As filed with the Securities and Exchange Commission on June 26, 2020

Registration No. 333-237795

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SONNET BIOTHERAPEUTICS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-2932652 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

100 Overlook Center, Suite 102

Princeton, New Jersey 08540

(609) 375-2227

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Pankaj Mohan, Ph.D.

CEO and Chairman

Sonnet BioTherapeutics Holdings, Inc.

100 Overlook Center, Suite 102

Princeton, New Jersey 08540

Tel: (609) 375-2227

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to the agent for service, to:

Steven M. Skolnick, Esq.

Alexander E. Dinur, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

Tel: (212) 262-6700

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: [ ]

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer: | [ ] | Accelerated filer: | [ ] |

| Non-accelerated filer: | [X] | Smaller reporting company: | [X] |

| Emerging growth company: | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act [ ]

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered(1) | Amount to be registered | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount

of registration fee(4) |

||||||||||||

| Common Stock, par value $0.0001 per share | 5,547,792 | (1)(2) | $ | 3.88 | (3) | $ | 21,525,433 | (3) | $ | 2,794.00 | ||||||

| (1) | All 5,547,792 shares of common stock issuable upon exercise of the warrants are to be offered by certain of the selling stockholders named herein, which warrants were issued on April 16, 2020 to such selling stockholders pursuant to that certain Securities Purchase Agreement, dated as of February 7, 2020, by and among the Registrant, Sonnet BioTherapeutics, Inc., a New Jersey Corporation and the investors listed on the Schedule of Buyers attached thereto. |

| (2) | Pursuant to Rule 416 under the Securities Act, this registration statement covers an indeterminate number of shares that may be issued upon stock splits, stock dividends or similar transactions. |

| (3) | Estimated in accordance with Rule 457(c) under the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee, based on the average of the high and low prices of shares of the registrant’s Common Stock, as reported on the Nasdaq Capital Market on June 23, 2020, a date within five business days prior to the initial filing of this registration statement on June 26, 2020. |

| (4) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold until the registration statement is effective. This prospectus is not an offer to sell these securities and does not solicit an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, preliminary prospectus dated June 26, 2020

SONNET BIOTHERAPEUTICS HOLDINGS, INC.

5,547,792 Shares of Common Stock

This prospectus of Sonnet BioTherapeutics Holdings, Inc. (formerly known as Chanticleer Holdings, Inc.), a Delaware corporation (the “Company” or “Sonnet”), relates solely to the resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”) of up to 5,547,792 shares of our common stock (“Common Stock”), par value $0.0001 per share (“Common Shares”). The 5,547,792 Common Shares consist solely of Common Shares issuable upon exercise of outstanding warrants to purchase Common Shares (the “Warrants”) issued by us on April 16, 2020, pursuant to that certain Securities Purchase Agreement, dated as of February 7, 2020, by and among Sonnet, Sonnet BioTherapeutics, Inc., a New Jersey corporation) (“Sonnet Sub”), and the investors named therein (the “Investors”), as amended (the “Securities Purchase Agreement”). The Warrants are comprised of two series of warrants, the Series A Warrants to purchase Common Stock (the “Series A Warrants”) and the Series B Warrants to Purchase Common Stock (the “Series B Warrants”).

The Series A Warrants have an exercise price of $5.3976, were exercisable upon issuance and have a term of five years from the date of issuance. The Series B Warrants have an exercise price of $0.0001, were exercisable upon issuance and will expire on the day following the later to occur of (i) the 45th trading day immediately following the earlier to occur of (x) the date a holder can sell all underlying securities pursuant to Rule 144 of the Securities Act (“Rule 144”) without restriction or limitation and without the requirement to be in compliance with Rule 144(c)(1) of the Securities Act and (y) April 16, 2021, and (ii) the date on which the Series B Warrants have been exercised in full (without giving effect to any limitation on exercise contained therein) and no shares remain issuable thereunder . We are registering the resale of the Common Shares underlying the Warrants (the “Warrant Shares”) as required by the Registration Rights Agreement we entered into with the Selling Stockholders on February 7, 2020 (the “Registration Rights Agreement”). Currently, 3,300,066 Common Shares are issuable under the Series A Warrants, and 2,247,726 Common Shares are issuable under the Series B Warrants. See “Description of Capital Stock—Outstanding Warrants.”

Our registration of the Warrant Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the Warrant Shares. The Selling Stockholders may sell the Warrant Shares covered by this prospectus in a number of different ways and at varying prices. For additional information on the possible methods of sale that may be used by the Selling Stockholders, you should refer to the section of this prospectus entitled “Plan of Distribution” of this prospectus. We will not receive any of the proceeds from the Warrant Shares sold by the Selling Stockholders, other than any proceeds from any cash exercise of the Warrants.

No underwriter or other person has been engaged to facilitate the sale of the Warrant Shares in this offering. The Selling Stockholders may, individually but not severally, be deemed to be an “underwriter” within the meaning of the Securities Act, of the Warrant Shares that they are offering pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration of the Warrant Shares. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the Warrant Shares.

You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus carefully before you invest. Our common stock is listed on The NASDAQ Capital Market under the symbol “SONN”. On June 23, 2020, the last reported sale price of our common stock on The NASDAQ Capital Market was $3.86 per share.

Investing in our securities involves risk. You should carefully consider the risks that we have described under the section captioned “Risk Factors” in this prospectus on page 19 before buying our Securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020

TABLE OF CONTENTS

Sonnet BioTherapeutics Holdings, Inc. and its consolidated subsidiaries are referred to herein as “Sonnet,” “the Company,” “we,” “us” and “our,” unless the context indicates otherwise.

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the securities offered by this prospectus. This prospectus and any future prospectus supplement do not constitute an offer to sell or a solicitation of an offer to buy any securities in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus or any prospectus supplement nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or such prospectus supplement or that the information contained by reference to this prospectus or any prospectus supplement is correct as of any time after its date.

| 2 |

Some of the statements contained or incorporated by reference in this prospectus may include forward-looking statements that reflect our current views with respect to our research and development activities, business strategy, business plan, financial performance and other future events. These statements include forward-looking statements both with respect to us, specifically, and the biotechnology sector, in general. We make these statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “estimate,” “may,” “should,” “anticipate,” “will” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise.

All forward-looking statements involve inherent risks and uncertainties, and there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, those factors set forth under the caption “Risk Factors” in this prospectus supplement and in our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this prospectus supplement. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this Note. Before purchasing any of our securities, you should consider carefully all of the factors set forth or referred to in this prospectus that could cause actual results to differ.

| 3 |

The following summary highlights some information from this prospectus. It is not complete and does not contain all of the information that you should consider before making an investment decision. You should read this entire prospectus, including the “Risk Factors” section on page 19, the financial statements and related notes and the other more detailed information appearing elsewhere or incorporated by reference into this prospectus.

The Company

Overview

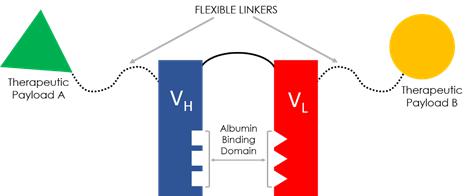

We are a clinical-stage biopharmaceutical company with a proprietary technology for developing novel biologic medicines we refer to as FHAB (Fully Human Albumin Binding). FHAB utilizes a fully human single chain antibody fragment (scFv) linked to either one or two therapeutic molecules capable of affecting single or bispecific mechanisms of action. The FHAB construct contains a domain that is designed to bind to and “hitch hike” on human serum albumin (HSA) for transport to targets such as solid tumors or to the lymphatic system for antiviral applications. We designed the construct to improve drug accumulation in specific tissues, as well as to extend the duration of activity in the body. FHAB development candidates are produced in a mammalian cell culture, which enables glycosylation, thereby reducing the risk of immunogenicity. We believe our FHAB technology is well suited for future drug development across a range of human disease areas, including autoimmune, pathogenic, inflammatory, and hematological conditions.

Our current internal pipeline development activities are focused on cytokines, a class of cell signaling peptides that, among other important functions, serve as potent immunomodulatory agents. Working both independently and synergistically, specific cytokines have shown the ability to modulate the activation and maturation of immune cells that fight cancer and pathogens. However, because they do not preferentially accumulate in specific tissues and are quickly eliminated from the body, the conventional approach to achieving a treatment effect with cytokine therapy typically requires the administration of high and frequent doses. This can result in a reduced treatment effect accompanied by the potential for systemic toxicity, which poses challenges to the therapeutic application of this class of drugs.

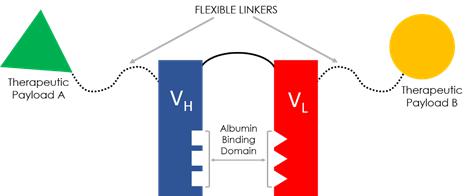

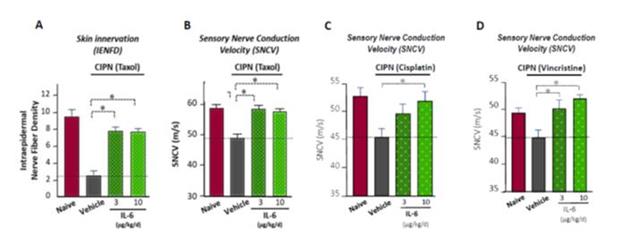

We have a pipeline of therapeutic compounds focused primarily on oncology indications of high unmet medical need.

| ● | SON-080, our most advanced candidate, is a low-dose formulation of Interleukin 6, in development for Chemotherapy Induced Peripheral Neuropathy (CIPN), an indication of high unmet medical need. Through Serono SA’s original exploration of the cytokine as a potential treatment for thrombocytopenia in cancer, Phase I and Phase I/II clinical data from over 200 patients were generated. After observing transient therapeutic activity at doses approaching the estimated maximum tolerated dose (MTD) for thrombocytopenia, Serono elected to pursue CIPN using lower doses, but the program was de-prioritized by Merck KGaA after it acquired the company in 2006. We agreed to purchase the global development rights to SON-080 in August 2019 and will be applying the Merck-Serono preclinical and clinical data package to our ongoing work in CIPN. | |

| We are currently requalifying the legacy clinical batch product and updating the safety package to comply with current regulatory requirements. We are undertaking the qualification and validation of the product prior to entering a preclinical toxicology study for further refining the dosing parameters for a Phase Ib/IIa trial in CIPN patients. We are designing this trial to leverage data from prior studies. Although the CIPN program continues to progress forward, the COVID-19 pandemic has impacted workflow at our contract research partners such that we now estimate delays pushing a trial initiation into the first half of 2021 from late 2020. Additionally, we continue to explore business development opportunities for the Diabetic Peripheral Neuropathy (DPN) indication. | ||

| ● | SON-1010 (IL12- FHAB), our most advanced FHAB-derived compound, utilizes a fully human version of Interleukin 12 (IL-12) linked to FHAB. This compound is being developed for solid tumor indications, including non-small cell lung cancer (NSCLC) and head and neck cancer, as well as for antiviral applications. We are targeting an IND submission for SON-1010 for cancer in the second half of 2021. In virology, we have initiated work on preliminary viral challenge studies in mice using an H1N1 model with data expected during the second half of 2020. If successful, a mouse-adapted SARS-CoV-1 challenge model study is expected to follow, which will inform our decision about a clinical trial strategy using FHAB in an adjuvant capacity, paired with a vaccine. | |

| ● | SON-1210 (IL15- FHAB-IL12), our lead bispecific construct, combines FHAB with fully human IL-12 and fully human Interleukin 15 (IL-15). This compound is being developed for solid tumor indications, including colorectal cancer, and we expect to file an IND in the second half of 2021. |

| 4 |

In our discovery pipeline, we are investigating:

| ● | SON-2014 (GMcSF- FHAB-IL18), a bispecific combination of Granulocyte-macrophage Colony Stimulating Factor (GM-CSF) and Interleukin-18 (IL-18) for melanoma and renal cancers; and | |

| ● | SON-3015 (anti-IL6- FHAB-anti-TGFβ), a bispecific combination of anti-IL6 and anti-Tumor Growth Factor Beta for tumor and bone metastases. |

We face numerous challenges and uncertainties with respect to the development and commercialization of our therapeutic compounds, including our FHAB technology. Please see “Risk Factors” contained elsewhere in this prospectus, and the sections entitled “Risk Factors” in the documents incorporated by reference into this prospectus.

Strategy

Our goal is to rapidly advance our pipeline and leverage our therapeutic FHAB platform to become a leader in the discovery, development, and commercialization of biologic drugs.

Advance our lead product candidate, SON-080, through clinical development: SON-080 is a fully human version of low dose Interleukin 6 (IL-6) being studied for chemotherapy-induced peripheral neuropathy (CIPN). SON-080 has successfully completed Phase I clinical trials in cancer patients and we expect to initiate a pilot efficacy Phase Ib/IIa study in CIPN patients during 2021.

FHAB program advancement: Preparation is underway to take SON-1010 into Phase I clinical testing in 2021, followed by SON-1210. Our goal is to advance two discovery assets per year into preclinical development, including SON-2014 in 2020, and potentially SON-3015. We also plan to disclose two additional discovery assets annually.

Manufacturing platform: Sonnet compounds are produced using an industry standard mammalian cell (Chinese Hamster Ovary/CHO) production platform that allows for rapid scale-up and commercial manufacturing using a standard commercial manufacturing process. The mammalian cell culture system enables glycosylation, thereby reducing the risk of immunogenicity for our products.

Regulatory strategy: We believe that Sonnet’s assets are differentiated and represent potential breakthroughs in biopharmaceutical drug development. We will endeavor to seek breakthrough therapy designation with regulatory agencies, which could potentially lead to accelerated clinical development timelines.

Pipeline licensing opportunities: We are pursuing partnering opportunities with leading biopharmaceutical companies for the development and commercialization of our pipeline assets.

FHAB technology expansion: Sonnet is exploring FHAB technology licenses with external partners interested in expanding its therapeutic deployment, which we believe could lead to the platform’s application to modalities such as in other immunological areas, vaccines, antibody drug conjugates and as a supplement to chimeric antigen receptor (CAR) T-cell technology. Provisional patents have been filed to secure exclusivity with FHAB in these fields.

| 5 |

The FHAB Technology

Our proprietary FHAB technology was engineered to address several important shortcomings of existing approaches to biopharmaceutical drug development. We designed FHAB as a plug-and-play, modular construct for innovating new chemical entities that does not need to be reconfigured for different therapeutic payloads. As is the case with all biologic drugs, dose level and frequency of administration are critical variables that oftentimes present as barriers to the development process. After injection, large molecule therapeutics, including peptides, proteins, fusion proteins, antibodies and the like, must remain intact and be capable of reaching their designated targets inside the body, without exceeding specific toxicity thresholds. Finally, they must also be produced using commercially attractive means.

Sonnet’s platform technology was designed to harness human serum albumin (HSA) as a therapeutic shuttling molecule. HSA is naturally present in the bloodstream and the predominant protein in blood plasma. Albumin is a major source of energy for inflamed, hypermetabolic tissues, including tumors. Due to the active need for nutrients, cancer cells overexpress albumin-binding proteins such as SPARC (Secreted Protein Acidic and Rich in Cysteine) and gp60 (Albondin glycoprotein).

Derived from the XOMA phage display library, Sonnet’s FHAB contains a fully human single chain antibody fragment (scFv) that binds HSA at Domain 2. FHAB has demonstrated a high binding affinity to serum albumin across species (human, mouse and cynomolgus monkey), with little-to-no immunogenicity, and retains the benefits of neonatal FcRn-mediated recycling of albumin for extending serum half-life by up to four weeks. Unlike monoclonal antibodies (mAbs), this binding occurs without invoking ADCC (antibody-dependent cellular cytotoxicity) and CDC (complement-dependent cytotoxicity). The FHAB construct physically binds serum albumin through an ionic, hydrophobic mechanism, which we believe offers a distinct advantage over technologies that rely on chemical, covalent binding. Once broken, a covalent bond cannot reform, whereas Sonnet’s FHAB is designed with the ability to bind, unbind and rebind to albumin. As albumin seeks albumin receptor gp60 and SPARC, FHAB leverages innate biological mechanisms for targeted delivery of the therapeutic payload to the tumor microenvironment.

Another unique advantage of Sonnet’s FHAB is its linker design. Used for attaching one or two large molecule therapeutic payloads, for single or bispecific activity, our G4S (glycine, serine) peptide linkers are flexible, while being long enough to prevent steric hindrance, and can assume a rod-like configuration for enhanced penetration of tight tissue matrixes. In addition to maintaining distance between the therapeutic functional domains, Sonnet linkers are fully human and non-immunogenic across the linker structure, including at the payload binding region. In bispecific constructs, the orientation of the therapeutic payloads can be manipulated to improve potential treatment effects.

| 6 |

As a final key design component, FHAB is produced in mammalian cell culture, specifically Chinese Hamster Ovary (CHO) cells, which enables glycosylation for reducing or potentially eliminating immunogenicity. Using CHO, we have created several different genetic fusion constructs with various low molecular weight therapeutic proteins (e.g., recombinant cytokines such as IL-12, IL-15, IL-18, anti-IL-6 and anti-TGFβ). Recombinant therapeutic proteins, including cytokines, have shown great therapeutic potential, but can lack tissue specificity, which can lead to toxicity. Due to their small (<50kDa) size, cytokines also suffer from a shorter circulation half-life (minutes-to-hours versus 21 days) versus monoclonal antibodies. In mouse models, FHAB-derived compounds have demonstrated substantially greater serum half-lives, improved tissue accumulation and marked tumor reduction activity when compared to their respective naked recombinant cytokines.

In summary, our FHAB technology underpins a modular, versatile scaffold that can be customized to yield a broad array of multi-targeted therapeutic candidates. Relative to existing albumin binding technologies, FHAB is differentiated by possessing a linear, rod-like shape designed for better target tissue penetration, a fully human design to reduce immunogenicity, mammalian glycosylation for reduced toxicity and FcRn binding for longer serum half-life. Importantly, FHAB-derived therapeutics have the potential for targeted delivery, reduced toxicity and wider therapeutic windows, with the added benefit of utilizing a tailored single or bispecific mechanism of action.

Applicability of FHAB Technology beyond Oncology:

Immunotherapy: We believe that our FHAB platform can innovate biologic drugs that target specific tissues while also increasing therapeutic half-life. As the FHAB construct is designed to enable the simultaneous deployment of two synergistic immunotherapy compounds, we envision a path to previously untapped immunotherapeutic advancements.

Drug Conjugation: With the FHAB technology, various drug compounds can be linked to the FHAB scaffold in combinations that extend beyond our first-wave pipeline of cytokines, which presents opportunities for development across myriad disease areas.

Vaccines: Vaccine developers are seeking to improve vaccine efficiency by conjugating vaccines to natural carriers, such as albumin. We believe the FHAB platform, with its modular scaffold structure, could be an efficient vehicle for delivering vaccines to lymph nodes, improving penetration and presentation, and extending half-life.

CAR T-cell Therapy: CAR T-cell therapy involves genetically modifying a patient’s own T cells to recognize cancer cells for more effectively targeting and killing tumors. We believe targeted Sonnet constructs utilizing interleukins could be systemically co-administered to enhance CAR T-cell efficacy.

| 7 |

Pipeline Overview

The following table summarizes information about pipeline programs where we have disclosed specific target indications:

SON-080

Through our pipeline discovery efforts, we have identified Interleukin 6 (IL-6) as a cytokine with important biological properties when delivered both as a standalone molecule, as well as when jointly inhibited in a bispecific combination with anti-TGFβ, using our FHAB technology. Our lead clinical stage asset, SON-080, is a fully human version of IL-6 manufactured in Chinese Hamster Ovary (CHO) cells. SON-080 has completed Phase I/II clinical trials in cancer patients with thrombocytopenia and will advance to the next stage of development in chemotherapy-induced peripheral neuropathy (CIPN), a common side effect of treatment with antineoplastic agents in cancer. CIPN is a debilitating condition that manifests itself as pain, numbness and tingling in the extremities. It has been reported in as many as 70% of patients undergoing specific cancer regimens and is a leading cause of patients prematurely aborting chemotherapy. In animal experiments designed to replicate clinical symptoms of CIPN, SON-080 has presented disease-modifying characteristics, including the potential to repair damaged nerves. We are planning discussion with regulatory authorities to finalize the design of a pilot efficacy study in patients with CIPN.

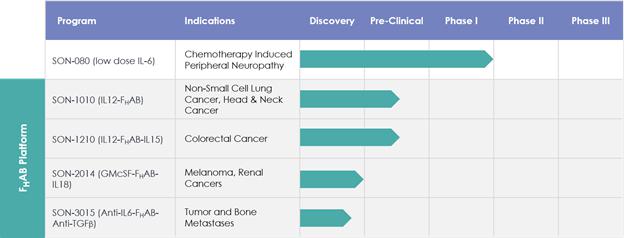

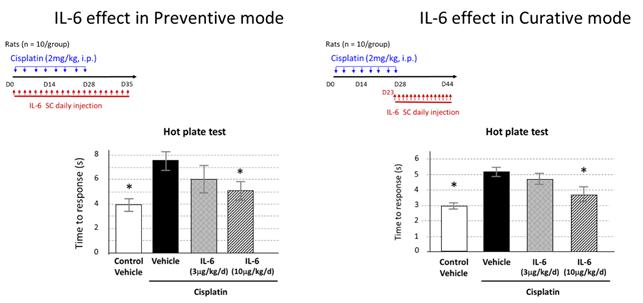

Based on our preclinical work, we believe that SON-080 can potentially regenerate damaged nerves, thereby addressing not only the pain-related symptoms, but also the profound discomfort and motor disability CIPN patients often experience. In the nervous system, IL-6 has exhibited potential neurotrophic-like properties, inducing anti-apoptotic gene expression, protecting neurons from toxic injuries, and promoting nerve regeneration and remyelination. SON-080 has demonstrated the potential to elicit nerve regrowth and to re-establish both normal nerve function (Figure 2) and sensations (Figure 3) in various preclinical models of CIPN induced by cisplatin, taxol or vincristine. Activity from treatment with SON-080 was also observed in preclinical models of type 2 diabetic neuropathy and other diseases affecting the nervous system or other organs. This broad activity suggests that the SON-080 mechanism of action might not be restricted to a given class of chemotherapeutic drugs and could elicit a universal neuroprotective-neurorestorative response. Additionally, preclinical data point to the potential of SON-080 to elicit both preventive and curative activity in neuropathies (Figure 3). This introduces the possibility of treating cancer survivors who still suffer from neuropathies, a population representing between 10% and 60% of the 14 million cancer survivors in the US.

| 8 |

Figure 2: Activity of SON-080 (IL-6) on neuropathy induced by taxol or cisplatin in rats measured at the histological (IENFD) or physiological (SNCV) levels

Figure 3: Data show preventive and curative activity potentiating restoration of normal sensitivity (here, using a behavioral response to hot stimulus in cisplatin-induced peripheral neuropathy).

SON-080 has completed Phase I/II studies in 214 cancer patients with chemotherapy-induced thrombocytopenia. Trial enrollees received subcutaneous doses ranging from 0.25 to 32 µg/kg daily, or thrice weekly. In these trials, where solid tumor cancers presented in more than 75% of the patients treated, the cumulative doses of IL-6 averaged in the 8000 μg range (122 – 54880 μg), and the mean duration of treatment equaled 28 days. One of the trials covered six chemotherapy cycles, with an IL-6 treatment period extending up to 203 days. In none of these trials was an exacerbation of either cancer or neuropathy observed.

The maximum tolerated dose (MTD) of SON-080 was determined in four studies by means of cohort dose escalations of sequential SON-080 dose groups utilizing established common toxicity criteria. When administered daily, the MTD following subcutaneous injection was determined to be between 3 and 8 μg/kg. When given thrice weekly, the MTD was estimated to be > 10 μg/kg. The most clinically relevant apparent toxicities that defined the treatment-limiting dose in these studies were flu-like symptoms and neurocortical toxicity manifested by somnolence, restlessness, confusion, hallucination, and disorientation. Figure 4 below summarizes the adverse events (AEs) and serious adverse events (SAEs) reported from the Phase I/II clinical studies that are believed to have resulted from treatment with SON-080.

| 9 |

| Total patients (n=214) | No. of AEs in at least 10% of patients treated with SON-080 | No. of SAEs in at least 2% of patients treated with SON-080 | ||||||

| Pyrexia | 151 (70.6%) | 19 (8.9%) | ||||||

| Rigors | 120 (56.1%) | - | ||||||

| Neutropenia | 31 (14.5%) | 15 (7.0%) | ||||||

| Thrombocytopenia | 48 (22.4%) | 15 (7.0%) | ||||||

| Anemia | 64 (29.9%) | 13 (6.1%) | ||||||

| Vomiting | 88 (41.1%) | 10 (4.7%) | ||||||

| Nausea | 106 (49.5%) | 8 (3.7%) | ||||||

| Fatigue | 82 (38.3%) | - | ||||||

| Dehydration | 7 (3.3%) | |||||||

| Dyspnoea | 37 (17.3%) | 7 (3.3%) | ||||||

| Abdominal pain | 27 (12.6%) | 6 (2.8%) | ||||||

| Dizziness | 41 (19.2%) | 5 (2.3%) | ||||||

| Headache | 68 (31.8%) | 5 (2.3%) | ||||||

| Constipation | 51 (23.8%) | - | ||||||

| Diarrhea | 50 (23.4%) | - | ||||||

| Injection site erythema | 46 (21.5%) | - | ||||||

| Fibrinogen increase | 45 (21.0%) | - | ||||||

| Anorexia | 45 (21.0%) | - | ||||||

| Hyperhidrosis | 41 (19.2%) | - | ||||||

| Malaise | 40 (18.7%) | - | ||||||

| Cough | 39 (18.2%) | - | ||||||

| Insomnia | 35 (16.4%) | - | ||||||

| Asthenia | 34 (15.9%) | - | ||||||

| Blood alkaline phosphatase increase | 33 (15.4%) | - | ||||||

| Flu-like symptoms | 28 (13.1%) | - | ||||||

| Alopecia | 28 (13.1%) | - | ||||||

| Mucosal inflammation | 27 (12.6%) | - | ||||||

| Back pain | 26 (12.1%) | - | ||||||

| Lethargy | 26 (12.1%) | - | ||||||

| Pain | 24 (11.2%) | - | ||||||

| Appetite decrease | 24 (11.2%) | - | ||||||

| Bilirubin increase | 23 (10.7%) | - | ||||||

| Arthralgia | 23 (10.7%) | - | ||||||

| Peripheral edema | 22 (10.3%) | - | ||||||

| Platelet count decrease | 22 (10.3%) | - | ||||||

| Hematuria | 22 (10.3%) | - | ||||||

| Veno-occlusive liver disease | - | 5 (2.3%) |

Figure 4: Summary of AEs and SAEs in cancer patients who received IL-6 either concomitantly or following chemotherapy. Doses tested included a range from 0.25 to 26 µg/kg, for a total drug exposure that ranged from 1 to 54,880 mg.

These data form the basis of our forthcoming clinical trials in CIPN, where dosing is expected to be significantly below MTD, as supported by our preclinical studies. For comparison, our target dose will provide a cumulative dose that is 25 times below the mean cumulative dose reached for similar period dosing. We also believe SON-080 has significant potential for treating other neuropathies including diabetic neuropathy, as well as potentially other diseases of the nervous system, and we are currently evaluating forward development paths for these opportunities.

| 10 |

SON-081

In addition to our CIPN program with SON-080, our SON-081 program may, subject to data collected from our planned CIPN studies with SON-080, explore the clinical utility of an identical formulation of IL-6 in diabetic peripheral neuropathy (DPN). DPN is currently diagnosed in 50%-80% of the diabetic patient population. According to World Health Organization (WHO) projections, the prevalence of diabetes is estimated to exceed 350 million people in 2030. Neuropathy is progressive and develops over the continuum of diabetes. The condition involves intractable pain with no obvious origin, as well as non-pain-related symptoms such as loss of balance, lack of sensation and autonomic dysfunctions, among others. These deficits impair quality of life and lead to a reduction of life expectancy. Diabetic foot ulcers are a major cost associated with diabetic medical care and are also directly linked to the development of DPN.

Notwithstanding the seriousness of the condition, current treatments only address the pain component of DPN, leaving disease progression and non-pain-related symptoms unaddressed. Furthermore, the few drugs currently used to reduce pain (i.e. Cymbalta, Lyrica, cannabinoids, opioids) are only partially efficacious and are associated with major side effects, which typically delays their introduction into a patient’s care. For these reasons, DPN remains a substantial unmet medical need with high commercial market potential.

Exercise has long been recognized by WHO and caregivers as an effective means of treating and potentially preventing diabetes and several pilot studies have provided evidence to support its role in improving DPN. However, a majority of diabetic patients are physically unable to perform exercise. Regular exercise is known to improve diabetes-associated markers (HbA1c, glucose homeostasis), to ameliorate heart rate variability and to stimulate recovery of both nerve function and blood flow. Recent evidence demonstrates that IL-6 is released during exercise and mediates some of the beneficial effects of physical activity. Sonnet has completed preclinical work in animal models of DPN in which exogenous administration of IL-6 exhibited restorative activity in epidermal nerve density, nerve function, blood flow and reactions to painful or disturbing stimuli. In this context, IL-6 may become a future pivotal disease-modifying therapy for the treatment of DPN.

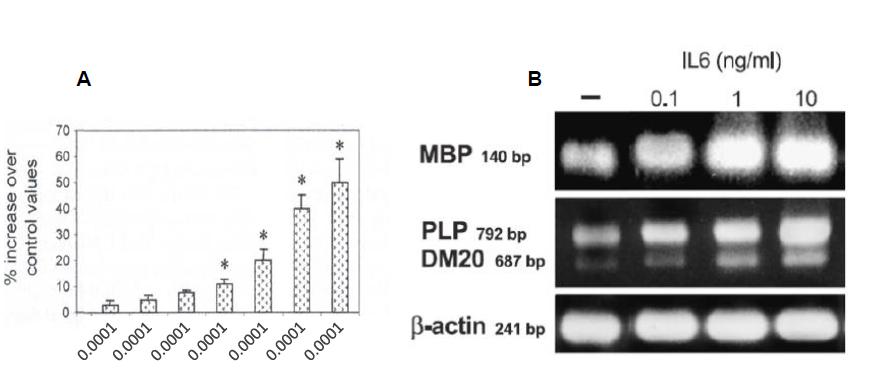

In vitro data on oligodendrocytes or organotypic cultures have shown that IL-6 potentially induces myelin gene expression by Schwann cells or oligodendrocytes (Figure 5).

Figure 5: Illustration of survival (A) and differentiation of oligodendrocytes as assessed by myelin basic protein (MBP), proteolipid protein (PLP) and its spliced variant expression (B).

| 11 |

Valerio et al, Mol Cell Neurosci 21 (2002) 602-615.

Pizzi et al, Mol Cell Neurosci 25 (2004) 301-311.

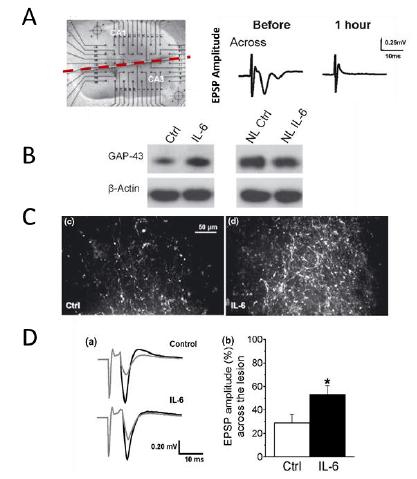

The neuroprotective activity of IL-6 has been evaluated in various paradigms, including excitotoxicity. As well as protecting neurons, IL-6 potentially promotes axonal regeneration and restoration of functional synapses (Figure 6).

Figure 6: Axonal regeneration activity in hemi-sectioned slices of the hippocampus (A), with increased expression of growth-associated protein 43 (GAP43) in injured slices but not in normal slices (NL) (B). Axonal regeneration activity across the lesion (C) and functional recovery (D) of suppressed (A) excitatory postsynaptic potential (EPSP).

Hakkoum et al, J Neurochem 100 (2007) 747-757.

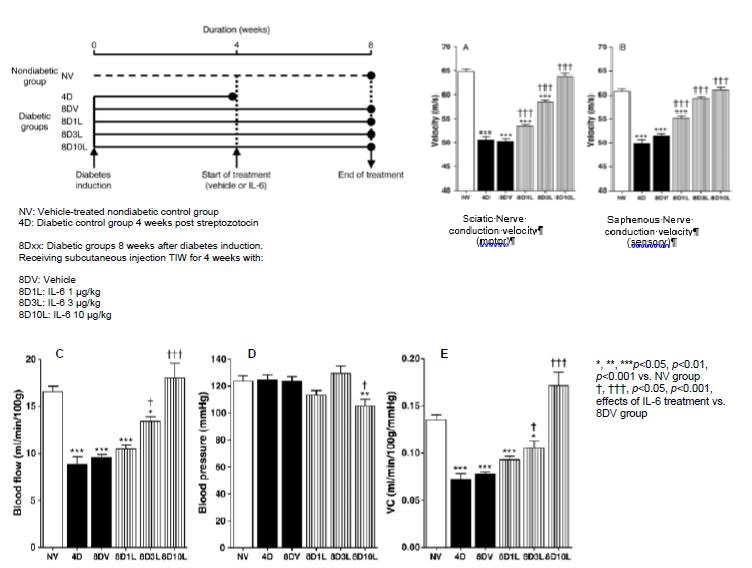

The activity of IL-6 in preclinical models of DPN has been evaluated by three independent laboratories. This work has shown that IL-6 exhibits positive activity in neuropathy in a dose-dependent manner and may also help restore normal physiological parameters after neuropathy is well established (i.e. four weeks after the induction of diabetes and consequential neuropathy). The beneficial activity is observed on motor (Figure 7-A) and sensory (Figure 7-B) nerve function (conduction velocity), and behaviorally by measuring thermal (Figure 7-C) and tactile (Figure 7-D) perceptions. In addition to the direct effects on myelin and axons previously observed in vitro, IL-6 has also been observed to have activity in restoring microvascular blood flow in the nerve (Figure 7-E), which is a major driver of diabetic neuropathies. Histological analyses of nerves in animals receiving preventive treatment with IL-6 during the development of neuropathy suggest that IL-6 exhibits protective activity on myelin, and may play a role in preserving nerve fiber integrity, as well as nerve conduction velocity and the perception of sensations.

| 12 |

Figure 7: Curative treatment with IL-6 in rats with established diabetic neuropathy induced by streptozotocin.

Cameron et al, Exp Neurol 207 (2007) 23-29.

Beyond its study in oncology, 15 pilot studies totaling 167 subjects, including 27 patients with type 2 diabetes, were conducted by independent academic groups not affiliated with Sonnet to evaluate the role of IL-6 in exercise and metabolism. The peer-reviewed results suggest that low dose IL-6 mimics several beneficial aspects of exercise, including expression of anti-inflammatory molecules, increased lipid metabolism, decreased insulin secretion and activation of the STAT3 signaling pathway in muscle.

We believe these data provide strong support for the clinical development of IL-6 in DPN. Through its mechanism of action and potential disease modifying activity, low dose IL-6 may offer a therapeutic solution for neuropathic symptoms, as well as for cardiac autonomic neuropathies (CAN), in diabetic patients. We intend to use data collected from our CIPN studies with SON-080 to inform our decision about potential next development steps for SON-081 in DPN.

| 13 |

SON-1010

Interleukin 12 (IL-12) is a circulating cytokine that has been shown to exert multiple effects on innate and adaptive immunity. These immune functions are critical in attacking cancer cells and pathogens. IL-12 is a heterodimeric cytokine produced by dendritic cells, monocytes and macrophages, also known as antigen presenting cells (APC’s). IL-12 has been shown to induce interferon gamma (IFN-ɣ) secretion by T cells and natural killer (NK) cells, promote the expansion and survival of activated T-cells and NK cells, supplement the cytolytic activity of cytotoxic T cells, support the differentiation of Th1 helper effector cells and enhance antibody dependent cellular cytotoxicity (ADCC). IL-12 has also been shown to stimulate in vitro antitumor activity of lymphocytes from patients with cancer and in vivo anti-tumor activity in murine tumor models of melanoma, colon carcinoma, mammary carcinoma and sarcoma.

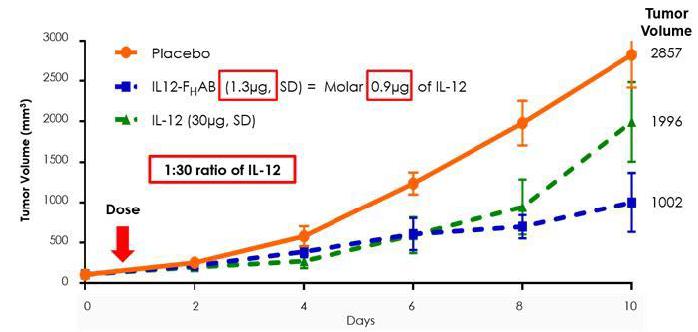

SON-1010 has demonstrated, preclinically, a larger reduction of tumor growth compared to IL-12 without FHAB (naked/standalone IL-12) in a mouse model of melanoma. Figure 8 below, from the mouse melanoma study, illustrates SON-1010’s 30-to-50-fold increase in tumor reduction compared to standalone IL-12 WT (wild type).

Furthermore, in the same model, SON-1010 accumulated in tumors in higher concentrations and remained in the serum, spleen, and tumor significantly longer than IL-12 WT without FHAB, potentially enabling less frequent administration and at lower doses.

Figure 8: IL-12 (1µg) and IL12- FHAB (1.3µg) are molar equivalent and have similar bioactivity, in vitro; however, in vivo, IL12- FHAB is approximately 30-fold more potent than IL-12 (at day 10, 1.3µg IL12- FHAB > IL-12 30µg).

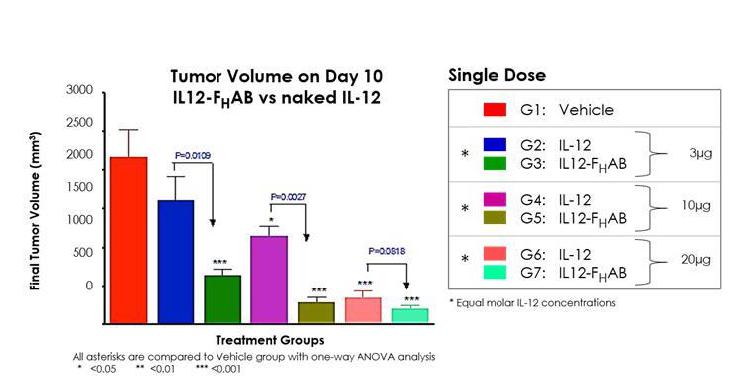

In another preclinical study using a B16G tumor model, SON-1010 demonstrated an improved dose response versus standalone IL-12 WT, along with increased survival duration (Figures 9 and 10).

| 14 |

Results from this study suggest that SON-1010 may have a greater effect on reducing tumor volume and extending survival versus standalone IL-12 WT.

Figure 9: Analysis of tumor volumes shows dose-dependent decreases in tumors in both IL-12 WT and IL12- FHAB-treated mice, as compared to vehicle control. IL12- FHAB-treated mice showed large, statistically significant decreases in tumor volumes when analyzed against equimolar-dosed, IL-12 WT-treated mice. Results suggest IL-12 anti-tumor activity is potentially enhanced with the extension of serum half-life by FHAB linkage.

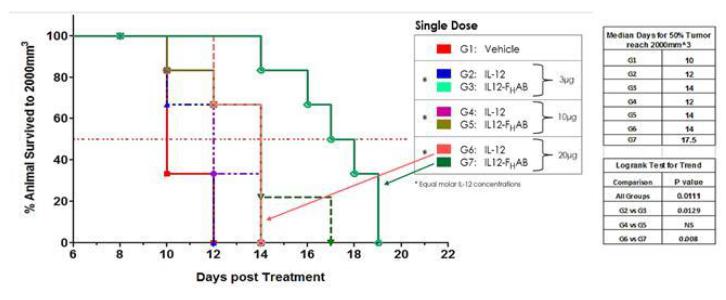

In Figure 10, below, a Kaplan-Meier analysis was performed to compare survival between animals treated with either SON-1010 or IL-12 WT. These data illustrate a correlation between the percent rate decrease in tumor growth (Figure 9) and an increase in survival duration (Figure 10). In this study, the slower growth of tumors in animals treated with SON-1010 correlates with a longer survival time, as compared to more rapid tumor growth observed with naked IL-12 WT treatment.

Survivability at the lowest doses of SON-1010 (3µg) was equivalent to the highest dose of IL-12 WT (30µg). All doses of SON-1010 showed a 50% survival increase over vehicle at 14 and 17.5 days.

Figure 10: Kaplan-Meier evaluation of mouse B16F tumor survivability shows an increase in survival with IL12- FHAB treatment. Doses of 10µg and 20µg of standalone IL-12 WT exhibited 50% survival at 2 and 4 days over vehicle control (10 days). All doses of IL12- FHAB showed 50% survival over vehicle at 14 and 17.5 days. Survivability at the lowest doses of IL12- FHAB were equivalent to highest dose standalone IL-12.

| 15 |

In immune oncology, we have completed in vitro pharmacology studies of affinity and binding kinetics that demonstrate species cross-reactivity of SON-1010 in serum albumin for hamster, rat, cynomolgus monkey and human. The results show that SON-1010 displays species specificity to cynomolgus monkey and human subjects, which will guide species selection for further preclinical toxicology work. A humanized mouse model (SCID) study designed to evaluate PK/PD and dose response is underway. This work will inform our decision about dosing in a forthcoming nonhuman primate study, scheduled to commence following analysis of the SCID mouse data.

Work on the master cell bank expressing SON-1010, formulation development and process development activities have all been completed, in addition to drug product formulation (liquid and lyophilized). Process transfer and cGMP product manufacturing are scheduled for the second half of 2020, followed by an IND-enabling toxicology study in the first half of 2021. An IND submission is expected in the second half of 2021.

Beyond immune oncology, we have filed updated intellectual property that includes provisions for three areas of antiviral drug development: (i) as an adjuvant to potentiate vaccine efficacy; (ii) as a broad spectrum antiviral that could be deployed against a wide array of viruses, particularly those that do not elicit Cytokine Release Syndrome (CRS); and (iii) as a platform for configuring bispecific, multifunctional vaccines comprising the FHAB construct conjugated with both a vaccine peptide and an immune stimulator (e.g., IL-12) that could enhance delivery to the lymphatic system.

We have manufactured and initiated animal testing of SON-1010 for select virology applications. We have initiated work on preliminary viral challenge studies in mice using an H1N1 model with data expected during the second half of 2020. If successful, a mouse-adapted SARS-CoV-1 challenge model study is expected to follow, which we expect would help us develop a clinical trial strategy using FHAB in an adjuvant capacity, paired with a vaccine.

SON-1210

SON-1210, our lead bispecific construct, combines IL-12 and IL-15 conjugated to FHAB. These cytokines were selected based on synergistic biologic activity.

IL-15 acts through its specific receptor, IL15Rα, which is expressed on antigen-presenting dendritic cells (APC), monocytes and macrophages. In addition to the potential antitumor properties of IL-12 described above, we believe IL-15 can potentially add the following complementary activity:

| ● | Induce differentiation and proliferation of T, B and natural killer (NK) cells | |

| ● | Enhance cytolytic activity of CD8+ T cells | |

| ● | Induce long-lasting CD8+ memory T cells enhancing immune surveillance against cancer for month/years | |

| ● | Stimulates differentiation and immunoglobulin synthesis by B cells | |

| ● | Induce maturation of dendritic cells | |

| ● | Up regulate IL-12b1 receptor expression |

Summary of the reciprocal biologic activity of Interleukins 12 and 15:

| ● | IL12: Increases IL15Rα receptor, IFNɣ, NK/T cells, TH1 (tumor killing) and decreases Treg | |

| ● | IL15: Increases IL12β 1 receptor, NK cells, CD8 memory and decreases apoptosis |

| 16 |

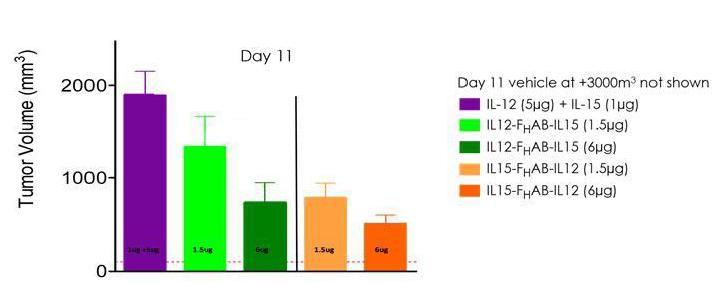

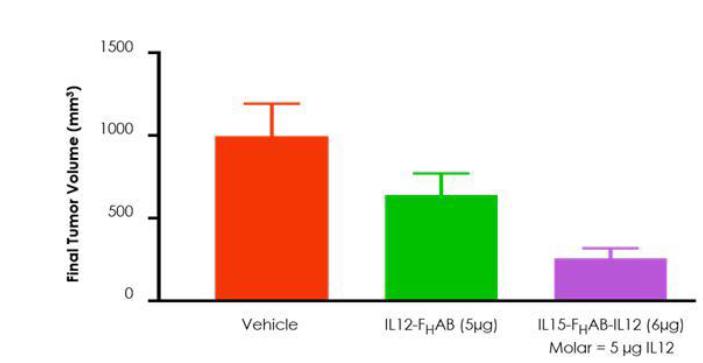

Figure 11: These data suggest an enhanced reduction in tumor growth with SON-1210 compared to concomitantly administered, naked IL-12 and IL-15 in a mouse model of melanoma.

Figure 12: The combination of IL-12 and IL-15 with FHAB displayed synergistic activity, leading to improved tumor volume reduction versus IL12-FHAB alone in a mouse model of melanoma.

Cell line development for SON-1210 is underway and final clone selection is expected in 2020. Early development material will be used in a humanized mouse model (SCID) study designed to evaluate PK/PD and dose response. This work will inform our decision about dosing in a forthcoming nonhuman primate study, expected to be initiated by mid-2021.

Discovery Assets: SON-2014 (GMCSF- FHAB-IL18) and SON-3015 (Anti IL6- FHAB-Anti TGFβ)

GM-CSF (granulocyte-macrophage colony stimulating factor) increases the capacity of dendritic cells (DC) and antigen presenting cells (APC) to process and present cancer antigens to naive T-cells, leading to activation of cytotoxic T cells. As a therapeutic, recombinant human GM-CSF (Leukine®) has been shown to boost the function of PD-1 inhibitors in melanoma patients, thereby promoting increased overall survival. IL-18 decreases IL-10 expression, which is immune suppressive, and increases IL-12 and IL-2 receptor. Additionally, IL-18 increases CXCL9 and CXCL10 expression, which increases TH1, NK and CD8 and tumor infiltrating T cells. Regarding progress with SON-2014, discrete GM-CSF and IL-18 for preclinical studies have been manufactured and we are currently undertaking a proof-of-concept study in mice to evaluate the efficacy of the co-administered cytokines.

TGF-β1/IL-6 biology is a strong predictor of overall survival in cancer, and the combined targeting of IL-6 and TGF-β1 signaling using SON-3015 may represent a promising strategy for treating tumor and bone metastases. TGFβ is released from degraded bone, and enhances IL-6 production, contributing to the vicious circle of bone metastasis. High FcRn expression in the bone environment would result in accumulation in the bone of the dual construct anti IL6- FHAB-anti TGFβ, thereby potentially inhibiting or blocking bone metastases. Regarding progress with SON-3015, we expect to complete lead selection for this discovery-stage bispecific molecule around year-end 2020 followed by a preclinical proof-of-concept study in mice.

We face numerous challenges and uncertainties with respect to the development and commercialization of our therapeutic compounds, including our FHAB technology. Please see “Risk Factors” contained elsewhere in this prospectus, and the sections entitled “Risk Factors” in the documents incorporated by reference into this prospectus.

The Merger, Reverse Stock Split and Name Change

On April 1, 2020, Sonnet (formerly known as Chanticleer Holdings, Inc.), completed its business combination with Sonnet BioTherapeutics, Inc. (“Sonnet Sub”), in accordance with the terms of the Agreement and Plan of Merger, dated as of October 10, 2019, as amended, by and among Sonnet, Sonnet Sub and Biosub Inc., a wholly-owned subsidiary of Sonnet (“Merger Sub”) (the “Merger Agreement”), pursuant to which Merger Sub merged with and into Sonnet Sub, with Sonnet Sub surviving as a wholly owned subsidiary of Sonnet (the “Merger”).

| 17 |

In connection with, and immediately prior to the completion of, the Merger, Sonnet effected a reverse stock split of the Common Shares, at a ratio of 1-for-26 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after taking into account the Reverse Stock Split, Sonnet issued Common Shares to Sonnet Sub’s stockholders at an exchange rate of 0.106572 Common Shares for each share of Sonnet Sub common stock outstanding immediately prior to the Merger. In connection with the Merger, Sonnet changed its name from “Chanticleer Holdings, Inc.” to “Sonnet BioTherapeutics Holdings, Inc.,” and the business conducted by Sonnet became the business conducted by Sonnet Sub.

Private Placement of Common Shares and Warrants

On April 1, 2020, Sonnet and Sonnet Sub completed a private placement transaction (the “Pre-Merger Financing”) with certain accredited investors (the “Investors”) pursuant to that certain Securities Purchase Agreement (the “Securities Purchase Agreement”) dated February 7, 2020 by and among the Company, Sonnet Sub and the Investors for an aggregate purchase price of approximately $19.0 million (comprised of (I) a $4 million credit from Sonnet Sub and the Company to Chardan Capital Markets, LLC (“Chardan”), in lieu of certain transaction fees otherwise owed to Chardan, and (II) $15 million in cash from the other Investors (the “Purchase Price”).

Pursuant to the Pre-Merger Financing, (i) Sonnet Sub issued and sold to the Investors shares of Sonnet Sub’s common stock (the “Initial Shares”) which converted pursuant to the exchange ratio in the Merger into an aggregate of approximately 1,076,000 shares (the “Converted Initial Shares”) of the Company’s common stock (“Common Stock”), (ii) Sonnet Sub deposited into escrow, for the benefit of the Investors, additional shares of Sonnet Sub’s common stock (the “Additional Shares”) which converted pursuant to the exchange ratio in the Merger into an aggregate of approximately 1,076,000 shares of Common Stock (the “Converted Additional Shares”), which Converted Additional Shares were delivered (or became deliverable) to the Investors on April 16, 2020, and (iii) the Company agreed to issue to each Investor on the tenth trading day following the consummation of the Merger Series A Warrants representing the right to acquire shares of Common Stock equal to 75% of the sum of (a) the Converted Initial Shares purchased by the Investor, (b) the Converted Additional Shares delivered or deliverable to the Investor, without giving effect to any limitation on delivery contained in the Securities Purchase Agreement and (c) the number of shares of Common Stock, if any, underlying the Series B Warrants issued to the Investor (the “Series A Warrants”) and additional Series B warrants to purchase shares of Common Stock (the “Series B Warrants” and together with the Series A Warrants, the “Warrants”).

On April 16, 2020 (the “Warrant Closing Date”), pursuant to the terms of the Securities Purchase Agreement, the Company issued the Series A Warrants and the Series B Warrants. For a description of the Series A Warrants and Series B Warrants, see “Description of Capital Stock—Outstanding Warrants.”

Corporate Information

Our principal offices are located at 100 Overlook Center, Suite 102, Princeton, New Jersey 08540, and our telephone number is (609) 375-2227. Our website address is www.sonnetbio.com. Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

This Offering

We are registering for resale by the Selling Stockholders named herein the 29,487,330 Warrant Shares as described below.

| Securities being offered: | 5,547,792 shares of our common stock, comprised of 3,300,066 Common Shares currently issuable under the Series A Warrants and 2,247,726 Common Shares currently issuable under the Series B Warrants. | |

| Use of proceeds: | We will not receive any of the proceeds from the sale or other disposition of shares of our Common Stock by the Selling Stockholders. | |

| Market for Common Stock: | Our Common Stock is listed on The NASDAQ Capital Market under the symbol “SONN.” On June 23, 2020, the last reported sale price of our Common Stock on The NASDAQ Capital Market was $3.86 per share. | |

| Risk factors: | See “Risk Factors” beginning on page 19 for risks you should consider before investing in our shares. | |

| 18 |

Investing in our securities involves risks. You should carefully consider the risks, uncertainties and other factors described in the Company’s Registration Statement on Form S-4 (File No. 333-235301) filed with the SEC on November 27, 2019 (as amended by Form S-4/A on February 7, 2020), and in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file with the Securities and Exchange Commission (the “SEC”), and in other documents which are incorporated by reference into this prospectus, as well as the risk factors and other information contained in or incorporated by reference into any accompanying prospectus supplement before investing in any of our securities. Our financial condition, results of operations or cash flows could be materially adversely affected by any of these risks. The risks and uncertainties described in the documents incorporated by reference herein are not the only risks and uncertainties that you may face.

For more information about our SEC filings, please see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

| 19 |

We will receive no proceeds from the sale of shares of Common Stock by the Selling Stockholders.

| 20 |

The shares of Common Stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders, upon exercise of the Warrants. For additional information regarding the issuances of those shares of Common Stock and the Warrants, see “Private Placement of Common Shares and Warrants” above. We are registering the Common Stock in order to permit the Selling Stockholders to offer the shares for resale from time to time. Except for the ownership of the shares of Common Stock and the Warrants, the Selling Stockholders have not had any material relationship with us within the past three years.

The table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of Common Stock by each of the Selling Stockholders. The second column lists the number of shares of Common Stock beneficially owned by each Selling Stockholder, based on its ownership of the shares of Common Stock and the Warrants, as of April 16, 2020, assuming exercise of the Warrants held by the Selling Stockholders on that date, without regard to any limitations on exercises. The third column lists the shares of Common Stock being offered by this prospectus by the Selling Stockholders.

This prospectus covers 5,547,792 shares of Common Stock currently underlying the Series A Warrants and Series B Warrants. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus, and is based on 9,201,619 shares of Common Stock outstanding on April 16, 2020. We may be required under the Registration Rights Agreement to register for resale, in the future, an additional 23,939,538 Common Shares that are not included in this prospectus, which may be issuable under the reset provision contained in the Warrants and described herein under “Description of Capital Stock—Outstanding Warrants.”

Under the terms of the Warrants, a Selling Stockholder may not exercise the warrants to the extent such exercise would cause such Selling Stockholder, together with its affiliates, to beneficially own a number of shares of Common Stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding Common Stock following such exercise, excluding for purposes of such determination Common Stock issuable upon exercise of the warrants which have not been exercised. The number of shares in the second column does not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Securityholder | Number of Shares of Common Stock Owned Prior to Offering (1) | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | Number of Shares of Common Stock Owned After Offering | Percentage of Shares of Common Stock Owned After Offering if Greater than 1% | ||||||||||||

| Empery Asset Master, Ltd. (2) | 126,004 | 110,956 | 15,048 | 2.4 | % | |||||||||||

| Empery Tax Efficient, LP (3) | 31,502 | 27,740 | 3,762 | 2.4 | % | |||||||||||

| Empery Debt Opportunity Fund, LP (4) | 2,992,533 | 2,635,200 | 357,333 | 2.4 | % | |||||||||||

| Altium Growth Fund, LP (5) | 3,111,986 | 2,773,896 | 338,090 | 2.3 | % | |||||||||||

| * | Represents less than 1%

|

| (1) | Beneficial ownership includes shares of Common Stock as to which a person or group has sole or shared voting power or dispositive power. Shares of Common Stock registered hereunder, as well as shares of Common Stock subject to options, warrants or convertible preferred stock that are exercisable or convertible within 60 days of April 16, 2020, are deemed outstanding for purposes of computing the number of shares beneficially owned and percentage ownership of the person or group holding such shares of Common Stock, options, warrants or convertible securities, but are not deemed outstanding for computing the percentage of any other person. |

| 21 |

| (2) | The number of shares consists of (i) 15,048 Common Shares held directly by the Selling Stockholder and (ii) 110,956 Common Shares issuable upon exercise of the Warrants, without giving effect to the blocker provision described above. Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd (“EAM”), has discretionary authority to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

| (3) | The number of shares consists of (i) 3,762 Common Shares held directly by the Selling Stockholder and (ii) 27,740 Common Shares issuable upon exercise of the Warrants, without giving effect to the blocker provision described above. Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

| (4) | The number of shares consists of (i) 357,333 Common Shares held directly by the Selling Stockholder and (ii) 2,635,200 Common Shares issuable upon exercise of the Warrants, without giving effect to the blocker provision described above. Empery Asset Management LP, the authorized agent of Empery Debt Opportunity Fund, LP (“EDOF”), has discretionary authority to vote and dispose of the shares held by EDOF and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EDOF. EDOF, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

|

| (5) | The number of shares consists of (i) 338,090 Common Shares held directly by the Selling Stockholder and (ii) 2,773,896 Common Shares issuable upon exercise of the Warrants, without giving effect to the blocker provision described above. Altium Capital Management, LP, the investment manager of Altium Growth Fund, LP, has voting and investment power over these securities. Jacob Gottlieb is the managing member of Altium Capital Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth Fund, LP and Jacob Gottlieb disclaims beneficial ownership over these shares. |

| 22 |

We are registering the shares of Common Stock issued and issuable upon exercise of the Warrants to permit the resale of these shares of Common Stock by the holders of the Warrants from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Stockholders of the shares of Common Stock. We will bear all fees and expenses incident to our obligation to register the shares of Common Stock

The Selling Stockholders may sell all or a portion of the shares of Common Stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers, the Selling Stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

| ● | on any national securities exchange or quotation service on which the securities may | |

| ● | be listed or quoted at the time of sale; | |

| ● | in the over-the-counter market; | |

| ● | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; | |

| ● | through the writing of options, whether such options are listed on an options exchange or otherwise; | |

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | short sales; | |

| ● | sales pursuant to Rule 144; | |

| ● | broker-dealers may agree with the selling securityholders to sell a specified number of | |

| ● | such shares at a stipulated price per share; | |

| ● | a combination of any such methods of sale; and | |

| ● | any other method permitted pursuant to applicable law. |

If the Selling Stockholders effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the Selling Stockholders or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of Common Stock or otherwise, the Selling Stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of Common Stock in the course of hedging in positions they assume. The Selling Stockholders may also sell shares of Common Stock short and deliver shares of Common Stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The Selling Stockholders may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares. The Selling Stockholders may pledge or grant a security interest in some or all of the warrants or shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, amending, if necessary, the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer and donate the shares of Common Stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of Common Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the Selling Stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

| 23 |

Under the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with. There can be no assurance that any Selling Stockholder will sell any or all of the shares of Common Stock registered pursuant to the registration statement, of which this prospectus form is a part.

The Selling Stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of Common Stock by the Selling Stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in marketmaking activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock. We will pay all expenses of the registration of the shares of Common Stock pursuant to the registration rights agreement, estimated to be $60,000 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that a Selling Stockholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the Selling Stockholders against liabilities, including some liabilities under the Securities Act, in accordance with the registration rights agreements, or the Selling Stockholders will be entitled to contribution. We may be indemnified by the Selling Stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the Selling Stockholder specifically for use in this prospectus, in accordance with the related registration rights agreement, or we may be entitled to contribution. Once sold under the registration statement, of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

| 24 |

DETERMINATION OF OFFERING PRICE

The prices at which the shares of Common Stock covered by this prospectus may actually be sold will be determined by the prevailing public market price for shares of Common Stock, by negotiations between the Selling Stockholders and buyers of our Common Stock in private transactions or as otherwise described in “Plan of Distribution.”

| 25 |

General

We are authorized to issue up to 130,000,000 shares of capital stock, including 125,000,000 shares of Common Stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, no par value. As of June 23, 2020, we had 9,201,619 shares of Common Stock and no shares of preferred stock issued and outstanding.

The additional shares of our authorized stock available for issuance may be issued at times and under circumstances so as to have a dilutive effect on earnings per share and on the equity ownership of the holders of our Common Stock. The ability of our board of directors to issue additional shares of stock could enhance the board’s ability to negotiate on behalf of the stockholders in a takeover situation but could also be used by the board to make a change-in-control more difficult, thereby denying stockholders the potential to sell their shares at a premium and entrenching current management. The following description is a summary of the material provisions of our capital stock. You should refer to our certificate of incorporation, as amended and bylaws, both of which are on file with the SEC as exhibits to previous SEC filings, for additional information. The summary below is qualified by provisions of applicable law.

Common Stock

Holders of our Common Stock are each entitled to cast one vote for each share held of record on all matters presented to stockholders. Cumulative voting is not allowed; the holders of a majority of our outstanding shares of Common Stock may elect all directors. Holders of our Common Stock are entitled to receive such dividends as may be declared by our board out of funds legally available and, in the event of liquidation, to share pro rata in any distribution of our assets after payment of liabilities. Our directors are not obligated to declare a dividend. It is not anticipated that we will pau dividends in the foreseeable future. Holders of our do not have preemptive rights to subscribe to any additional shares we may issue in the future. There are no conversion, redemption, sinking fund or similar provisions regarding the Common Stock. All outstanding shares of Common Stock are fully paid and nonassessable.

The rights, preferences and privileges of holders of Common Stock are subject to the rights of the holders of any outstanding shares of preferred stock.

Preferred Stock

We may issue up to 5,000,000 shares of preferred stock, no par value, in one or more series. Our board of directors is hereby expressly authorized to provide, out of the unissued shares of preferred stock, for one or more series of preferred stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the voting powers, if any, of the shares of such series, and the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of such series. The powers, preferences and relative, participating, optional and other special rights of each series of preferred stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding.

The issuance of preferred stock could decrease the amount of earnings and assets available for distribution to the holders of Common Stock or adversely affect the rights and powers, including voting rights, of the holders of Common Stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of Sonnet, which could depress the market price of our Common Stock.

Anti-Takeover Effects of Certain Provisions of Delaware Law and Our Certificate of Incorporation and Bylaws

Our Certificate of Incorporation, as amended, and Bylaws, as amended contain provisions that could have the effect of discouraging potential acquisition proposals or tender offers or delaying or preventing a change of control. These provisions are as follows:

| ● | they provide that special meetings of stockholders may be called by the President, the board of directors or at the request by stockholders of record owning at least thirty-three and one-third (33 1/3%) percent of the issued and outstanding voting shares of our Common Stock; |

| 26 |

| ● | they do not include a provision for cumulative voting in the election of directors. Under cumulative voting, a minority stockholder holding a sufficient number of shares may be able to ensure the election of one or more directors. The absence of cumulative voting may have the effect of limiting the ability of minority stockholders to effect changes in our board of directors; and | |

| ● | they allow us to issue, without stockholder approval, up to 5,000,000 shares of preferred stock that could adversely affect the rights and powers of the holders of our Common Stock. |

We are subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Subject to certain exceptions, the statute prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder unless:

| ● | prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; | |