Filed Pursuant to Rule 424(b)(3)

Registration No. 333-291017

PROSPECTUS

Hyperliquid Strategies Inc

Up to 160,000,000 Shares of Common Stock

This prospectus relates to the potential offer and sale from time to time by Chardan Capital Markets LLC (“Chardan” or the “Selling Securityholder”) of up to 160,000,000 shares of our common stock, par value $0.01 per share (“Common Stock” or “Pubco Common Stock”), that have been or may be issued by us to Chardan pursuant to a ChEF Purchase Agreement, dated as of October 22, 2025, by and between us and Chardan (as amended from time to time, the “Purchase Agreement”), establishing a committed equity facility (the “Facility”). Such shares of our Common Stock that we may elect, in our sole discretion, to issue and sell to Chardan from time to time under the Purchase Agreement are referred to herein as the “Purchase Shares”. The actual number of shares of our Common Stock issuable will vary depending on the then current market price of shares of our Common Stock sold to Chardan under the Facility, but will not exceed the number of shares of Common Stock set forth in the first sentence of this paragraph unless we file an additional registration statement under the Securities Act of 1933, as amended (the “Securities Act”) with the Securities and Exchange Commission (the “SEC”). See “The Committed Equity Financing” for a description of the Purchase Agreement and the Facility and “Selling Securityholder” for additional information regarding Chardan and “Plan of Distribution (Conflicts of Interest)” for a description of compensation payable to Chardan.

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of our Common Stock by Chardan. We may receive up to $1.0 billion in aggregate gross proceeds from Chardan under the Purchase Agreement in connection with sales of the shares of our Common Stock to Chardan pursuant to the Purchase Agreement after the date of this prospectus. However, the actual proceeds from Chardan may be less than this amount depending on the number of shares of our Common Stock sold and the price at which the shares of our Common Stock are sold. In connection with the execution of the Purchase Agreement, we agreed to pay Chardan a commitment fee consisting of (i) $125,000 payable on the later of the date of the closing of the transactions contemplated by the Transaction Agreement (defined below) and the date the registration statement of which this prospectus forms a part is effective (the “Commencement Date”), (ii) $250,000 payable once we have received an aggregate of $25.0 million in proceeds from sales of our Common Stock under the Facility and (iii) $625,000 payable once we have received an aggregate of $50.0 million in proceeds from sales of our Common Stock under the Facility (collectively, the “Commitment Fee”). We also paid Chardan a documentation fee equal to $25,000 (the “Documentation Fee”) as consideration in connection with the preparation of the Purchase Agreement. See “Plan of Distribution” for a discussion of the fees and expenses payable by us to Chardan under the Purchase Agreement.

This prospectus provides you with a general description of such securities and the general manner in which Chardan may offer or sell the securities. More specific terms of any securities that Chardan may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

Chardan may offer, sell or distribute all or a portion of the shares of our Common Stock acquired under the Purchase Agreement and hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will bear all costs, expenses and fees in connection with the registration of the shares of our Common Stock, including with regard to compliance with state securities or “blue sky” laws. The timing and amount of any sales of the shares of our Common Stock purchased by Chardan are within the sole discretion of Chardan. Chardan is an underwriter under the Securities Act, and any profit on the sale of shares of our Common Stock by Chardan and any discounts, commissions or concessions received by Chardan may be deemed to be underwriting discounts and commissions under the Securities Act. Although Chardan is obligated to purchase shares of our Common Stock under the terms and subject to the conditions and limitations of the Purchase Agreement to the extent we choose to sell such shares of our Common Stock to it (subject to certain conditions), there can be no assurances that we will choose to sell any shares of our Common Stock to Chardan or that Chardan will sell any or all of the shares of our Common Stock, if any, purchased under the Purchase Agreement pursuant to this prospectus. Chardan will bear all commissions and discounts, if any, attributable to its sale of shares of our Common Stock. See “Plan of Distribution (Conflicts of Interest).”

You should read this prospectus and any prospectus supplement or amendment, together with additional information described under the heading “Where You Can Find More Information,” carefully before you invest in our securities.

We will not sell any Purchase Shares to Chardan, and no sales of shares of our Common Stock would be made by Chardan under this prospectus, until after the closing of the transactions contemplated by the Business Combination Agreement that we entered into on July 11, 2025 with Sonnet BioTherapeutics Holdings, Inc., a Delaware corporation (the “Company” or “Sonnet”), Rorschach I LLC, a Delaware limited liability company (“Rorschach”), TBS Merger Sub Inc., a Delaware corporation and our wholly owned subsidiary (“Company Merger Sub”) and Rorschach Merger Sub, LLC, a Delaware limited liability company and our wholly owned subsidiary (“Rorschach Merger Sub”) (as amended on September 22, 2025 and as further amended from time to time, the “Transaction Agreement”). The Transaction Agreement provides (i) Rorschach Merger Sub will merge with and into Rorschach (the “Rorschach Merger”), with Rorschach surviving the Rorschach Merger as our direct wholly owned subsidiary, and (ii) immediately following the Rorschach Merger, Company Merger Sub will merge with and into the Company (the “Company Merger” and, together with the Rorschach Merger, the “Mergers” or “Business Combination”), with the Company surviving the Company Merger as our direct wholly owned subsidiary. On December 2, 2025, the Business Combination was consummated.

We intend to use any net proceeds from any sales of shares of our Common Stock to Chardan under the Facility for general corporate purposes, including potential purchases of HYPE Tokens.

Upon the closing of the Business Combination, our Common Stock was listed on the Nasdaq Capital Market under the symbol “PURR”.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and a “smaller reporting company” as defined under the federal securities and, as such, are subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 15 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 2, 2025.

TABLE OF CONTENTS

| i |

ABOUT THIS PROSPECTUS

This prospectus is part of a resale registration statement on Form S-1 that we filed with the SEC whereby the Selling Securityholder may, from time to time, sell the securities offered by it described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholder of the securities offered by it described in this prospectus.

Neither we nor the Selling Securityholder has authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholder takes responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholder will make an offer to sell these securities in any jurisdiction where such offer or sale is not permitted. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

The Selling Securityholder and its permitted transferees may use this resale registration statement to sell securities from time to time through any means described in the section titled “Plan of Distribution.” More specific terms of any securities that the Selling Securityholder and its permitted transferees offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement or post-effective amendment modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part, together with the additional information to which we refer you in the section of this prospectus titled “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or will be filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

This prospectus contains certain market data and industry statistics and forecasts that are based on studies sponsored by us, independent industry publications and other publicly available information. Although we believe these sources are reliable, estimates as they relate to projections involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus. Accordingly, investors should not place undue reliance on this information.

This prospectus contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Unless the context otherwise requires, references in this prospectus to “Pubco,” “we,” “us” and “our” and any related terms refer to Hyperliquid Strategies Inc and its consolidated subsidiaries.

| ii |

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus or the context otherwise requires:

“Advisor” means Rorschach Advisors LLC, a Delaware limited liability company;

“Advisor Agreements” means the Advisor Rights Agreement and Advisory Agreement to be entered into between Pubco and Rorschach Advisor LLC in connection with the Closing;

“Advisor Shares” means that number of shares of Pubco Common Stock equal to 5% of the shares of Pubco Common Stock issued and outstanding, on a fully-diluted, as converted basis, immediately following the Company Merger Effective Time;

“Advisor Warrants” means the warrants issuable to the Advisor to purchase a number of shares of Pubco Common Stock equal to, in the aggregate, 15% of the fully diluted number of outstanding shares of Pubco Common Stock immediately after Closing, pursuant to the Transaction Agreement;

“Aggregate Company Consideration” means the aggregate number of shares of Pubco Common Stock payable to the Company Securityholders in connection with the Company Merger in accordance with the terms and conditions of the Transaction Agreement and the Transaction Documents;

“Aggregate Rorschach Consideration” means an aggregate of number shares of Pubco Common Stock to be issued at the Rorschach Merger Effective Time to the Rorschach Members in accordance with the Transaction Agreement, determined by dividing (a) one-fifth of the sum of (i) (A) the HYPE Tokens Value held by Rorschach immediately prior to the Rorschach Merger Effective Time plus (B) any Contributed Cash held by Rorschach immediately prior to the Rorschach Merger Effective Time, by (ii) the Company Price Per Share, and, once calculated, (b) adding to such total number of shares of Pubco Common Stock determined in clause (a) the total number of Advisor Shares to be issued to Rorschach;

“Aggregate Transaction Consideration” means (a) the Aggregate Rorschach Consideration and (b) the Aggregate Company Consideration;

“Ancillary Agreements” means the Pubco Registration Rights Agreement, the Advisor Rights Agreement, the Advisory Agreement, the Advisor Warrants, the CVR Agreement, the Subscription Agreements;

“Bridge Financing” means the sale of $2.0 million of convertible notes in the principal amount of $2.0 million of the Company on June 30, 2025;

“Bridge Financing Warrants” means the warrants to purchase an aggregate of up to 865,052 shares of Company Common Stock received by the investors in the Bridge Financing (which warrants will be converted into or become exercisable for an aggregate of 173,010 shares of Pubco Common Stock at the Closing, reflecting the five-for-one exchange ratio in the Transaction Agreement).

“Business Combination” means the Rorschach Merger and the Company Merger;

“Chardan” means Chardan Capital Markets LLC;

“Closing” means the consummation of the Transactions;

“Closing Date” means the date on which the Closing occurs;

“Closing PIPE” means those certain Subscription Agreements entered concurrently with the Transaction Agreement whereby the Company agreed to issue and sell, immediately prior to the Closing, an aggregate of 243,787,992 shares of Company Common Stock at a purchase price of $1.25 per share (which shares will be converted into an aggregate of 48,757,597 shares of Pubco Common Stock at the Closing, reflecting the five-for-one exchange ratio in the Transaction Agreement);

| 1 |

“Company” means Sonnet Biotherapeutics Holdings, Inc.;

“Company Common Stock” means the Company’s common stock, with a par value of $0.0001 per share;

“Company In-The-Money Warrant” means a Company Warrant that, as of immediately prior to the Company Merger Effective Time, has an exercise price that is less than the Company Price Per Share;

“Company Merger” means the merger of Company Merger Sub with and into the Company, with the Company surviving the Company Merger as a direct wholly owned subsidiary of Pubco;

“Company Merger Effective Time” means the date and time of the filing of a certificate of merger (or such later time as may be agreed by each of the parties and specified in the certificate of merger) with the Secretary of State of the State of Delaware, in accordance with the relevant provisions of the DGCL.

“Company Merger Sub” means TBS Merger Sub Inc.;

“Company Out-Of-The-Money Warrant” means a Company Warrant that, as of immediately prior to the Company Merger Effective Time, has an exercise price that is equal to or greater than the Company Price Per Share;

“Company Price Per Share” means $1.25;

“Company RSAs” means restricted stock awards relating to shares of Company Common Stock immediately prior to the Company Merger Effective Time;

“Company RSUs” means restricted stock units relating to shares of Company Common Stock immediately prior to the Company Merger Effective Time;

“Company Securityholders” means, collectively, the holders of Company Common Stock, Company Vested RSUs and Company In-The-Money Warrants immediately prior to the Company Merger Effective Time;

“Company Unvested RSA” means a Company RSA that has not vested immediately prior to the Company Merger Effective Time;

“Company Unvested RSU” means a Company RSU that has not vested immediately prior to the Company Merger Effective Time;

“Company Vested RSU” means a Company RSU that has vested prior to the Company Merger Effective Time;

“Company Warrant” means a warrant to purchase shares of Company Common Stock, whether or not exercisable;

“Contributed Cash” means any cash and/or cash equivalents contributed by certain investors to Rorschach as part of the Contribution.

“Contribution” means the contribution by certain investors of HYPE Tokens and cash and cash equivalents to Rorschach pursuant to the Transaction Documents;

“CVR” means a contractual contingent value right representing the right to receive Pubco Common Stock on the terms and subject to the conditions set forth in the CVR Agreement;

“CVR Agreement” means that certain Contingent Value Rights Agreement to be entered between Pubco and the Rights Agent, a form of which is attached to the Transaction Agreement as Exhibit E;

“DGCL” means the Delaware General Corporation Law;

| 2 |

“Dissenting Shares” means shares of Company Common Stock that are held by Sonnet stockholders who shall have neither voted in favor of the Company Merger nor consented thereto in writing and who shall have demanded properly in writing appraisal for such Company Common Stock in accordance with Section 262 of the DGCL and otherwise complied with all of the provisions of the DGCL relevant to the exercise and perfection of dissenters’ rights;

“DLLCA” means the Limited Liability Company Act of the State of Delaware;

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder;

“FDA” means the United States Food and Drug Administration;

“Financings” means the Bridge Financing and the Initial PIPE;

“GAAP” means accounting principles generally accepted in the United States;

“HYPE Token” means the native token of the Hyperliquid Layer 1 blockchain;

“HYPE Tokens Value” means the value determined by multiplying (a) the aggregate number of HYPE Tokens held by Rorschach immediately prior to the Rorschach Merger Effective Time by (b) $46.372. For the avoidance of doubt, if less than Two Hundred Million Dollars ($200,000,000) in HYPE Tokens Value is contributed to Rorschach as of immediately prior to the Rorschach Merger Effective Time, additional cash and cash equivalents may be contributed by investors to Rorschach or the Company immediately prior to the Rorschach Merger Effective Time to address any such shortfall in the HYPE Tokens Value for the purposes of satisfying the condition set forth in Section 8.03(d) of the Transaction Agreement;

“Initial PIPE” means those certain securities purchase agreements entered concurrently with the execution of the Transaction Agreement whereby the Company agreed to issue and sell the Series 5 Preferred Stock and the Initial PIPE Warrants, for gross proceeds of $5.5 million;

“Initial PIPE Warrants” means those certain warrants to purchase up to 8,800,000 shares of Company Common Stock issued and sold to investors in the Initial PIPE (which warrants will be converted into or become exercisable for an aggregate of 1,760,000 shares of Pubco Common Stock at the Closing, reflecting the five-for-one exchange ratio in the Transaction Agreement);

“Interim Financing” means the issuance by the Company of up to an aggregate of $3,000,000 of its securities as permitted under the Transaction Agreement.

“Nasdaq” means The Nasdaq Stock Market LLC;

“Per Share Company Merger Consideration” means one share of Pubco Common Stock and one CVR;

“Pubco” or “HSI” means Hyperliquid Strategies Inc;

“Pubco A&R Organizational Documents” means the Pubco Charter and the bylaws of Pubco;

“Pubco Board” means the Board of Directors of Pubco;

“Pubco Bylaws” means Pubco’s amended and restated bylaws;

“Pubco Charter” means Pubco’s amended and restated certificate of incorporation;

“Pubco Common Stock” or “Common Stock” means the common stock, par value $0.01 per share, of Pubco;

“Pubco Registration Rights Agreement” means the Registration Rights Agreement to be entered into among Pubco, the Advisor and certain other investors in connection with the Closing;

“Pubco Series A Preferred Stock” means the series of preferred stock of Pubco, par value $0.01 per share, designated in connection with the Closing.

| 3 |

“Rorschach” means Rorschach I LLC;

“Rorschach Members” means the members of Rorschach;

“Rorschach Merger” means the merger of Rorschach Merger Sub with and into Rorschach, with Rorschach surviving the Rorschach Merger as a direct wholly owned subsidiary of Pubco;

“Rorschach Merger Effective Time” means the date and time of the filing of a certificate of merger (or such later time as may be agreed by each of the parties and specified in the certificate of merger) with the Secretary of State of the State of Delaware, in accordance with the relevant provisions of the DLLCA.

“Rorschach Merger Sub” means Rorschach Merger Sub LLC;

“SEC” means the U.S. Securities and Exchange Commission;

“Securities Act” means the Securities Act of 1933, as amended;

“Sonnet” means Sonnet Biotherapeutics Holdings, Inc. and its consolidated subsidiaries;

“Sonnet Special Meeting” means the special meeting of stockholders of Sonnet to be held to vote on the approval of the Transactions and other related matters.

“Subscription Agreements” means those certain subscription agreements entered by and among the investors in the Closing PIPE, the Company and Pubco;

“Transaction Agreement” means the Business Combination Agreement, dated as of July 11, 2025, among Rorschach, Pubco, the Merger Subs and Sonnet, as amended on September 22, 2025 and as may be further amended;

“Transaction Documents” means the Transaction Agreement and the Ancillary Agreements; and

“Transactions” means the transactions contemplated by Transaction Agreement and the other Transaction Documents, including the Business Combination.

| 4 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking” statements for purposes of the federal securities laws, including statements regarding the Transactions and the Facility. All statements, other than historical facts, are forward-looking statements, including statements regarding the expected benefits of the Transactions, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of Pubco following completion of the Transactions; the projected future financial performance of Rorschach, Sonnet and Pubco; and legal, economic and regulatory conditions. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “plan,” “could,” “would,” “project,” “predict,” “continue,” “target” or other similar words or expressions or negatives of these words, but not all forward-looking statements include such identifying words. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. We can give no assurance that such plans, estimates or expectations will be achieved and therefore, actual results may differ materially from any plans, estimates or expectations in such forward-looking statements.

Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others: failure to realize the anticipated benefits of the Transactions; costs related to the Transactions and as a result of becoming a public company; changes in business, market, financial, political and regulatory conditions; risks relating to Pubco’s anticipated operations and business, including the highly volatile nature of the price of HYPE tokens; the risk that Pubco’s stock price will be highly correlated to the price of HYPE tokens and the price of HYPE tokens may decrease at any time; risks related to increased competition in the industries in which Pubco will operate; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding HYPE tokens; risks relating to the treatment of crypto assets for U.S. and foreign tax purposes; risks that Pubco experiences difficulties managing its growth and expanding operations; challenges in implementing Pubco’s business plan including HYPE token-related financial and advisory services, due to operational challenges, significant competition and regulation; the outcome of any potential legal proceedings that may be instituted against Sonnet, Rorschach, Pubco or others and other risk factors as further described in the section of this prospectus titled “Risk Factors.” This list should not be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements.

Any forward-looking statements speak only as of the date of this prospectus. We undertake no obligation to update any forward-looking statements, whether as a result of new information or developments, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

| 5 |

PROSPECTUS SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our Common Stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our Common Stock, you should read the entire prospectus carefully, including the “Risk Factors” and the financial statements and related notes included in this prospectus.

The Companies

Pubco

Pubco is a Delaware corporation that was formed for the purpose of engaging in the Transactions. Since the date of its incorporation on July 2, 2025 until the Closing Date, Pubco has not engaged in any activities other than as contemplated by the Transaction Documents. On December 2, 2025, the Transactions were consummated, upon which Pubco became a holding company whose principal assets are the ownership of Rorschach and Sonnet. Immediately after the completion of the Transactions, Pubco’s equity capital consists solely of Pubco Common Stock and Pubco preferred stock. For a description of the capital stock of Pubco, see the section titled “Description of Pubco Capital Stock”.

The principal executive offices of Pubco are located at 477 Madison Avenue, 22nd Floor, New York, NY 10022, and the telephone number at that address is (212) 883-4330. Following the Closing, the principal executive offices of Pubco will be located at 477 Madison Avenue, 22nd Floor, New York, NY 10022, and the telephone number at this location is (212) 883-4330.

Rorschach

Rorschach is a Delaware limited liability company formed on June 13, 2025. Rorschach was formed for the purpose of completing the Transactions pursuant to the Transaction Agreement, and had no business operations prior to the Closing Date. See the section titled “Information About Rorschach and Pubco” for more information.

Sonnet

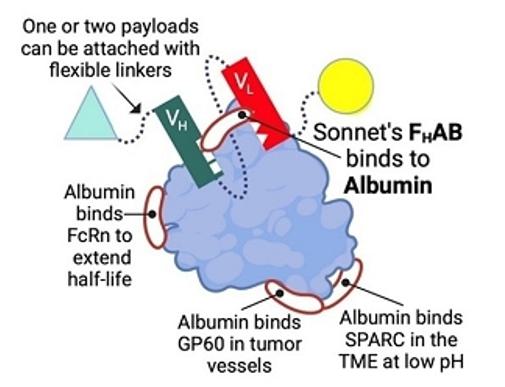

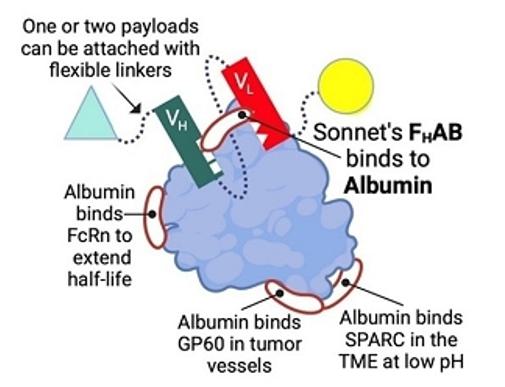

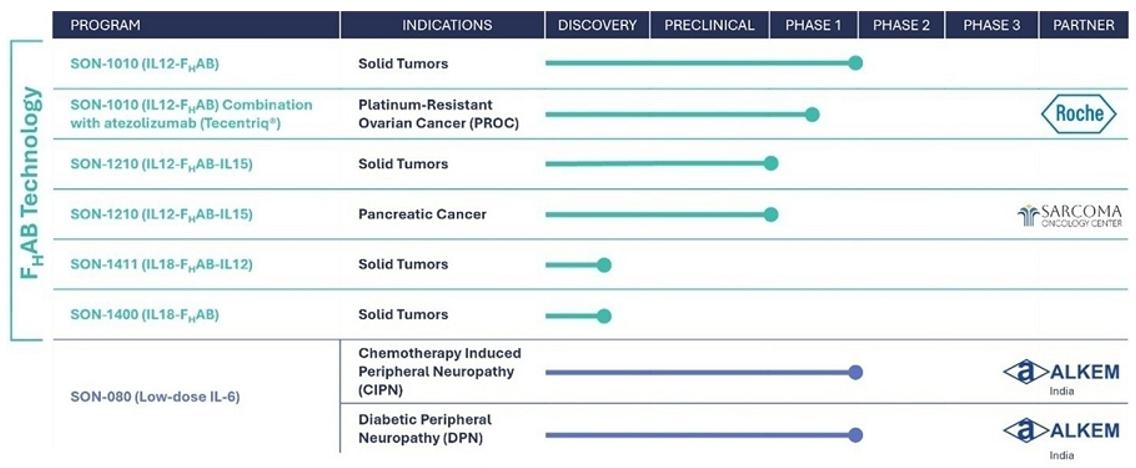

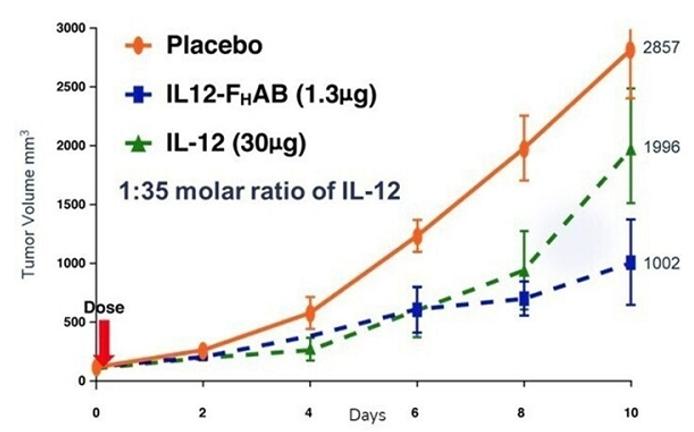

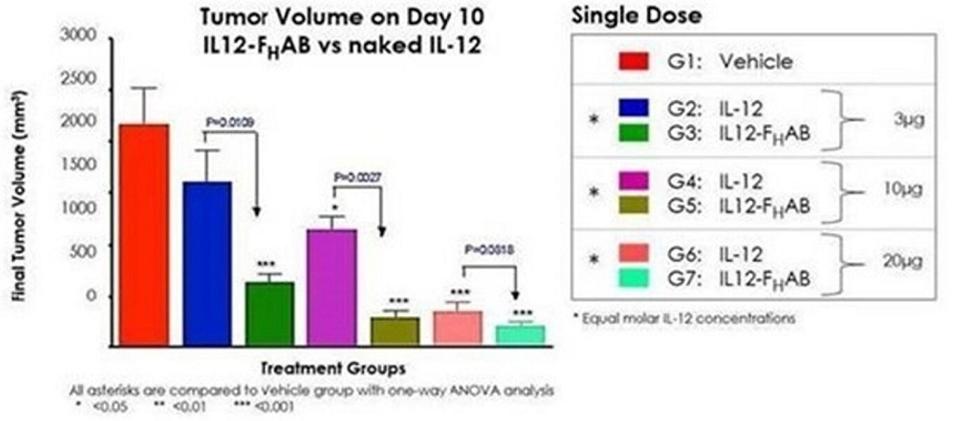

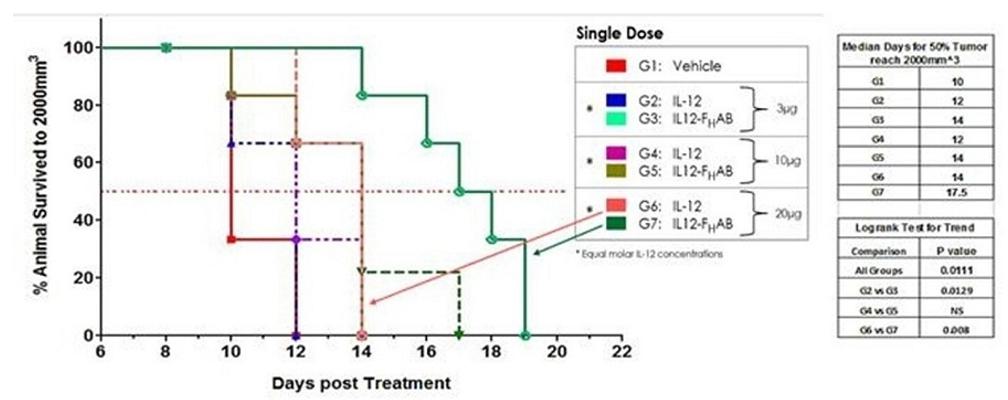

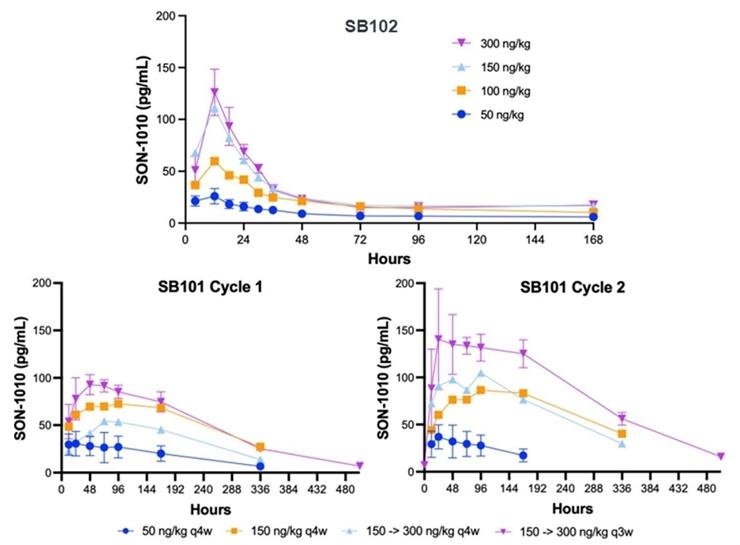

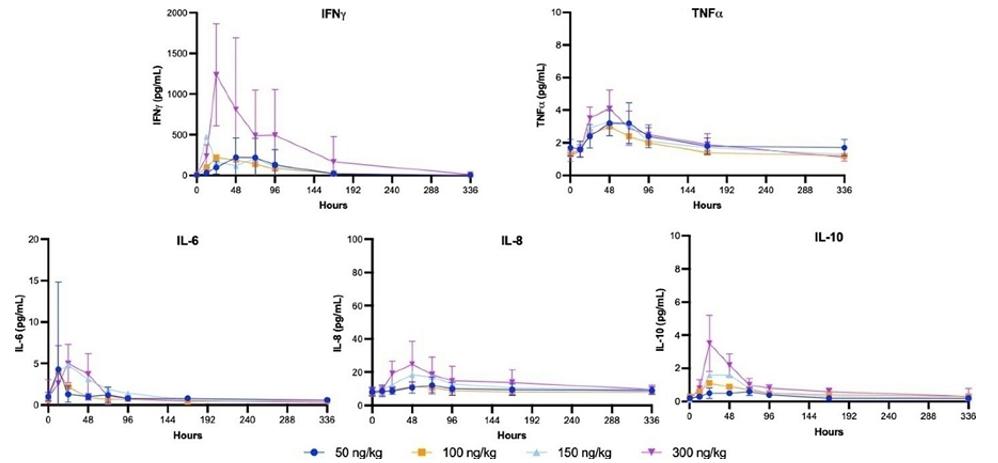

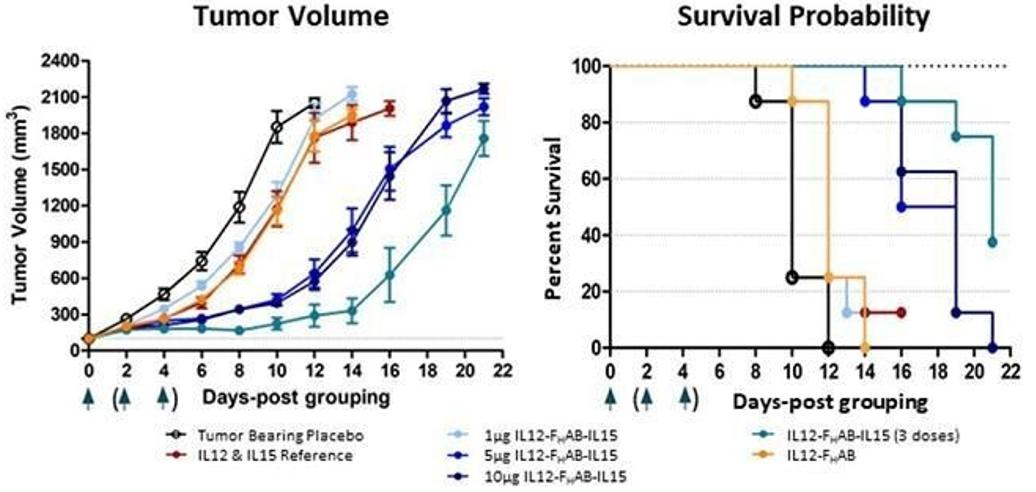

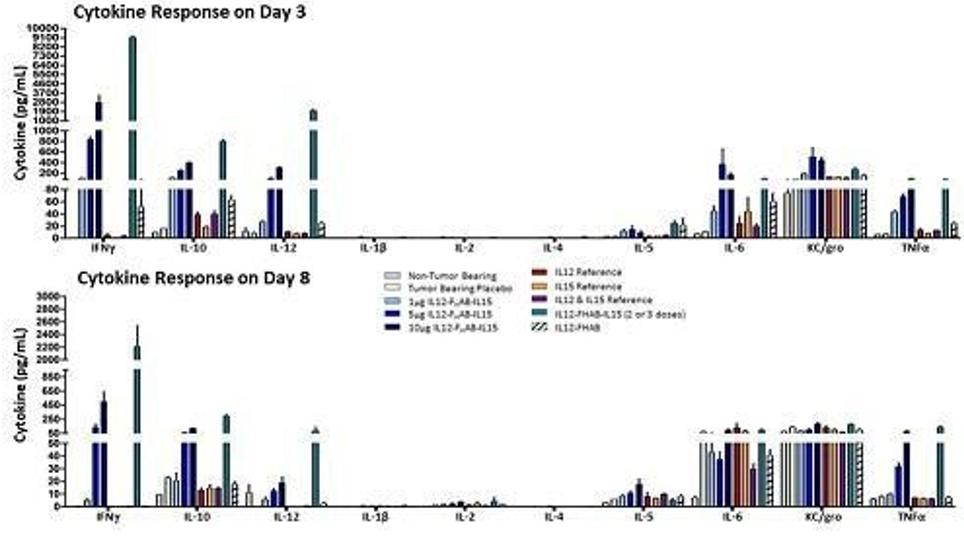

Sonnet is a clinical stage, oncology-focused biotechnology company with a proprietary platform for innovating biologic medicines of single- or bifunctional action. Known as FHAB® (Fully Human Albumin Binding), the technology utilizes a fully human single chain antibody fragment that binds to and “hitch-hikes” on human serum albumin (HSA) for transport to target tissues. Sonnet designed the FHAB construct to improve drug accumulation in tumors, as well as to extend the duration of activity in the body. FHAB development candidates are produced in a mammalian cell culture, which enables glycosylation and a biological structure similar to the natural cytokines in vivo. Sonnet believes its FHAB technology, for which it received a U.S. patent in June 2021, is a distinguishing feature of its biopharmaceutical platform that is well suited for future drug development across a range of human disease areas, including oncology, autoimmune, pathogenic, inflammatory, and hematological conditions. See the section titled “Information About Sonnet” for more information.

| 6 |

The Committed Facility

On October 22, 2025, we entered into the Purchase Agreement with Chardan establishing the Facility. Pursuant to and upon the terms and subject to the conditions and limitations set forth in the Purchase Agreement, beginning on the later of the Closing Date and the date the registration statement of which this prospectus forms a part is effective (the “Commencement Date”), we have the right from time to time at our option to direct Chardan to purchase up to $1.0 billion of shares of our Common Stock. Sales of our Common Stock to Chardan under the Purchase Agreement, and the timing of any sales, will be determined by us from time to time in our sole discretion and will depend on a variety of factors, including, among other things, market conditions, the trading price of our Common Stock and determinations by us regarding the use of proceeds from any sale of such Common Stock. The net proceeds from any sales under the Facility will depend on the frequency with, and prices at, which the shares of our Common Stock are sold to Chardan. To the extent we sell shares under the Purchase Agreement, we currently plan to use any proceeds therefrom for general corporate purposes, including potential purchases of HYPE Tokens.

The Purchase Agreement and the registration rights agreement, dated as of October 22, 2025, by and between Pubco and Chardan, and entered into in connection with the Purchase Agreement (the “Chardan Registration Rights Agreement”), contain customary registration rights, representations, warranties, conditions and indemnification obligations by each party. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and are subject to certain important limitations.

See the section titled “The Committed Facility” for more information.

The Transactions

The Transactions were consummated on December 2, 2025. On the Closing Date, and subject to the terms and conditions of the Transaction Agreement, (a) at the Rorschach Merger Effective Time, Rorschach Merger Sub merged with and into Rorschach, with Rorschach surviving the Rorschach Merger as a direct wholly owned subsidiary of Pubco, and (b) at the Company Merger Effective Time, Company Merger Sub merged with and into the Company, with the Company surviving the Company Merger as a direct wholly owned subsidiary of Pubco. As a result of the Rorschach Merger, each limited liability company interest of Rorschach issued and outstanding immediately prior to the Rorschach Merger Effective Time was canceled and the holder thereof received shares of Pubco Common Stock. As a result of the Company Merger, each share of Company Common Stock issued and outstanding immediately prior to the Company Merger Effective Time (excluding Dissenting Shares) was canceled and converted into the right to receive (i) one-fifth of one share of Pubco Common Stock and (ii) one CVR.

Pursuant to the Transaction Agreement, at or prior to the Closing, certain investors contributed HYPE to Rorschach, and certain investors may contribute cash to Rorschach (collectively, the “Contribution”), in each case pursuant to contribution agreements entered into between Rorschach and such investors (the “Contribution Agreements”). Subject to the terms and conditions of the Transaction Agreement, at the effective time of the Rorschach Merger, the equity holders of Rorschach immediately prior to the Closing received, in the aggregate, that number of shares of Pubco Common Stock equal to one-fifth of the aggregate amount of the Contribution divided by $1.25, except that one equity holder received, in lieu of shares of Pubco Common Stock otherwise issuable to it, shares of Pubco Series A Preferred Stock that are convertible into shares of Pubco Common Stock, subject to the terms and conditions thereof (including certain “blocker” provision). At the Closing, based on Contribution Agreements and Subscription Agreements entered concurrently with the signing of the Transaction Agreement, Pubco holds approximately $580 million in HYPE tokens (based on an agreed spot price of HYPE of $46.372, as used in the Transaction Agreement) and has cash of at least $300 million on its balance sheet (prior to payment of expenses related to the Transactions).

Also pursuant to the terms of the Transaction Agreement, at the Closing, Pubco issued to the Advisor (i) the Advisor Shares, in an amount equal to 5% of the shares of Pubco Common Stock issued and outstanding, on a fully-diluted, as converted basis, immediately following the Company Merger Effective Time and (ii) the Advisor Warrants to purchase a number of shares of Pubco Common Stock equal to, in the aggregate, 15% of the fully diluted number of outstanding shares of Pubco Common Stock immediately after Closing. The Advisor Warrants are exercisable for five years following the Closing, at an exercise price equal to (i) for one-third of the Advisor Warrants, $9.375, (ii) for one-third of the Advisor Warrants, $12.50 and (iii) for one-third of the Advisor Warrants, $18.75.

| 7 |

Immediately following the Closing, Rorschach and the other investors (including Chardan) own approximately 98.2% of the outstanding shares of Pubco Common Stock (assuming the conversion of all shares of Pubco Series A Preferred Stock issued in connection with the Transactions, without giving effect to the “blocker” provisions of the Pubco Series A Preferred Stock) and former Company Securityholders (including the investors in the Initial PIPE) own the remaining outstanding shares of Pubco Common Stock.

Advisory Relationships and Fees

Chardan acted as Rorschach’s exclusive merger and acquisition advisor with respect to the Business Combination and received a fee, payable in cash or equity, at Chardan’s option, equal to $4.0 million, which Chardan elected to receive in equity.

Post-Transactions Governance and Management

The business and affairs of Pubco are managed by or under the direction of the Pubco Board. The board of directors of Pubco was initially comprised of seven members, which include Robert Diamond as Chairman, Jeff Tuder, Eric Rosengreen, Thomas King, Larry Leibowitz, and Nailesh Bhatt and Albert Dyrness, two of the current board members of Sonnet. Following the Closing, on the Closing Date, the newly-appointed Pubco Board increased the size of the Pubco Board to eight members and re-appointed David Schamis to fill the newly-created vacancy. Additionally, the officers of Pubco are David Schamis as Chief Executive Officer and such other individuals as Rorschach may select. Following Closing and during the CVR Term, Raghu Rao remains the Chief Executive Officer of the Company, which operates as a wholly owned subsidiary of Pubco. See the section titled “Management of Pubco Following the Transactions” for additional information.

Certain Agreements Related to the Transactions

Initial PIPE Purchase Agreements

Concurrently with the execution of the Transaction Agreement, the Company entered into separate securities purchase agreements (the “PIPE Purchase Agreements”) with certain accredited investors pursuant to which the Company agreed to issue an aggregate of (i) 5,500 shares of the Company’s newly designated Series 5 Preferred Stock, stated value $1,000 per share, initially convertible at a conversion price of $1.25 per share, or 4,400,000 shares of Company Common Stock, and (ii) Initial PIPE Warrants to purchase up to 8,800,000 shares of Company Common Stock, for an offering price of $1,000 per share of Series 5 Preferred Stock and accompanying warrant, pursuant to a private placement in accordance with Section 4(a)(2) of the Securities Act. The Initial PIPE closed on July 15, 2025. The gross proceeds were $5.5 million from the Initial PIPE, before deducting offering expenses.

In addition, on June 30, 2025, Sonnet completed the Bridge Financing of convertible notes in the aggregate principal amount of $2.0 million. The investors in the Bridge Financing received warrants to purchase an aggregate of up to 865,052 shares of Company Common Stock (the “Bridge Financing Warrants”). On the closing date of the Initial PIPE, the notes issued in the Bridge Financing automatically converted into an aggregate of (i) 2,000 shares of Series 5 Preferred Stock, initially convertible at a conversion price of $1.25 per share, or 1,600,000 shares of Company Common Stock, and (ii) warrants to purchase up to 3,200,000 shares of Company Common Stock (together with the Initial PIPE Warrants, the “PIPE Warrants”). The Company intends to use the net proceeds from the Initial PIPE and the Bridge Financing for working capital and general corporate purposes, including the advancement of the Company’s current programs in connection with the planned future sale of the Company Legacy Assets (as defined in the CVR Agreement).

The Bridge Financing Warrants are exercisable immediately upon issuance at an exercise price equal to $1.156 per share, and will expire on the five-year anniversary of the date of issuance. A holder of the Bridge Financing Warrants will not have the right to exercise any portion of its Bridge Financing Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of Company Common Stock outstanding immediately after giving effect to such exercise. A holder may increase or decrease the beneficial ownership limitation up to 9.99%, provided, however, that any increase in the beneficial ownership limitation will not be effective until 61 days following notice of such change to the Company.

| 8 |

The PIPE Warrants are exercisable immediately upon issuance at an exercise price equal to $1.25 per share, and will expire on the five-year anniversary of the date of issuance; provided, however, until Stockholder Approval (as defined in the PIPE Purchase Agreement) is obtained, the PIPE Warrants will only be exercisable and the Series 5 Preferred Stock will only be convertible, in the aggregate, into up to an aggregate of 666,212 shares of Company Common Stock, representing 19.99% of the number of shares of Company Common Stock outstanding immediately prior to the date of the PIPE Purchase Agreement, subject to adjustment. The exercise price of the PIPE Warrants may be adjusted for stock dividends and stock splits, subsequent rights offerings, pro rata distributions of dividends or the occurrence of a Fundamental Transaction (as defined in the Form of PIPE Warrant). A holder of PIPE Warrants will not have the right to exercise any portion of its PIPE Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of Company Common Stock outstanding immediately after giving effect to such exercise. A holder may increase or decrease the beneficial ownership limitation up to 9.99%, provided, however, that any increase in the beneficial ownership limitation will not be effective until 61 days following notice of such change to the Company.

All Company Common Stock figures above will be subject to the five-for-one exchange ratio in the Transaction Agreement.

Subscription Agreements

Also concurrently with the execution of the Transaction Agreement, certain accredited investors (the “Subscribers”) entered into subscription agreements with the Company and Pubco (the “Subscription Agreements”), pursuant to which the Company agreed to issue, and the Subscribers agreed to purchase, immediately prior to the Closing, an aggregate of 243,787,992 shares of Company Common Stock at a purchase price of $1.25 per share, pursuant to a private placement in accordance with Section 4(a)(2) of the Securities Act (which shares will be converted into shares of Pubco Common Stock at the Closing, giving effect to the five-for-one exchange ratio in the Transaction Agreement). The gross proceeds were $300 million from the Closing PIPE, before deducting offering expenses. Pursuant to the terms of the Subscription Agreement, prior to the Closing, the parties agreed that neither the Company nor Pubco would enter into any agreement for the investment or contribution of cash by any additional investors or contributors on terms more favorable to such persons than the terms set forth in the Subscription Agreement or the Transaction Agreement as then in effect, unless, in any such case, the investors signatory to the Subscription Agreement have also been provided the opportunity to amend the terms of the Subscription Agreement to reflect such other terms. The Subscription Agreements provide that if the shares of Pubco Common Stock received by the Subscribers at Closing are “restricted securities” pursuant to Rule 144(a)(3) under the Securities Act or are otherwise not freely tradeable under the Securities Act immediately following the Closing, the Subscribers will be entitled to become a party to the Pubco Registration Rights Agreement (as defined below).

The consummation of the Closing PIPE was contingent upon, and occurred substantially concurrently with, the Closing and the satisfaction or waiver of customary closing conditions. On the Closing Date, the Closing PIPE was consummated.

Chardan acted as the Company’s and Rorschach’s exclusive advisor with respect to the Closing PIPE and receive a fee, payable in cash or equity at Chardan’s option, equal to up to 7.0% of the aggregate gross proceeds raised in connection with the Closing PIPE, which Chardan elected to receive in equity. The Company also agreed to reimburse Chardan for certain of its expenses in an amount up to $100,000.

| 9 |

Advisor Agreements

Pursuant to the Transaction Agreement, in connection with the Closing, Pubco and Rorschach Advisors LLC, a Delaware limited liability company (the “Advisor”), entered into an Advisor Rights Agreement (the “Advisor Rights Agreement”) and a Strategic Advisor Agreement (the “Advisory Agreement”). The Advisor Rights Agreement provides the Advisor certain rights with respect to Pubco, including, subject to the conditions set forth in the Advisor Rights Agreement, director nomination rights and information rights. Pursuant to the Advisory Agreement, the Advisor will provide technical advisory services to Pubco related to the digital asset ecosystem, including Hyperliquid and related digital assets, developments in digital asset industries, the selection of third-party vendors with respect to asset management and related digital asset services and other strategic advice regarding digital assets treasury operations for a term of five years. The Advisory Agreement provides that, unless otherwise agreed by Advisor and subject in all respects to applicable law, in the event that Pubco raises equity or equity-linked financing during the term, Advisor shall be entitled to receive grants of equity in the form of (a) shares of Pubco Common Stock equal to 5% of the number of shares of Pubco Common Stock issued or issuable pursuant to such financing and (b) warrants to purchase an aggregate number of shares of Pubco Common Stock equal to 15% of the number of shares of Pubco Common Stock issued or issuable pursuant to such financing, in substantially the same form as the Advisor Warrants, or as otherwise may be agreed by Pubco and Advisor. The Advisor shall also be entitled to receive such additional compensation, if any, as may be approved by the Pubco Board.

Contingent Value Rights Agreement

At the Closing, Pubco entered into the CVR Agreement with Continental Stock Transfer & Trust Company, as rights agent (“Rights Agent”), pursuant to which holders of Company Common Stock (not including the shares of Company Common Stock issued to the Subscribers pursuant to the Subscription Agreements) and Company In-The-Money Warrants, in each case, as of immediately prior to the Company Merger Effective Time, received one CVR for each then-outstanding share of Company Common Stock held by such stockholder (or, in the case of the Company In-The-Money Warrants, each share of Company Common Stock for which such Company In-The-Money Warrants is exercisable into as of such date). The CVR Payment (as defined in the CVR Agreement) will be payable upon the closing of a sale, license, transfer, disposition, divestiture or other monetization transaction (i.e., a royalty transaction) (or a series of transactions) and/or winding down of, or other disposition(s) of any the Company Legacy Assets (a “Company Legacy Transaction”), out of the net proceeds actually received by the Company in a Company Legacy Transaction, during the period beginning on the Closing Date and ending on the third anniversary of the date of the CVR Agreement (the “CVR Term”). The shares of Pubco Common Stock issuable in connection with the CVR Payment (the “CVR Shares”) are subject to certain deductions pursuant to the terms of the CVR Agreement.

The payment date for the CVR Shares will be within 10 business days after the rights agent receives the CVR Shares from Pubco upon the closing of a Company Legacy Transaction. In the event that a Company Legacy Transaction does not occur during the CVR Term or a Company Legacy Transaction does occur during the CVR Term but the amount of deductions payable pursuant to the terms of the CVR Agreement, including expenses related to the transaction, liabilities of the Company related to the Company’s outstanding warrants prior to the Closing and other expenses payable pursuant to the CVR Agreement, exceed the proceeds received pursuant to the Company Legacy Transaction, the holders of the CVRs will not receive any CVR Shares pursuant to the CVR Agreement. There can be no assurances that any holders of CVRs will receive any CVR Shares with respect thereto.

Until the earlier to occur of (a) the expiration of the CVR Term, and (b) the date on which Pubco and its affiliates have, whether before or after the Closing, paid or incurred costs, fees and expenses totaling an amount equal to (i) the $7,500,000 in Financings plus (ii) up to $3,000,000 in Interim Financing (if raised in accordance with the Transaction Agreement) in connection with the development of the Company Legacy Assets and/or the pursuit of a Company Legacy Transaction, Pubco will, and will cause its controlled affiliates to, use efforts and resources to develop, bring to market and sell the product candidates included in the Company Legacy Assets, consistent with the exercise of reasonable business judgment taking into account all relevant factors to, among others, (i) continue the development programs for the Company Legacy Assets and (ii) conduct a sale process (including engagement of advisors) with respect to a Company Legacy Transaction during the CVR Term; provided, that in the event the $7,500,000 in Financings and the $3,000,000 in Interim Financing is expended prior to the expiration of the CVR Term, then the Company will, until the earlier to occur of (A) one year thereafter and (B) the expiration of the CVR Term, be entitled to raise additional capital at the Company level or enter into a third-party licensing agreement or other strategic agreement, on terms reasonably acceptable to Pubco, in an effort to pursue a Company Legacy Transaction during the CVR Term.

| 10 |

Notwithstanding the foregoing, Pubco may, in its reasonable discretion, (i) during the CVR Term, determine that a Company Legacy Asset is not commercially viable and abandon further development and/or commercialization (in which case Pubco’s obligations set forth in paragraph above will immediately cease and be of no further force and effect), (ii) during the CVR Term, determine that a Company Legacy Transaction with respect to some or all of the Company Legacy Assets is not likely to occur during the CVR Term or at all and abandon further pursuit of a Company Legacy Transaction with respect to such Company Legacy Assets (in which case Pubco’s obligations set forth in paragraph above will immediately cease and be of no further force and effect with respect to such Company Legacy Assets and such Company Legacy Transaction), and (iii) following the expiration of the CVR Term without the execution and delivery of a definitive agreement for a Company Legacy Transaction, take any action in respect of the Company Legacy Assets. Notwithstanding anything contained therein to the contrary (but subject to the paragraph above), Pubco will have sole and absolute discretion and decision-making authority over whether to continue to invest, how much to invest in any of the Company Legacy Assets and whether and on what terms, if any, to enter into a Company Legacy Transaction.

The CVRs are not transferable, except in certain limited circumstances as will be provided in the CVR Agreement, will not be certificated or evidenced by any instrument and will not be listed for trading on any exchange.

Pubco Registration Rights Agreement

Pursuant to the Transaction Agreement, on the Closing Date, Pubco entered into a Registration Rights Agreement (the “Pubco Registration Rights Agreement”) with the Advisor and certain investors in Rorschach, pursuant to which, among other things, Pubco agreed to provide such holders with customary registration rights with respect to the shares of Pubco Common Stock to be owned by such holders following the Closing.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act (the “JOBS Act”), and a “smaller reporting company” as defined in Rule 12b-2 under the Exchange Act. As such, we are eligible for and intend to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies and/or smaller reporting companies for as long as we continue to be an emerging growth company and/or smaller reporting company, including (i) the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (ii) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, our financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates.

| 11 |

Summary of Risk Factors

Risks Related to the Facility

| ● | It is not possible to predict the actual number of shares of our Common Stock, if any, we will sell under the Purchase Agreement to Chardan, or the actual gross proceeds resulting from those sales or the dilution to you from those sales |

| ● | Investors who buy Common Stock from Chardan at different times will likely pay different prices. |

| ● | The sale or issuance of shares of our Common Stock to Chardan will result in additional outstanding shares and the resale of shares of our Common Stock by Chardan that it acquires pursuant to the Purchase Agreement, or the perception that such sales may occur, could cause the price of shares of our Common Stock to decrease. |

| ● | We may use proceeds from sales of our Common Stock made pursuant to the Purchase Agreement in ways with which you may not agree or in ways which may not yield a significant return. |

Risks Related to Hype and Hyperliquid

| ● | HYPE is a highly volatile asset, and fluctuations in the price of HYPE may influence our financial results and the market price of our listed securities. |

| ● | HYPE and other digital assets are novel assets and are subject to significant legal and regulatory uncertainty. |

| ● | Our HYPE treasury strategy subjects us to enhanced regulatory oversight. |

| ● | We plan to use a portion of our capital raised that is not required to provide working capital for our ongoing operations to acquire HYPE, which may adversely affect our financial results and the market price of our securities. |

| ● | If we were deemed to be an investment company under the Investment Company Act, applicable restrictions likely would make it impractical for us to continue segments of our business as currently contemplated. |

| ● | HYPE is created and transmitted through the operations of the peer-to-peer Hyperliquid network, a decentralized network of computers running software following the HYPE protocol. If the Hyperliquid network is disrupted or encounters any unanticipated difficulties, the value of HYPE could be negatively impacted. |

| ● | We face risks relating to the custody of our HYPE, including the loss or destruction of private keys required to access our HYPE and cyberattacks or other data loss relating to our HYPE, including smart contract related losses and vulnerabilities. |

| ● | Our historical financial statements do not reflect the potential variability in earnings that we may experience in the future relating to our HYPE holdings. |

| ● | Unrealized fair value gains on our HYPE holdings could cause us to become subject to the corporate alternative minimum tax under the Inflation Reduction Act of 2022. |

| ● | Due to the unregulated nature and lack of transparency surrounding the operations of many HYPE trading venues, HYPE trading venues may experience greater fraud, security failures or regulatory or operational problems than trading venues for more established asset classes, which may result in a loss of confidence in HYPE trading venues and adversely affect the value of our HYPE. |

Risks Related to the Transactions and Pubco Following Consummation of the Transactions

| ● | We have broad discretion in the use of a portion of the net proceeds from the PIPE Financing and you will not have the opportunity as of this process to assess whether such net proceeds are being used in a manner of which you approve. |

| ● | Completion of the Transactions may trigger change in control or other provisions in certain agreements to which Sonnet or any of its respective subsidiaries or joint ventures is a party. |

| ● | The Transactions have involved substantial costs and required substantial management resources. |

| ● | Pubco stockholders will experience dilution from the issuance of Pubco Common Stock, PIPE Warrants, and CVRs and may experience additional dilution in the future due to any exercise of existing warrants and any future issuances of equity securities in Pubco. |

| 12 |

Risks Related to the Business of Sonnet

| ● | We have a history of significant operating losses and expect to incur significant and increasing losses for the foreseeable future, and we may never achieve or maintain profitability. |

| ● | Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern. |

| ● | We will need substantial additional funding, and if we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product discovery and development programs or commercialization efforts. |

| ● | We are substantially dependent on the success of our internal development programs and our product pipeline candidates may not successfully complete clinical trials, receive regulatory approval or be successfully commercialized. |

| ● | We are at an early stage in our development efforts, our product candidates represent a new category of medicines and may be subject to heightened regulatory scrutiny until they are established as a therapeutic modality. |

| ● | We may not satisfy The Nasdaq Capital Market’s requirements for continued listing of our common stock in the future. If we cannot satisfy these requirements, The Nasdaq Capital Market could delist our common stock. |

| ● | Even if we complete the necessary preclinical studies and clinical trials, the marketing approval process is expensive, time consuming and uncertain and may prevent us or any collaborators from obtaining approvals for the commercialization of some or all of our product candidates. As a result, we cannot predict when or if, and in which territories, we, or any collaborators, will obtain marketing approval to commercialize a product candidate. |

| ● | We face significant competition and if our competitors develop and market products that are more effective, safer or less expensive than the product candidates we develop, our commercial opportunities will be negatively impacted. |

| ● | The commercial success of any current or future product candidate will depend upon the degree of market acceptance by physicians, patients, payors and others in the medical community. |

| ● | For certain product candidates, we may depend on development and commercialization collaborators to develop and conduct clinical trials with, obtain regulatory approvals for, and if approved, market and sell product candidates. If such collaborators fail to perform as expected, the potential for us to generate future revenue from such product candidates would be significantly reduced and our business would be harmed. |

| ● | We will rely on third parties, including independent clinical investigators and CROs, to conduct and sponsor some of the clinical trials of our product candidates. Any failure by a third party to meet its obligations with respect to the clinical development of our product candidates may delay or impair our ability to obtain regulatory approval for our product candidates. |

| ● | If we are unable to obtain and maintain patent and other intellectual property protection for our products and product candidates, or if the scope of the patent and other intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize products similar or identical to ours, and our ability to successfully commercialize our products and product candidates may be adversely affected. |

| ● | We expect to expand our organization, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations. |

| ● | We do not expect to pay cash dividends in the foreseeable future and therefore investors should not anticipate cash dividends on their investment. |

| 13 |

THE OFFERING

The summary below describes the principal terms of the offering. The “Description of Pubco Capital Stock” section of this prospectus contains a more detailed description of the Common Stock.

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” beginning on page 15 of this prospectus.

| Issuer | Hyperliquid Strategies Inc | |

| Shares of Common Stock offered by the Selling Securityholder | Up to 160,000,000 shares of Common Stock that we may elect, in our sole discretion, to issue and sell to Chardan, from time to time from and after the Commencement Date (as defined herein) under the Purchase Agreement.

The actual number of shares of our Common Stock issued and outstanding will vary depending on the then current market price of shares of our Common Stock sold to Chardan under the Facility. | |

| Terms of the Offering | Chardan will determine when and how it will dispose of any shares of our Common Stock acquired under the Purchase Agreement that are registered under this prospectus for resale. | |

| Common Stock outstanding prior to the Offering | 127,025,563 shares. | |

| Common Stock outstanding immediately after the Offering | 287,025,563 shares, assuming the sale of 160,000,000 shares of our Common Stock under the Purchase Agreement. The actual number of shares issued will vary depending on the sales prices in this offering. | |

| Use of Proceeds | We will not receive any proceeds from the resale of shares of our Common Stock by Chardan. However, we may receive up to $1.0 billion in aggregate gross proceeds from Chardan under the Purchase Agreement in connection with sales of shares of our Common Stock to Chardan pursuant to the Purchase Agreement from time to time after the date of this prospectus. The actual proceeds we receive may be less than this amount (before being reduced for the discount to Chardan) depending on the number of shares of our Common Stock sold and the price at which the shares of our Common Stock are sold. We intend to use any proceeds from any sales of shares of our Common Stock to Chardan under the Facility for general corporate purposes, including potential purchases of HYPE Tokens. See “Use of Proceeds.” | |

| Conflicts of Interest | Chardan is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and is expected to act as an executing broker for the resale of shares of Common Stock in this offering. The receipt by Chardan of all the proceeds from resales of shares of Common Stock results in a “conflict of interest” under FINRA Rule 5121. Accordingly, such resales will be conducted in compliance with FINRA Rule 5121. To the extent that the shares of Common Stock do not have a “bona fide public market”, as defined in FINRA Rule 5121, a qualified independent underwriter will participate in the preparation of, and exercise the usual standards of “due diligence” with respect to, the registration statement. LifeSci has agreed to act as qualified independent underwriter for this offering and will receive a quarterly fee of $50,000 to be paid on the first business day of each quarter for so long as the Purchase Agreement remains in effect, up to an aggregate amount of $400,000 for doing so. Pursuant to FINRA Rule 5121, Chardan will not confirm resales of shares of Common Stock to any account over which it exercises discretionary authority without the prior written approval of the customer. See “Plan of Distribution (Conflicts of Interest).” | |

| Market for our Common Stock | Our Common Stock is listed on the Nasdaq Capital Market under the symbol “PURR”. | |

| Risk factors | Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

The number of shares of our Common Stock that will be outstanding immediately after this offering gives effect to the consummation of the Business Combination pursuant to which Pubco issued approximately 127,025,563 shares of Common Stock at the Closing, assumes the sale and issuance by us of 160,000,000 shares of our Common Stock to Chardan pursuant to the Purchase Agreement and excludes:

| ● | 26,587,647 shares of Pubco Common Stock issuable upon the conversion of outstanding shares of Pubco Series A Preferred Stock (subject to certain blocker provisions); | |

| ● | 30,198,092 shares of Common Stock issuable upon the exercise of warrants outstanding immediately following the Closing, with a weighted average exercise price of $15.21 per share; and | |

| ● | 6,351,278 shares of Common Stock reserved for future issuance under the 2025 Equity Incentive Plan immediately following the Closing. |

Unless otherwise indicated, this prospectus reflects and assumes no issuances or exercises of any other outstanding shares, options or warrants after December 2, 2025.

| 14 |

RISK FACTORS

Investing in our securities involves a high degree of risk. We urge you to carefully consider all of the information contained in this prospectus. In particular, you should consider the risk factors below. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described below or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. As a result, you could lose all or part of your investment.

The following risk factors are classified into four sections for convenience: (i) “Risks Related to the Facility,” (ii) Risks Related to HYPE and Hyperliquid, (iii) “Risks related to the Transactions and Pubco Following the Consummation of the Transactions,” and (iv) “Risks related to the Business of Sonnet.” References in this section to “we,” “us” and “our” and related terms refer to Hyperliquid Strategies Inc and its consolidated subsidiaries or Sonnet Biotherapeutics Holdings, Inc. and its consolidated subsidiaries, as applicable.

Risks Related to the Facility

It is not possible to predict the actual number of shares of our Common Stock, if any, we will sell under the Purchase Agreement to Chardan, or the actual gross proceeds resulting from those sales or the dilution to you from those sales.

On October 22, 2025, we entered into the Purchase Agreement with Chardan, pursuant to which we may sell to Chardan up to $1.0 billion of shares of our Common Stock (the “Total Commitment”), upon the terms and subject to the conditions and limitations set forth in the Purchase Agreement. The shares of our Common Stock that may be issued under the Purchase Agreement may be sold by us to Chardan at our discretion from time to time until the earliest to occur of (i) the 36-month anniversary of the later of the effective date of the registration statement of which this prospectus forms a part and the Closing Date, (ii) the date on which Chardan has purchased the Total Commitment pursuant to the Purchase Agreement, (iii) the date on which our Common Stock fails to be listed or quoted on The Nasdaq Capital Market or any successor Principal Market (as defined in the Purchase Agreement), and (iv) the date on which, pursuant to or within the meaning of any bankruptcy law, we commence a voluntary case or any person commences a proceeding against us, a custodian is appointed for us or for all or substantially all of our property, or we make a general assignment for the benefit of our creditors (each date of such termination, an “Automatic Termination Event”).

We generally have the right to control the timing and amount of any sales of our Common Stock to Chardan under the Purchase Agreement. Sales of our Common Stock, if any, to Chardan under the Purchase Agreement will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Chardan all, some or none of the Common Stock that may be available for us to sell to Chardan pursuant to the Purchase Agreement. Accordingly, we cannot guarantee that we will be able to sell all of the Total Commitment or how much in proceeds we may obtain under the Purchase Agreement. If we cannot sell securities under the Facility, we may be required to utilize more costly and time-consuming means of accessing the capital markets, which could have a material adverse effect on our liquidity and cash position.

Because the purchase price per share of Common Stock to be paid by Chardan for the Common Stock that we may elect to sell to Chardan under the Purchase Agreement, if any, will fluctuate based on the market prices of our Common Stock at the time we elect to sell shares to Chardan pursuant to the Purchase Agreement, if any, and the purchase price that Chardan is required to purchase the shares of Common Stock under the Purchase Agreement and as described under “The Committed Equity Financing,” it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of shares of Common Stock that we will sell to Chardan under the Purchase Agreement, the purchase price per share that Chardan will pay for shares of Common Stock purchased from us under the Purchase Agreement, or the aggregate gross proceeds that we will receive from those purchases by Chardan under the Purchase Agreement.

| 15 |

We are registering 160,000,000 shares of our Common Stock under this prospectus. The actual number of shares of our Common Stock issuable will vary depending on the then current market price of shares of our Common Stock sold to Chardan in this offering and the number of shares of our Common Stock we ultimately elect to sell to Chardan under the Purchase Agreement. If it becomes necessary for us to issue and sell to Chardan under the Purchase Agreement more than the 160,000,000 shares of our Common Stock being registered for resale under this prospectus in order to receive aggregate gross proceeds equal to $1.0 billion under the Purchase Agreement, we must file with the SEC one or more additional registration statements to register under the Securities Act the resale by Chardan of any such additional shares of our Common Stock we wish to sell from time to time under the Purchase Agreement, which the SEC must declare effective, in each case before we may elect to sell any additional shares of our Common Stock under the Purchase Agreement.

Chardan is not obligated to buy any Common Stock under the Purchase Agreement if such shares, when aggregated with all other Common Stock then beneficially owned by Chardan and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in Chardan beneficially owning Common Stock in excess of 4.99% of our outstanding voting power or shares of Common Stock. Our inability to access a portion or the full amount available under the Purchase Agreement, in the absence of any other financing sources, could have a material adverse effect on our business or results of operation.

Investors who buy Common Stock from Chardan at different times will likely pay different prices.

Pursuant to the Purchase Agreement, the timing, price and number of shares of Common Stock sold to Chardan will vary depending on when we choose to sell shares, if any, to Chardan. If and when we elect to sell Common Stock to Chardan pursuant to the Purchase Agreement, after Chardan has acquired such Common Stock, Chardan may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices. As a result, investors who purchase shares from Chardan in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from Chardan in this offering as a result of future sales made by us to Chardan at prices lower than the prices such investors paid for their shares in this offering.

The sale or issuance of shares of our Common Stock to Chardan will result in additional outstanding shares and the resale of shares of our Common Stock by Chardan that it acquires pursuant to the Purchase Agreement, or the perception that such sales may occur, could cause the price of shares of our Common Stock to decrease.

On October 22, 2025, we entered into the Purchase Agreement with Chardan, pursuant to which Chardan agreed to purchase from us shares of Common Stock up to the amount of the Total Commitment, upon the terms and subject to the conditions and limitations set forth in the Purchase Agreement. The shares of our Common Stock issuable pursuant to the Purchase Agreement may be sold by us to Chardan at our sole discretion, subject to the satisfaction of certain conditions in the Purchase Agreement, from time to time, until the earliest to occur of (i) the 36-month anniversary of the later of the effectiveness of the registration statement of which this prospectus forms a part and the Closing Date, (ii) the date on which Chardan has purchased the Total Commitment pursuant to the Purchase Agreement, (iii) the date on which our Common Stock fails to be listed or quoted on The Nasdaq Capital Market or any successor Principal Market, and (iv) the date on which, pursuant to or within the meaning of any bankruptcy law, we commence a voluntary case or any person commences a proceeding against us, a custodian is appointed for us or for all or substantially all of our property, or we make a general assignment for the benefit of our creditors.] The purchase price for shares of our Common Stock that we may sell to Chardan under the Purchase Agreement will fluctuate based on the trading price of shares of our Common Stock. Depending on market liquidity at the time, sales of shares of our Common Stock may cause the trading price of shares of our Common Stock to decrease. We generally have the right to control the timing and amount of any future sales of shares of our Common Stock to Chardan. Additional sales of shares of our Common Stock, if any, to Chardan will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Chardan all, some or none of the additional shares of our Common Stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares of our Common Stock to Chardan, after Chardan has acquired shares of our Common Stock, Chardan may resell all, some or none of such shares of our Common Stock at any time or from time to time in its discretion. Therefore, sales to Chardan by us could result in substantial dilution to the interests of other holders of shares of our Common Stock. In addition, if we sell a substantial number of shares of our Common Stock to Chardan under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares of our Common Stock or the mere existence of our arrangement with Chardan may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales.

| 16 |

We may use proceeds from sales of our Common Stock made pursuant to the Purchase Agreement in ways with which you may not agree or in ways which may not yield a significant return.

We will have broad discretion over the use of proceeds from sales of our Common Stock made pursuant to the Purchase Agreement, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds, their ultimate use may vary substantially from their currently intended use. While we expect to use the net proceeds from this offering as set forth in “Use of Proceeds,” we are not obligated to do so. The failure by us to apply these funds effectively could harm our business, and the net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our Common Stock.

Risks Related to HYPE and Hyperliquid