases involves significant management judgment.

Investments

We determine fair value to be the amount for which an investment could be exchanged in an orderly disposition over a reasonable period of time between willing parties other than in a forced or liquidation sale. Our evaluation process is intended to provide a consistent basis for determining the fair value of our available-for-sale investments. In summary, for individual securities classified as available-for-sale securities, an enterprise shall determine whether a decline in fair value below the amortized cost basis is other than temporary. If the decline in fair value is judged to be other than temporary, the individual security shall be written down to fair value as a new cost basis and the amount of the write-down shall be included in earnings (accounted for as a realized loss). The new cost basis shall not be changed for subsequent recoveries in fair value. Subsequent increases in the fair value of available-for-sale securities shall be included in other comprehensive income and subsequent decreases in fair value, if not an other-than-temporary impairment, also shall be included in other comprehensive income.

The first step in the analysis is to determine if the security is impaired. All of our available-for-sale securities were listed and we use the closing market price and other factors to determine the amount of impairment if any. The second step, if there is an impairment, is to determine if the impairment is other than temporary. To determine if a decline in the value of an equity security is other than temporary and that a write-down of the carrying value is required, we considered the following:

| · | The length of time and the extent to which the market value has been less than the cost; |

| · | The financial condition and near-term prospects of the issuer, including any specific events which may influence the operations of the issuer such as changes in technology that may impair the earnings potential of the investment or the discontinuance of a segment of the business that may affect the future earnings potential; or |

| · | The intent and ability of the holder to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value. |

Unless evidence exists to support a realizable value equal to or greater than the carrying value of the investment in equity securities classified as available-for-sale, a write-down to fair value accounted for as a realized loss should be recorded. Such loss should be recognized in the determination of net income of the period in which it occurs and the written down value of the investment in the issuer becomes the new cost basis of the investment.

Investments in which the Company has the ability to exercise significant influence and that, in general, are at least 20 percent owned are stated at cost plus equity in undistributed net earnings (loss), less distributions received. The Company also has equity investments in which it owns less than 20% which are stated at cost. An impairment loss would be recorded whenever a decline in the value of an equity investment or investment carried at cost is below its carrying amount and is determined to be other than temporary. In judging “other than temporary,” the Company considers the length of time and extent to which the fair value of the investment has been less than the carrying amount of the investment, the near-term and long-term operating and financial prospects of the investee, and the Company’s long-term intent of retaining the investment in the investee.

| 24 |

COMMITMENTS AND CONTINGENCIES

Effective August 1, 2010, the Company extended its office lease agreement for a period of one year at a monthly rental of $2,100, for its office located at 11220 Elm Lane, Suite 103, Charlotte, NC 28277. Since August 1, 2011, the lease has continued at the same rate on a month-to-month basis.

The Company leases the land and building for our four restaurants in South Africa through our subsidiaries. The leases are for five year terms and include options to extend the terms. We lease our restaurant facilities under “triple net” leases that require us to pay minimum rent, real estate taxes, maintenance costs and insurance premiums and, in some instances, percentage rent based on sales in excess of specified amounts.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table presents a summary of our contractual operating lease obligations and commitments as of December 31, 2011:

| Payments due by period | ||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

| Long-Term Debt Obligations (1) | $ | 263,921 | $ | 20,250 | $ | 243,671 | $ | - | $ | - | ||||||||||

| Operating Lease Obligations (2) | 3,202,977 | 526,787 | 1,213,143 | 1,463,047 | ||||||||||||||||

| Purchase Obligations (3) | 550,000 | 550,000 | - | - | - | |||||||||||||||

| Total | $ | 4,016,898 | $ | 1,097,037 | $ | 1,456,814 | $ | 1,463,047 | $ | - | ||||||||||

(1) Represents the outstanding principal amounts and interest on all our long-term debt.

(2) Represents operating lease commitments for our four Hooters restaurants in South Africa.

(3) Represents commitments for Hooters international restaurants in Australia

If the raise discussed in Note 14, Subsequent Events, is successful, the Company plans to commit approximately $4,500,000 in Brazil and $3,400,000 in South Africa for additional restaurant locations.

| 25 |

|

|

·

|

4% of gross revenue is paid to HOA monthly as a continuing royalty fee for the first 18 months a restaurant is open. After this initial period, the rate is calculated based on the last 12 months revenue on a sliding scale. Currently our Durban location is our only location that has been open more than 18 months and the rate for the next 12 months has been set at 4%.

|

|

|

·

|

4% of gross revenue is to be spent on advertising and marketing.

|

|

|

·

|

Open seven locations by December 31, 2014.

|

| 26 |

|

|

·

|

Advise us on locating and opening a completed restaurant, including supplier lists, acceptable site criteria, and architectural plan (at HOA’s option).

|

|

|

·

|

Provide us with management training and pre-opening training for non-management employees.

|

|

|

·

|

Advise us on operation, advertising and promotion.

|

|

|

·

|

Provide us with the requirements for a standardized system for accounting, cost control, and inventory control.

|

Our first location in South Africa opened in December 2009 and as of December 31, 2011 LP’s have been paid $129,877 (36.9%) against their 20% return. Our second location opened in June 2010 and as of December 31, 2011 LP’s have been paid $65,461 (15.9%) against their 20% return. Our third location opened in June 2011 and as of December 31, 2011 LP’s have been paid $18,000 (4.2%) against their 20% return. The payments to investors for our first and second locations were primarily funded from the cash flows of the restaurants. The payments to investors for the third location were funded by the Company as an advance on expected future cash flows.

| 27 |

|

|

·

|

Brazil - we have acquired development rights for

Hooters in five states of Brazil, which would include Rio de Janeiro. We have partnered with the current local franchisee

who owns the Hooters franchise rights in the state of Sao Paolo and we own 60% of the entity holding the development rights, with

our local partner owning the remaining 40%.

|

|

|

·

|

Hungary - we have applied to HOA for franchise rights in Hungary, where we anticipate we would own 80% of the entity holding the franchise rights, with our local partner owning the remaining 20%. We anticipate that we will contract with our local partner, who we believe is an experienced franchise restaurateur, to manage the day-to-day operations of the locations, although we do not presently have any agreement in writing.

|

|

|

·

|

Australia - we have partnered with the current

Hooters franchisee in a joint venture. The first Hooters restaurant under this joint venture (which would be the third

Hooters restaurant currently open) opened in January 2012 in Campbelltown, a suburb of Sydney. We are in discussions

to purchase from the same franchisee a partial interest in the first two existing Hooters locations in the Sydney area.

|

|

|

·

|

Europe – we have a non-binding letter of

intent with a current franchisee to purchase 100% of an existing Hooters location.

|

| 28 |

| 29 |

| 30 |

|

NAME

|

AGE

|

POSITION

|

||

Michael

D. Pruitt

|

51

|

President,

CEO and Director since June 2005

|

||

Michael

Carroll

|

63

|

Independent

Director since June 2005

|

||

Brian

Corbman

|

36

|

Independent

Director since August 2005

|

||

Paul

I. Moskowitz

|

55

|

Independent

Director since April 2007

|

||

Keith

Johnson

|

54

|

Independent

Director since November 2009

|

| 31 |

| 32 |

|

Name and Principal Position

|

Year

|

Salary

|

Bonus

|

Total

|

||||||||||

| Michael D. Pruitt (CEO since | 2011 | $ | 168,000 | $ | - | $ | 168,000 | |||||||

| June 2005)(1) | 2010

|

$ | 154,000 | $ | - | $ | 154,000 | |||||||

| 2009 | $ | 171,000 | $ | - | $ | 171,000 | ||||||||

|

|

(1)

|

The 2009 compensation includes $11,000 in consulting fees during the time Mr. Pruitt had temporarily discontinued his salary.

|

| 33 |

|

2011

|

2010

|

|||||||

|

Chanticleer Investors, LLC

|

$ | - | $ | 6,035 | ||||

|

Chanticleer Investors II, LLC

|

- | 46,547 | ||||||

|

Chanticleer Dividend Fund, Inc.

|

74,281 | 30,937 | ||||||

|

Hoot SA II LLC

|

825 | - | ||||||

|

Other

|

- | 750 | ||||||

| $ | 75,106 | $ | 84,269 | |||||

|

2011

|

2010

|

|||||||

|

Avenel Financial Group, a company owned by Mr. Pruitt

|

13,849 | 46,349 | ||||||

|

Chanticleer Investors, LLC

|

4,045 | - | ||||||

|

Hoot SA I, LLC

|

15,409 | - | ||||||

|

Hoot SA III, LLC

|

- | 70,000 | ||||||

|

Chanticleer Foundation

|

10,750 | - | ||||||

| $ | 44,053 | $ | 116,349 | |||||

| 34 |

|

2011

|

2010

|

|||||||

|

Chanticleer Investors, LLC

|

$ | - | $ | 19,875 | ||||

|

Chanticleer Investors II, LLC

|

- | 11,171 | ||||||

|

North American Energy Resources, Inc.

|

1,750 | 6,125 | ||||||

|

Efftec International, Inc.

|

- | 22,500 | ||||||

| $ | 1,750 | $ | 59,671 | |||||

| 35 |

|

|

·

|

each person known by the Company to beneficially own more than 5% of the outstanding shares of the Company's Common Stock;

|

|

|

·

|

the Company's executive officer;

|

|

|

·

|

each of the Company's directors; and

|

|

|

·

|

all of the Company's directors and its executive officer as a group.

|

|

Number of Shares of

|

Percentage of Class

|

|||||||||||

|

Name

|

Common Stock Owned

|

Pre-offering

|

Post-offering

|

|||||||||

|

Sandor Capital Master Fund LP (1)

|

298,200 | 9.9 | % | 3.7 | % | |||||||

|

Robert B. Prag (2)

|

298,200 | 9.9 | % | 3.7 | % | |||||||

|

Michael D. Pruitt (3)

|

404,610 | 13.4 | % | 5.1 | % | |||||||

|

Michael Carroll

|

11,000 | * | * | |||||||||

|

Brian Corbman

|

11,100 | * | * | |||||||||

|

Paul I. Moskowitz

|

6,200 | * | * | |||||||||

|

Keith Johnson

|

2,000 | * | * | |||||||||

|

Officers and Directors As a Group (5 Persons)

|

434,910 | 14.4 | % | 5.4 | % | |||||||

|

|

(1)

|

John S. Lemak has investment and voting control over the securities held by Sandor Capital Master Fund LP. Sandor maintains principal offices at 2828 Routh Street, Suite 500, Dallas, TX 75201. The amounts set forth in the table include 174,772 shares of common stock owned by Sandor, 24,700 shares of common stock owned by John S. Lemak, and 98,728 shares of common stock underlying Class A Warrants owned by Sandor. The amounts set forth in the table exclude additional shares underlying Class A Warrants and Class B Warrants owned by Sandor and John S. Lemak, which warrants limit exercise to that number of shares that, when aggregated with the holder’s existing ownership of the Company’s common stock, would result in such holder, together with related persons or entities, owning more than 9.9% of the Company’s issued and outstanding common stock. This information is based solely on information in Schedule 13G. |

| 36 |

|

|

(2)

|

Mr. Prag’s address is 2455 El Amigo Road, Del Mar, CA 92014. The amounts set forth in the table include 152,000 shares of common stock owned by Mr. Prag, 28,000 shares of common stock owned by Del Mar Consulting Group, Inc. Retirement Plan Trust (with respect to which Mr. Prag serves as Trustee), and 115,000 shares of common stock underlying Class A Warrants owned by Mr. Prag. The amounts set forth in the table exclude additional shares underlying Class A Warrants and Class B Warrants owned by Mr. Prag and Del Mar Consulting Group, Inc. Retirement Plan Trust, which warrants limit exercise to that number of shares that, when aggregated with the holder’s existing ownership of the Company’s common stock, would result in such holder, together with related persons or entities, owning more than 9.9% of the Company’s issued and outstanding common stock. This information is based solely on information in Schedule 13G. |

|

|

(3)

|

Includes 62,680 shares of common stock held by Avenel Financial Group, Inc., a corporation controlled by Michael D. Pruitt. The amounts set forth in the table exclude additional shares underlying Class A Warrants and Class B Warrants owned by Mr. Pruitt, which warrants limit exercise to that number of shares that, when aggregated with the holder’s existing ownership of the Company’s common stock, would result in such holder, together with related persons or entities, owning more than 9.9% of the Company’s issued and outstanding common stock.

|

| 37 |

|

Underwriter

|

Number of Units

|

|||

|

Dawson James Securities, Inc.

|

||||

|

Total

|

5,000,000 | |||

| 38 |

|

|

·

|

Stabilizing transactions consist of bids or purchases made by the representative for the purpose of preventing or slowing a decline in the market price of our securities while this offering is in progress.

|

|

|

·

|

Short sales and over-allotments occur when the representative, on behalf of the underwriting syndicate, sells more of our units than it purchases from us in this offering. To cover the resulting short position, the representative may exercise the over-allotment option described above or may engage in syndicate covering transactions. There is no contractual limit on the size of any syndicate covering transaction. The underwriters will make available a prospectus in connection with any such short sales. Purchasers of shares sold short by the underwriters are entitled to the same remedies under the federal securities laws as any other purchaser of shares covered by the registration statement.

|

|

|

·

|

Syndicate covering transactions are bids for or purchases of our securities on the open market by the representative on behalf of the underwriters in order to reduce a short position incurred by the representative.

|

|

|

·

|

Penalty bids permit the representative to reclaim a selling concession from a syndicate member when the units originally sold by the syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions.

|

|

|

·

|

If the underwriters commence these activities, they may discontinue them at any time without notice. The underwriters may carry out these transactions on the Over the Counter Market or otherwise.

|

| 39 |

|

Per Unit

|

Total Without

Over-Allotment

Option

|

Total With

Over-Allotment

Option

|

||||||||||

|

Total underwriting discount to be paid by us

|

$ | $ | $ | |||||||||

|

Non-accountable expense allowance

|

$ | $ | $ | |||||||||

|

|

·

|

our history and our prospects;

|

|

|

·

|

the industry in which we operate;

|

|

|

·

|

the status and development prospects for our products and services;

|

|

|

·

|

the previous experience of our executive officers; and

|

|

|

·

|

the general condition of the securities markets at the time of this offering.

|

| 40 |

| 41 |

|

|

·

|

prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

·

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned (1) by persons who are directors and also officers and (2) by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

·

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 662/3% of the outstanding voting stock which is not owned by the interested stockholder.

|

| 42 |

| 43 |

|

Page

|

|

Report

of Independent Registered Public Accounting Firm |

49

|

| Annual Financial Statements | |

Consolidated

Balance Sheets at December 31, 2010 and 2009

|

50

|

Consolidated

Statements of Operations for the Years Ended December 31, 2010 and 2009

|

51

|

Consolidated

Statements of Stockholders’ Equity at December 31, 2010 and 2009

|

52

|

Consolidated

Statements of Cash Flows for the Years Ended December 31, 2010 and 2009

|

53

|

Notes

to Consolidated Financial Statements

|

55

|

| Quarterly Financial Statements | 79 |

Balance

Sheets as of September 30, 2011 and December 31, 2010

|

80

|

Statements

of Operations – For the Three Months Ended September 30, 2011 and 2010

|

81

|

Statements

of Operations – For the Nine Months Ended September 30, 2011 and 2010

|

82

|

Statements

of Cash Flows – For the Nine Months Ended September 30, 2011 and 2010

|

83

|

Notes

to Consolidated Financial Statements

|

85

|

| 44 |

CREASON & ASSOCIATES, P.L.L.C.

7170 S. Braden Ave., Suite 100

Tulsa, Oklahoma 74136

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Chanticleer Holdings, Inc.:

We have audited the accompanying consolidated balance sheets of Chanticleer Holdings, Inc. and Subsidiaries (the "Company") as of December 31, 2011 and 2010, and the related consolidated statements of operations and comprehensive income, stockholders’ equity and cash flows for the years ended December 31, 2011 and 2010. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We did not audit the financial statements of Kiarabrite (Pty) Ltd, Dimaflo (Pty) Ltd, Tundraspex (Pty) Ltd, Civisign (Pty) Ltd and Dimalogix (Pty) Ltd (collectively referred to as the South Africa Operations), wholly-owned and majority-owned subsidiaries, which statements reflect total assets and revenues constituting 72 percent and 66 percent, respectively, of the related consolidated totals. Those statements were audited by other auditors whose reports have been furnished to us, and our opinion, insofar as it relates to the amounts included for the South Africa Operations, is based solely on the reports of the other auditors.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, based on our audit and the reports of the other auditors, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Chanticleer Holdings, Inc. and Subsidiaries as of December 31, 2011 and 2010, and the consolidated results of their operations and their cash flows for the years ended December 31, 2011 and 2010, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that Chanticleer Holdings, Inc. and Subsidiaries will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, Chanticleer Holdings, Inc. has incurred substantial net losses and negative cash flows from operations for the past several years, along with negative working capital. In addition, the Company has future plans that may require substantial financial obligations. There can be no assurance that the Company will be able to generate sufficient cash revenues to fund its current operations and fulfill its future commitments. These conditions raise substantial doubt about Chanticleer Holdings, Inc. and Subsidiaries’ ability to continue as a going concern. Management’s plans regarding these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that may result from the outcome of these uncertainties.

| /s/Creason & Associates, P.L.L.C. |

Tulsa, Oklahoma

April 3, 2012

| 45 |

Chanticleer Holdings, Inc. and Subsidiaries

Consolidated Balance Sheets

December 31, 2011 and 2010

| 2011 | 2010 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 151,928 | $ | 46,007 | ||||

| Accounts receivable | 103,982 | 4,258 | ||||||

| Inventory | 59,266 | - | ||||||

| Due from related parties | 76,591 | 84,269 | ||||||

| Prepaid expenses | 231,914 | 24,184 | ||||||

| TOTAL CURRENT ASSETS | 623,681 | 158,718 | ||||||

| Property and equipment, net | 2,508,823 | 25,563 | ||||||

| Intangible assets, net | 470,164 | - | ||||||

| Investments at fair value | 318,353 | 352,500 | ||||||

| Other investments | 1,579,677 | 853,798 | ||||||

| Deposits and other assets | 3,980 | 23,980 | ||||||

| TOTAL ASSETS | $ | 5,504,678 | $ | 1,414,559 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Current maturities of long-term debt and notes payable | $ | 1,171,855 | $ | 250,000 | ||||

| Convertible notes payable | 1,625,000 | - | ||||||

| Accounts payable | 267,475 | 211,432 | ||||||

| Accrued expenses | 21,521 | 66,103 | ||||||

| Other current liabilities | 496,643 | 1,750 | ||||||

| Income taxes payable | 14,608 | - | ||||||

| Due to related parties | 30,204 | 116,349 | ||||||

| TOTAL CURRENT LIABILITIES | 3,627,306 | 645,634 | ||||||

| Long-term debt, less current maturities | 236,109 | 686,500 | ||||||

| TOTAL LIABILITIES | 3,863,415 | 1,332,134 | ||||||

| Commitments and contingencies (Note 12) | ||||||||

| Stockholders' equity: | ||||||||

| Common stock: $0.0001 par value; authorized 200,000,000 shares; issued 3,012,121 shares and 2,571,918 shares; and outstanding 2,498,891 and 2,048,688 shares at December 31, 2011 and 2010, respectively | 301 | 257 | ||||||

| Additional paid in capital | 6,459,506 | 5,456,067 | ||||||

| Other comprehensive income | 48,665 | 68,027 | ||||||

| Non-controlling interest | 1,692,019 | 24,175 | ||||||

| Accumulated deficit | (6,032,808 | ) | (4,929,418 | ) | ||||

| Less treasury stock, 513,230 shares and 523,230 shares at December 31, 2011 and 2010, respectively | (526,420 | ) | (536,683 | ) | ||||

| 1,641,263 | 82,425 | |||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 5,504,678 | $ | 1,414,559 | ||||

See accompanying notes to consolidated financial statements.

| 46 |

Chanticleer Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations

For the Years Ended December 31, 2011 and 2010

| 2011 | 2010 | |||||||

| Revenue: | ||||||||

| Restaurant sales, net | $ | 967,418 | $ | - | ||||

| Management fee income - non-affiliates | 493,167 | 20,833 | ||||||

| Management fee income - affiliates | 3,235 | 115,468 | ||||||

| Total revenue | 1,463,820 | 136,301 | ||||||

| Expenses: | ||||||||

| Restaurant cost of sales | 360,810 | - | ||||||

| Restaurant operating expenses | 483,946 | - | ||||||

| General and administrative expense | 1,245,752 | 935,110 | ||||||

| Asset impairment | - | 250,000 | ||||||

| Depreciation and amortization | 87,617 | 11,079 | ||||||

| Total expenses | 2,178,125 | 1,196,189 | ||||||

| Loss from operations | (714,305 | ) | (1,059,888 | ) | ||||

| Other income (expense) | ||||||||

| Equity in earnings (losses) of investments | (76,113 | ) | 58,337 | |||||

| Realized gains from sales of investments | 19,991 | 106,035 | ||||||

| Interest income | 4,541 | 46,000 | ||||||

| Miscellaneous income | 476 | - | ||||||

| Interest expense | (180,825 | ) | (140,016 | ) | ||||

| Other than temporary decline in available-for-sale securities | (147,973 | ) | (40,386 | ) | ||||

| Total other income (expense) | (379,903 | ) | 29,970 | |||||

| Net loss before income taxes | (1,094,208 | ) | (1,029,918 | ) | ||||

| Provision for income taxes | 14,608 | - | ||||||

| Net loss before non-controlling interest | (1,108,816 | ) | (1,029,918 | ) | ||||

| Non-controlling interest | 5,426 | 18,353 | ||||||

| Net loss | (1,103,390 | ) | (1,011,565 | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Unrealized gain (loss) on available-for-sale securities (none applies to non-controlling interest) | (13,005 | ) | 152,027 | |||||

| Foreign translation losses | (6,357 | ) | - | |||||

| Other comprehensive loss | $ | (1,122,752 | ) | $ | (859,538 | ) | ||

| Net earnings (loss) per share, basic and diluted | $ | (0.47 | ) | $ | (0.51 | ) | ||

| Weighted average shares outstanding | 2,370,036 | 1,990,462 | ||||||

See accompanying notes to consolidated financial statements.

| 47 |

Chanticleer Holdings, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

Years ended December 31, 2011 and 2010

| Accumulated | ||||||||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| Additional | Comprehensive | Non- | ||||||||||||||||||||||||||||||

| Common Stock | Paid-in | Income | Controlling | Accumulated | Treasury | |||||||||||||||||||||||||||

| Shares | Par | Capital | (Loss) | Interest | Deficit | Stock | Total | |||||||||||||||||||||||||

| Balance, December 31, 2009 | 2,492,752 | $ | 250 | $ | 5,255,624 | $ | (84,000 | ) | $ | - | $ | (3,917,853 | ) | $ | (536,003 | ) | $ | 718,018 | ||||||||||||||

| Common stock issued for: | ||||||||||||||||||||||||||||||||

| Consultants | 15,572 | 1 | 24,999 | - | - | - | - | 25,000 | ||||||||||||||||||||||||

| Amounts due related party | 33,594 | 3 | 58,787 | - | - | - | - | 58,790 | ||||||||||||||||||||||||

| Accounts payable | 10,000 | 1 | 17,499 | - | - | - | - | 17,500 | ||||||||||||||||||||||||

| Director fees | 20,000 | 2 | 42,498 | - | - | - | - | 42,500 | ||||||||||||||||||||||||

| Beneficial conversion feature of convertible notes payable | - | - | 56,660 | - | - | - | - | 56,660 | ||||||||||||||||||||||||

| Available-for-sale securities | - | - | - | 152,027 | - | - | - | 152,027 | ||||||||||||||||||||||||

| Purchase treasury stock | - | - | - | - | - | - | (680 | ) | (680 | ) | ||||||||||||||||||||||

| Non-controlling interest | - | - | - | - | 42,528 | - | - | 42,528 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | (18,353 | ) | (1,011,565 | ) | - | (1,029,918 | ) | |||||||||||||||||||||

| Balance, December 31, 2010 | 2,571,918 | 257 | 5,456,067 | 68,027 | 24,175 | (4,929,418 | ) | (536,683 | ) | 82,425 | ||||||||||||||||||||||

| Common stock issued for: | ||||||||||||||||||||||||||||||||

| Convertible notes payable and accrued interest | 412,286 | 41 | 731,046 | - | - | - | - | 731,087 | ||||||||||||||||||||||||

| Services | 27,750 | 3 | 74,570 | - | - | - | - | 74,573 | ||||||||||||||||||||||||

| Cash | 167 | - | 500 | - | - | - | - | 500 | ||||||||||||||||||||||||

| Available-for-sale securities contributed by CEO | - | - | 125,331 | - | - | - | - | 125,331 | ||||||||||||||||||||||||

| Warrants sold, net | - | - | 20,608 | - | - | - | - | 20,608 | ||||||||||||||||||||||||

| Amortize warrants | - | - | 35,247 | - | - | - | - | 35,247 | ||||||||||||||||||||||||

| Sell treasury stock | - | - | 16,137 | - | - | - | 10,263 | 26,400 | ||||||||||||||||||||||||

| Available-for-sale securities | - | - | - | (13,005 | ) | - | - | - | (13,005 | ) | ||||||||||||||||||||||

| Non-controlling interest | - | - | - | - | 1,673,270 | - | - | 1,673,270 | ||||||||||||||||||||||||

| Foreign translation loss | - | - | - | (6,357 | ) | - | - | - | (6,357 | ) | ||||||||||||||||||||||

| Net loss | - | - | - | - | (5,426 | ) | (1,103,390 | ) | - | (1,108,816 | ) | |||||||||||||||||||||

| Balance, December 31, 2011 | 3,012,121 | $ | 301 | $ | 6,459,506 | $ | 48,665 | $ | 1,692,019 | $ | (6,032,808 | ) | $ | (526,420 | ) | $ | 1,641,263 | |||||||||||||||

See accompanying notes to consolidated financial statements.

| 48 |

Chanticleer Holdings, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2011 and 2010

| 2011 | 2010 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (1,103,390 | ) | $ | (1,011,565 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Other than temporary decline in value of available-for-sale securities | 147,973 | 40,386 | ||||||

| Bad debt expense - related party | 750 | 24,907 | ||||||

| Non-controlling interest | (5,426 | ) | (18,353 | ) | ||||

| Consulting and other services rendered in exchange for investment securities | (1,500 | ) | (33,000 | ) | ||||

| Depreciation and amortization | 87,617 | 11,079 | ||||||

| Equity in (earnings) loss of investments | 76,113 | (58,337 | ) | |||||

| Asset impairment | - | 250,000 | ||||||

| Common stock issued for services | 74,573 | 49,375 | ||||||

| (Gain) loss on sale of investments | (19,991 | ) | (106,035 | ) | ||||

| Beneficial converstion feature of convertible notes payable | - | 56,660 | ||||||

| Amortization of warrants | 35,247 | - | ||||||

| (Increase) decrease in amounts due from affiliate | (54,217 | ) | (46,547 | ) | ||||

| (Increase) decrease in accounts receivable | (73,830 | ) | (4,258 | ) | ||||

| (Increase) decrease in prepaid expenses and other assets | (168,393 | ) | - | |||||

| (Increase) decrease inventory | 5,988 | - | ||||||

| Increase (decrease) in accounts payable and accrued expenses | (58,779 | ) | 89,807 | |||||

| Increase (decrease) in income taxes payable | 14,608 | - | ||||||

| Increase (decrease) in deferred revenue | (1,750 | ) | (19,083 | ) | ||||

| Advance from related parties for working capital | - | 14,650 | ||||||

| Net cash used by operating activities | (1,044,407 | ) | (760,314 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Proceeds from sale of investments | 190,325 | 281,765 | ||||||

| Investment distribution | 8,140 | 16,137 | ||||||

| Purchase of investments | (1,285,500 | ) | (26,334 | ) | ||||

| Acquisition of subsidiaries | (205,000 | ) | - | |||||

| Purchase of property and equipment | (388,109 | ) | (4,517 | ) | ||||

| Treasury stock proceeds (acquired) | 26,400 | (680 | ) | |||||

| Deposit made for investment | - | (20,000 | ) | |||||

| Net cash provided (used) by investing activities | (1,653,744 | ) | 246,371 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from sale of common stock | 500 | - | ||||||

| Proceeds from sale of common stock warrants, net | 20,608 | - | ||||||

| Loan proceeds | 2,790,000 | 541,000 | ||||||

| Loan repayment | (7,036 | ) | (4,500 | ) | ||||

| Loans to related parties | - | (48,924 | ) | |||||

| Loan from related party | - | 70,000 | ||||||

| Net cash provided by financing activities | 2,804,072 | 557,576 | ||||||

| Net increase in cash and cash equivalents | 105,921 | 43,633 | ||||||

| Cash and cash equivalents, beginning of year | 46,007 | 2,374 | ||||||

| Cash and cash equivalents, end of year | $ | 151,928 | $ | 46,007 | ||||

See accompanying notes to consolidated financial statements.

| 49 |

Chanticleer Holdings, Inc. and Subsidiaries

Consolidated Statements of Cash Flows, continued

For the Years Ended December 31, 2011 and 2010

| 2011 | 2010 | |||||||

| Supplemental cash flow information: | ||||||||

| Cash paid for interest and income taxes: | ||||||||

| Interest | $ | 98,837 | $ | 31,999 | ||||

| Income taxes | - | - | ||||||

| Non-cash investing and financing activities: | ||||||||

| Common stock issued for amounts due related party | $ | - | $ | 58,790 | ||||

| Common stock issued for accounts payable | - | 17,500 | ||||||

| Reclassification of investment accounted for under the cost method as available-for-sale security | - | 100,000 | ||||||

| Due to related party exchanged for convertible note payable | 25,000 | - | ||||||

| Convertible notes payable exchanged for common stock | 711,500 | - | ||||||

| Accrued interest exchanged for common stock | 10,000 | - | ||||||

| Investment contributed byt the Company's CEO | 125,331 | - | ||||||

| Common stock issued for prepaid consulting contract | 44,850 | - | ||||||

| Acquisition of subsidiaries: | ||||||||

| Current assets, excluding cash and cash equivalents | $ | 93,638 | - | |||||

| Property and equipment and intangible assets | 2,651,197 | - | ||||||

| Total assets excluding cash and cash equivalents | 2,744,835 | - | ||||||